Shares of SJVN Ltd. surged over 8% on Wednesday after its first-quarter profit beat analysts' estimates. The board's decision to dilute its stake in subsidiary SJVN Green Energy Ltd. also supported the gains.

The government-run power producer's consolidated net profit surged 31% year-on-year to Rs 357.09 crore in the quarter ended June 2024, according to an exchange filing. That compares with the consensus estimate of Rs 303 crore given by analysts polled by Bloomberg.

During the same period, revenue from operations rose 29% year-on-year to Rs 870.37 crore in the June quarter, compared to a Bloomberg estimate of Rs 737 crore.

Operating profit, or earnings before interest, tax, depreciation, and amortisation, rose 33% to Rs 667.5 crore, while Ebitda margin expanded from 74.5% to 76.7% in the first quarter.

The board approved a proposal to raise funds through a stake sale in its wholly-owned subsidiary, SJVN Green Energy. It also laid the groundwork for the monetisation of the Nathpa Jhakri hydropower station.

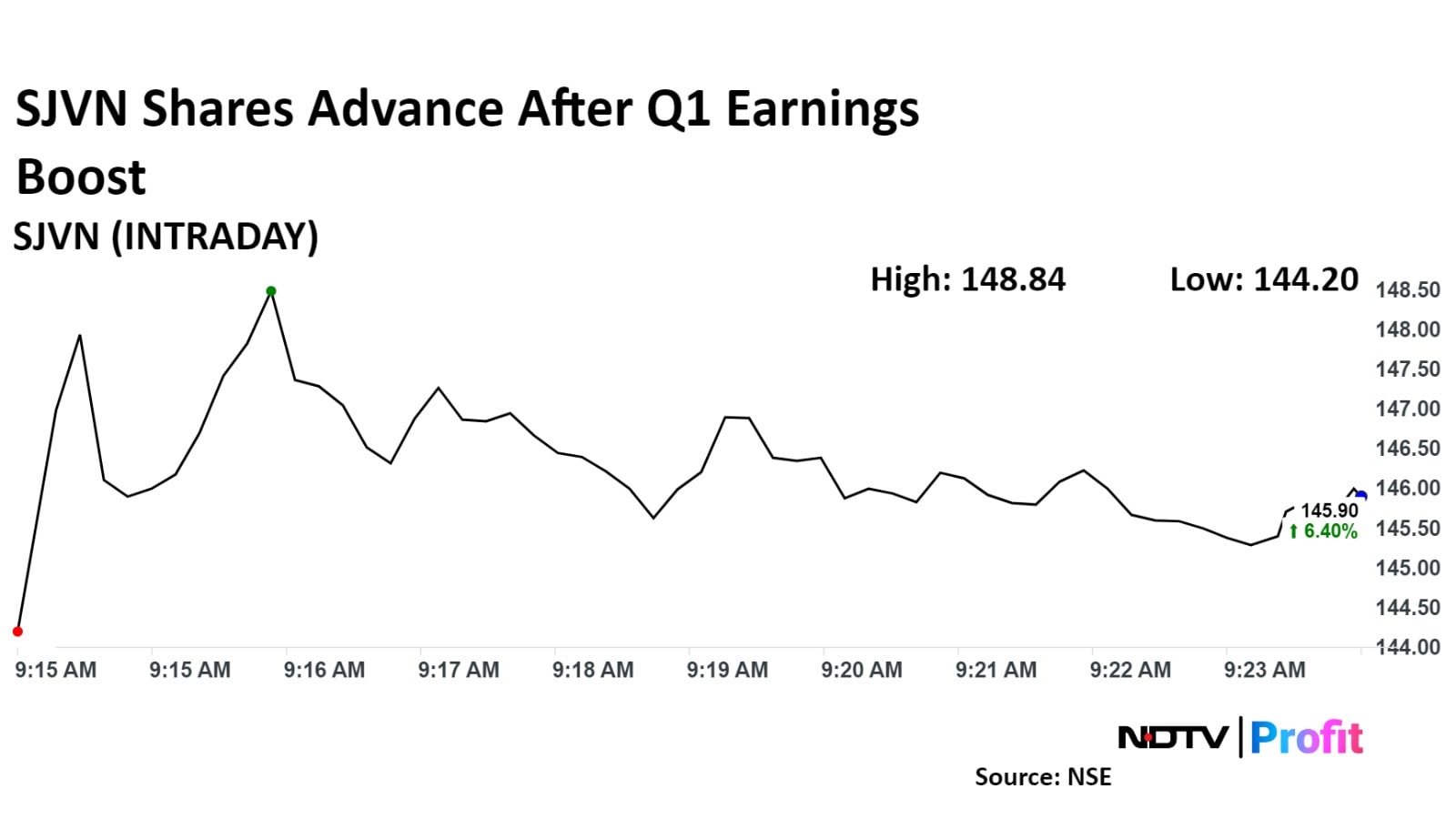

Shares of SJVN gained 8.5% to Rs 148.84 apiece, before paring gains to trade 5.2% higher at Rs 144.26 by 9:32 a.m. The benchmark NSE Nifty 50 was trading 0.07% lower.

The stock has risen 151% in the last 12 months and 54% on a year-to-date basis. The total traded volume so far in the day stood at 5.4 times its 30-day average. The relative strength index was at 52.

Three out of the six analysts tracking SJVN have a 'buy' rating on the stock, and three suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 44.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.