Shares of SJVN Ltd. rose 6% on Tuesday after it signed a memorandum of understanding with GMR Group's arm, GMR Upper Karnali Hydro Power Ltd., and IREDA Ltd. for the development of a mega hydro project in Nepal.

The project cost of the Upper Karnali hydroelectric project will be Rs 9,100 crore. SJVN and GMR will hold 34% shareholding each, IREDA will have 5%, and the balance equity will be held by Nepal Electricity Authority in the proposed joint venture, according to an exchange filing.

The 900 megawatt plant will be developed on the build-own-operate-transfer model with a 25-year concessional period after commissioning. The project is proposed to be funded through a 70:30 debt-equity ratio, the company said.

The project is in advanced stages of development and will be Nepal's largest hydropower plant after completion. It will be connected to the Indian grid through dedicated transmission lines.

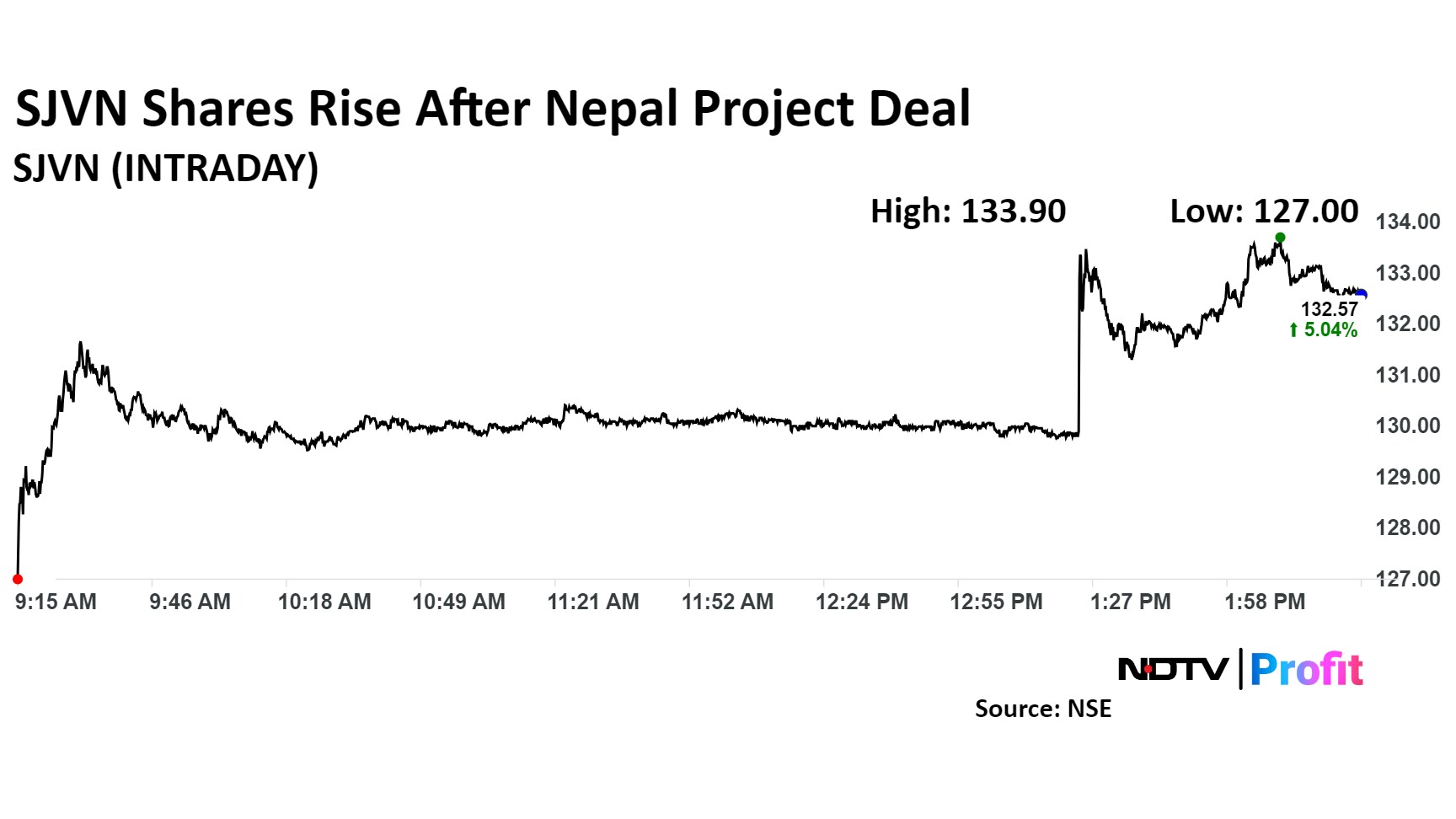

Shares of SJVN advanced 6% to an intraday high of Rs 133.9 apiece. The scrip was trading 5% higher at Rs 132.57 by 2:30 p.m. The benchmark NSE Nifty 50 was trading 0.57% higher.

It has risen 72% in the last 12 months and 42% on a year-to-date basis. The total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 44.

Three out of the six analysts tracking SJVN have a 'buy' rating on the stock, one recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 17.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.