Shares of Shriram Properties Ltd., a residential real estate developer from South India, were up 7% after the company announced a joint development agreement for a six acre land parcel in Undri, Pune.

The project will feature over 650 apartments and retail or commercial spaces, with a total saleable area of more than 1 million square feet, as per a media release on Wednesday.

With an estimated revenue potential of Rs 700-750 crore, Shriram Properties aims to launch the project in the second half of this fiscal.

The company is also nearing the finalisation of rights for an additional eight acres, primarily for retail and commercial use, as per the release.

"This investment is consistent with our asset light strategy for accelerated growth. Pune is a promising market, and we see significant potential for large, established brands like Shriram," said chairman and managing director Murali Malayappan.

"Owing to its proximity to IT/ITeS, Undri emerges as a vital micro market witnessing significant demand in recent years. We are looking forward to the project launch during this quarter and remain committed to delivering top-notch quality swiftly and ensuring utmost satisfaction for our customers," he stated.

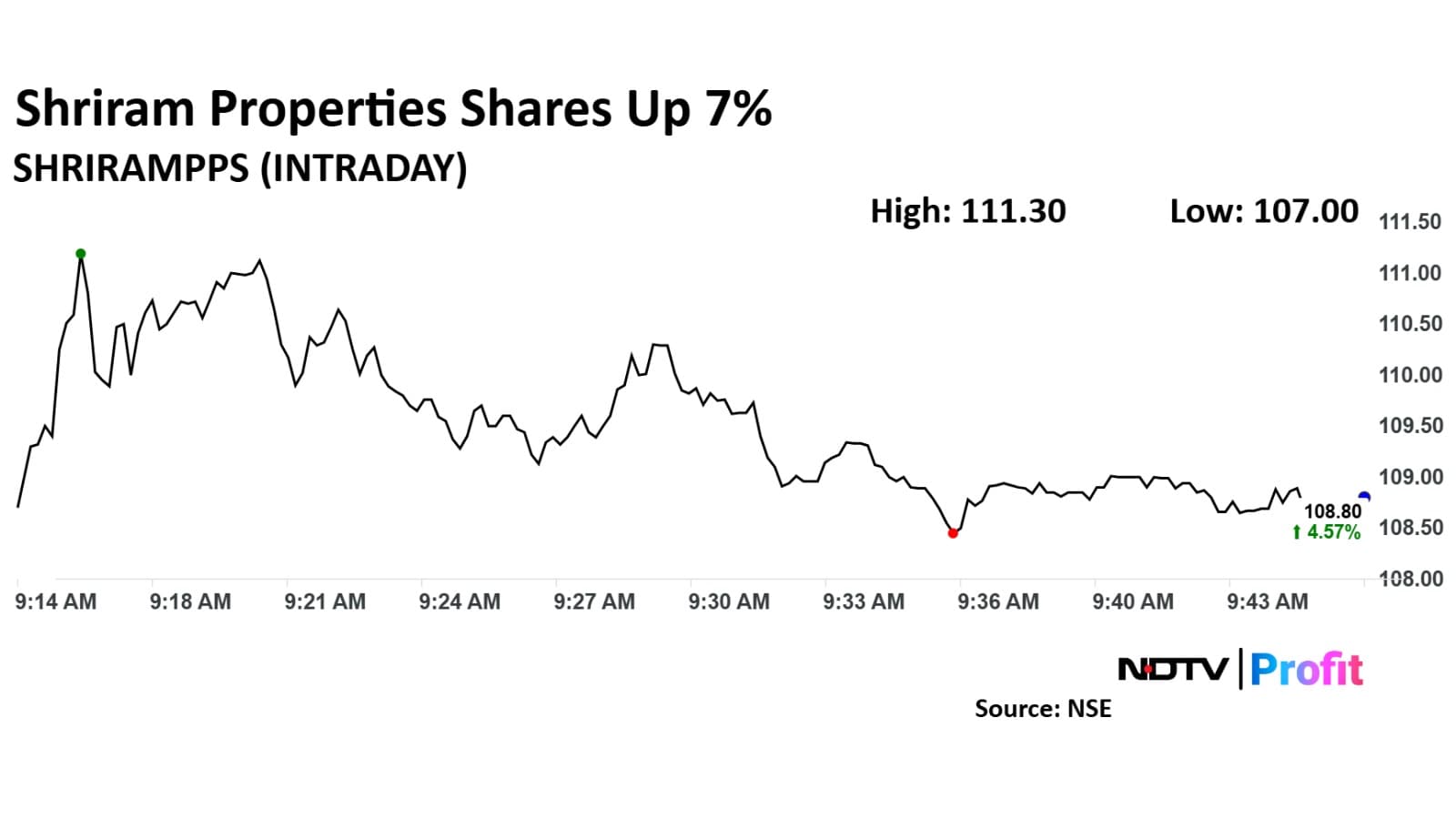

Shriram Properties Share Price

Shriram Properties share price was trading 7% higher in early trade on Wednesday.

The scrip rose as much as 6.97% to Rs 111.30 apiece, the highest level since Oct. 23, 2024. However, it pared some gains to trade 4.72% higher at Rs 108.70 apiece, as of 09:33 a.m. This compares to a 0.27 decline in the NSE Nifty 50 index.

It has fallen 10.66% on a year-to-date basis, and has risen 20.87% in the last twelve months. Total traded volume so far in the day stood at 5.9 times its 30-day average. The relative strength index was at 41.36.

The only brokerage tracking the company, Sunidhi Securities & Finance Ltd., has a 'buy' rating on the stock, according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.