Shares of Shoppers Stop Ltd. fell in early trade after reporting a consolidated net loss of about Rs 23 crore in the first quarter of fiscal 2025, compared to a profit of Rs 14 crore in the year-ago quarter.

Consolidated revenue from operations rose 7.61% to Rs 1,069.31 crore as against Rs 993.61 crore, according to an exchange filing. The company attributed the hit in sales to subdued consumption due to prolonged heat waves, elections and inflation.

Meanwhile, total expenses increased 12.59% to Rs 1,104.51 crore, compared to Rs 980.92 crore in the same quarter last fiscal.

Some of the company's recovery plan includes premiumisation, marketing investment, high-end coffee shops, increased personal shoppers, and rationalising costs, while also closing unviable stores, said Managing Director and Chief Executive Officer Kavindra Mishra.

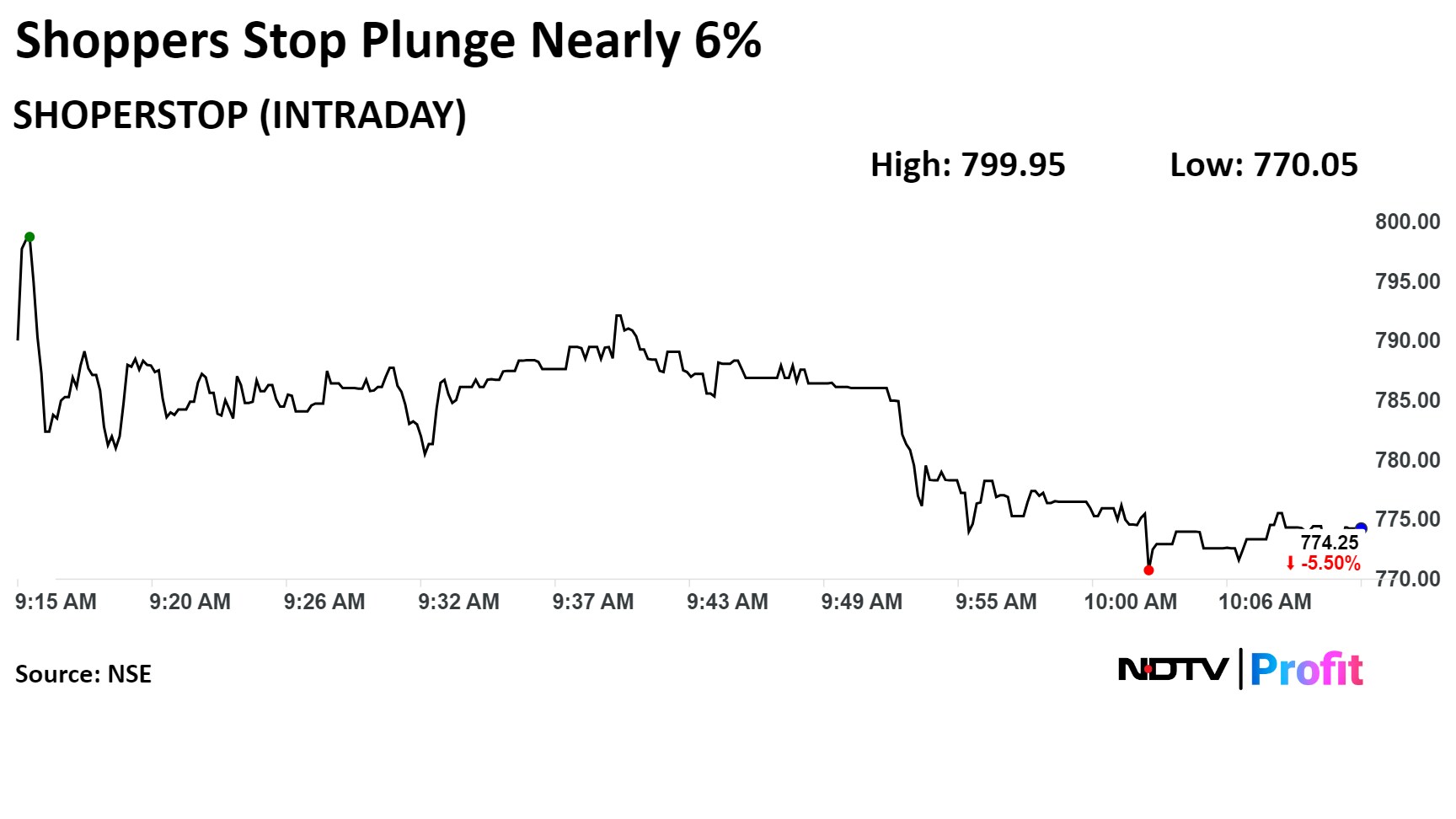

Shares of Shoppers Stop Ltd. fell as much as 6.02% before paring loss to trade 5.61% lower at Rs 773.35 apiece, compared to a 0.39% decline in the benchmark NSE Nifty 50 as of 10:08 a.m.

The stock has risen 0.15% in the last 12 months and 12.24% year-to-date. The relative strength index was at 48.07.

Six out of the 10 analysts tracking the company have a 'buy' rating on the stock, two recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' consensus price target implies a potential upside of 7.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.