The NSE Nifty 50 and BSE Sensex resumed decline after a two–day rally, amid a jump in the market volatility as Infosys Ltd. and ICICI Bank Ltd. share prices declined. The NSE India Volatility index ended at the highest level since Aug. 13.

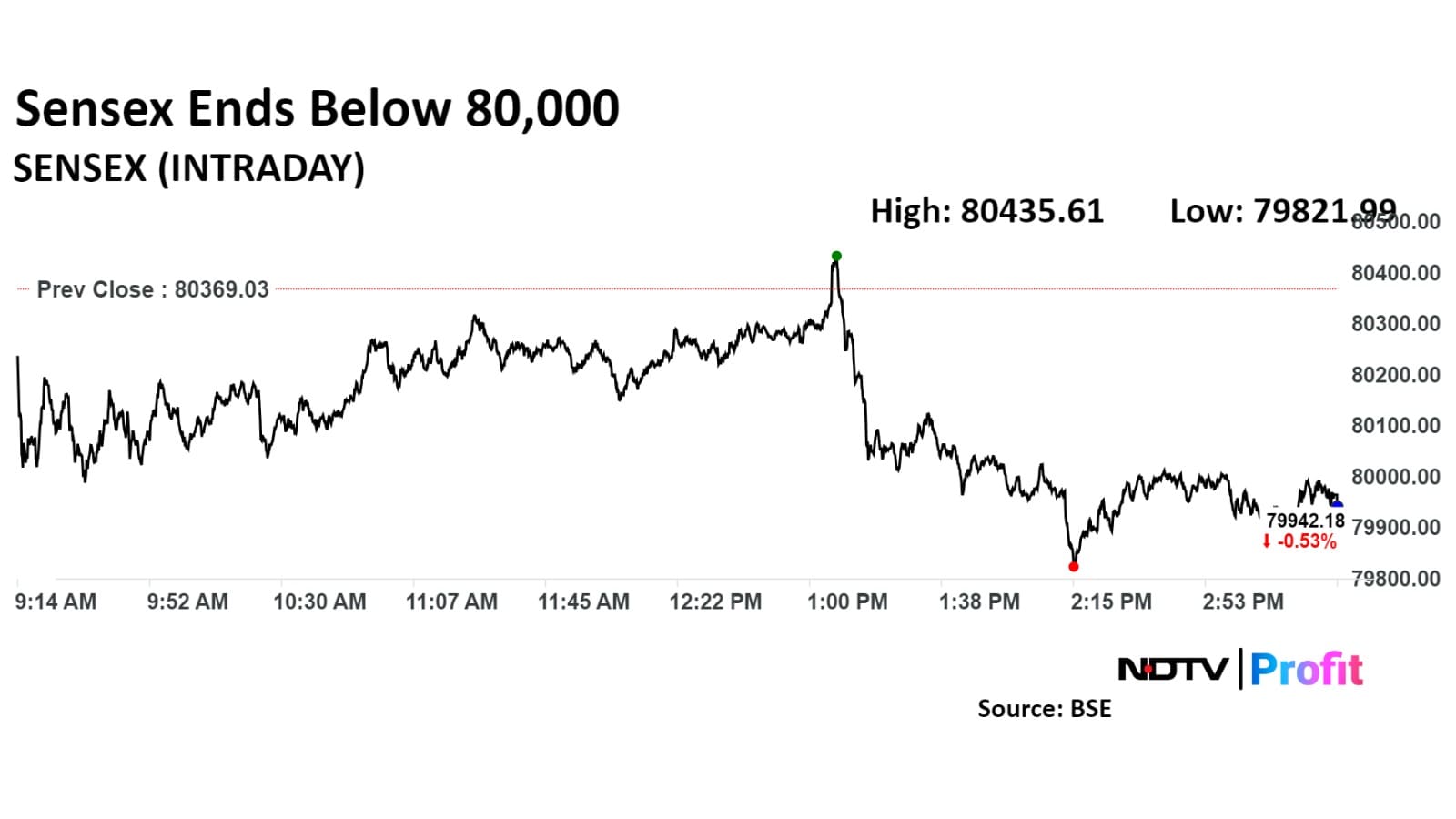

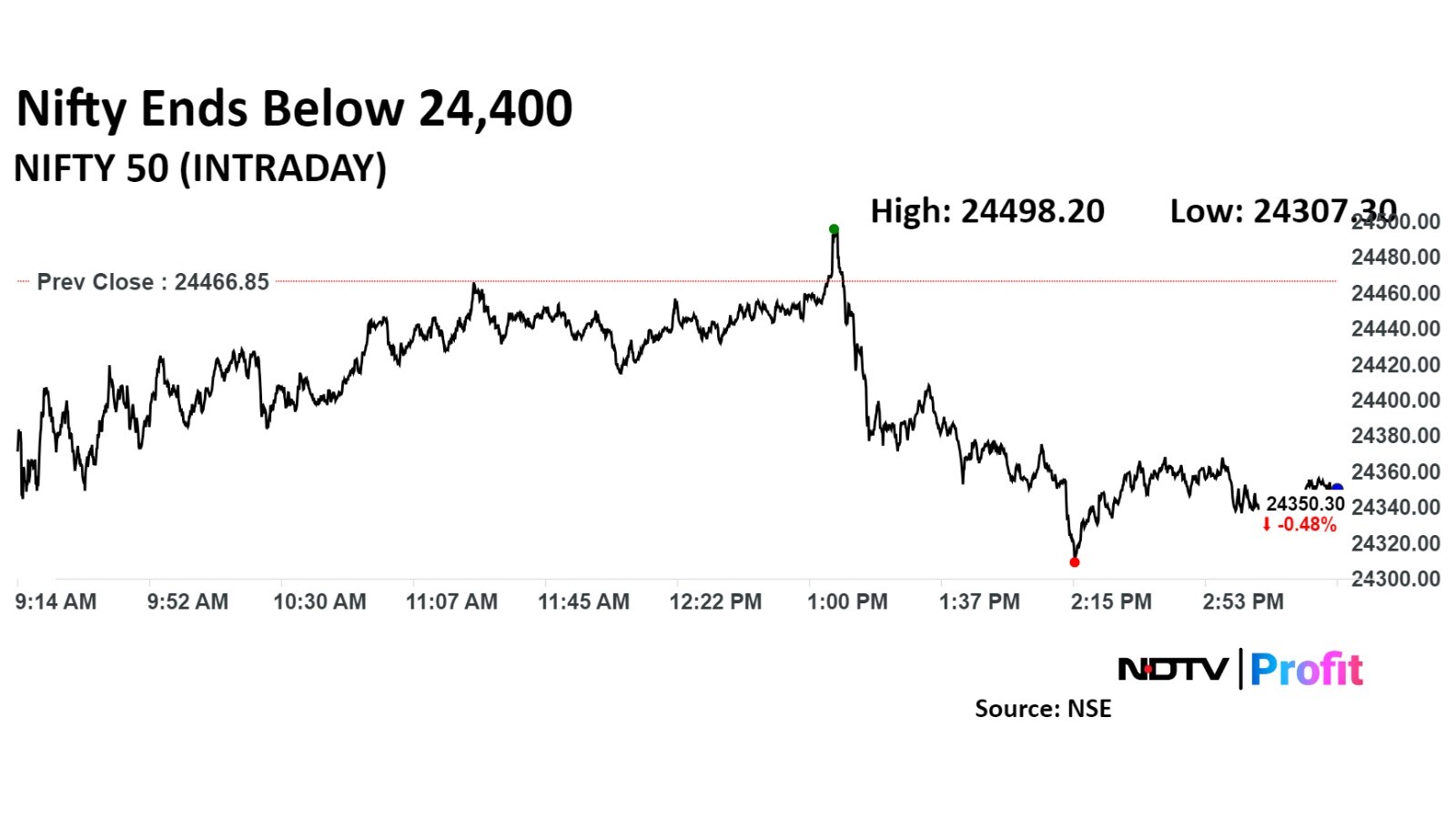

The Nifty 50 ended 126.00 points, or 0.51% lower at 24,340.85, and the Sensex ended 426.85 points, or 0.53% down at 79,942.18.

Moreover, a decline in Asian share indices and Europe markets also pressured the Indian benchmarks as investors across the world await Gross Domestic Product data from Europe and the US.

During the session, the Nifty 50 declined 0.65% to 24,307.30, and the Sensex declined 0.68% to 79,821.99.

The India Volatility index jumped 8.16% to 15.70, the highest level since Aug. 14. The index ended 6.85% higher at 15.51.

Cipla Ltd. share price ended over 4% lower on Wednesday, as analysts cut target price, citing weaker than expected domestic business and challenges in its key products.

The Sensex settled 0.53% down at 79,9942.18

The Nifty 50 ended 0.48% down at 24,350.30.

"On daily charts, the index has formed small candle, which suggests indecisiveness between the bulls and the bears. We are of the view that, currently, market is witnessing range bound activity, hence buying on dips and sell on rallies would be the ideal strategy," said Shrikant Chouhan, head, equity research, Kotak Securities Ltd.

For traders, 24,250-24,200/79,700-79,500 would act as key supports zones, while 24,500-24,550/80,400-80,600 could act as key resistance areas for the bulls. However, below 24,200/79,500 uptrend would be vulnerable, he said.

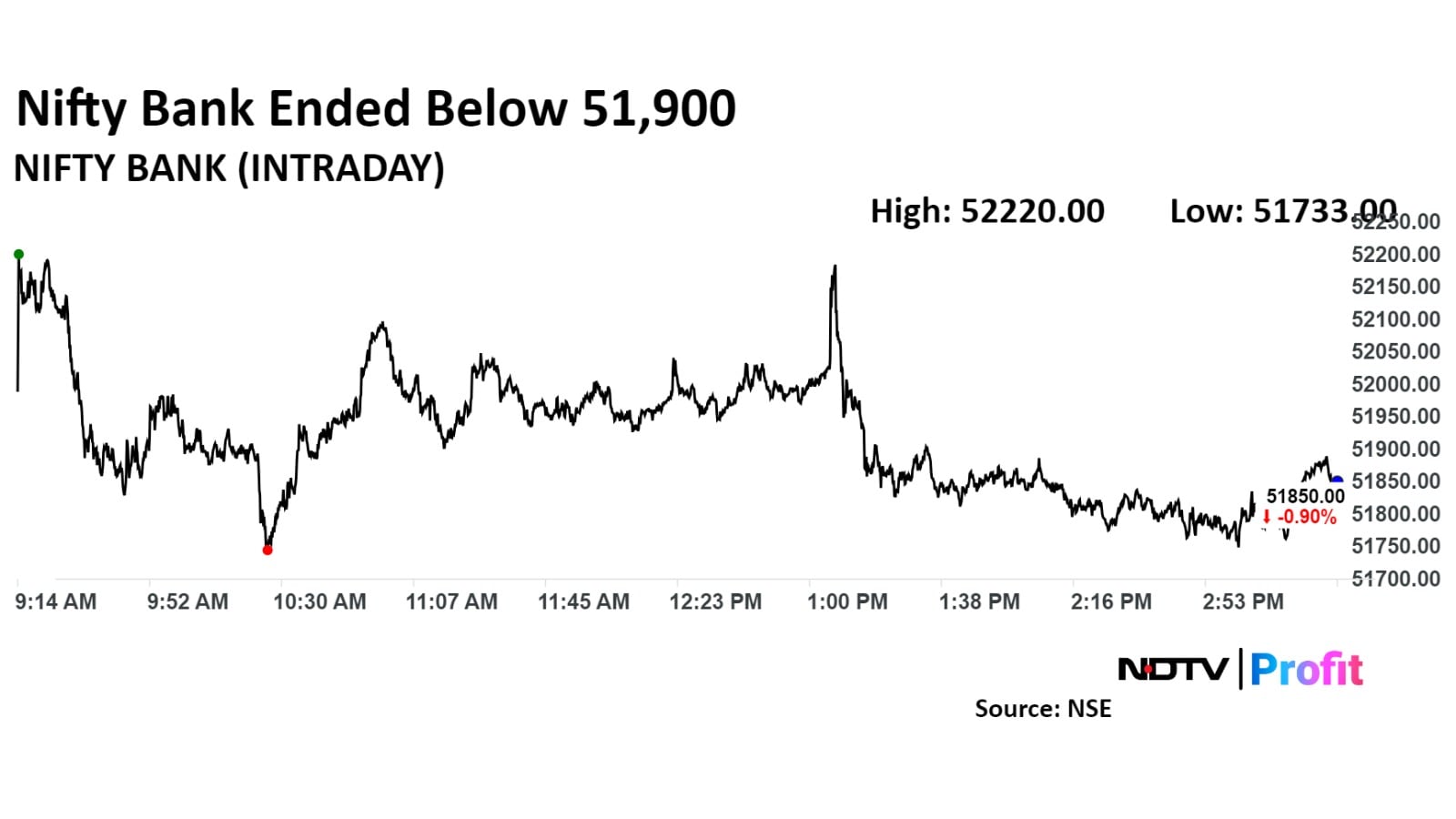

The Nifty Bank ended 0.90% down at 51,850.00

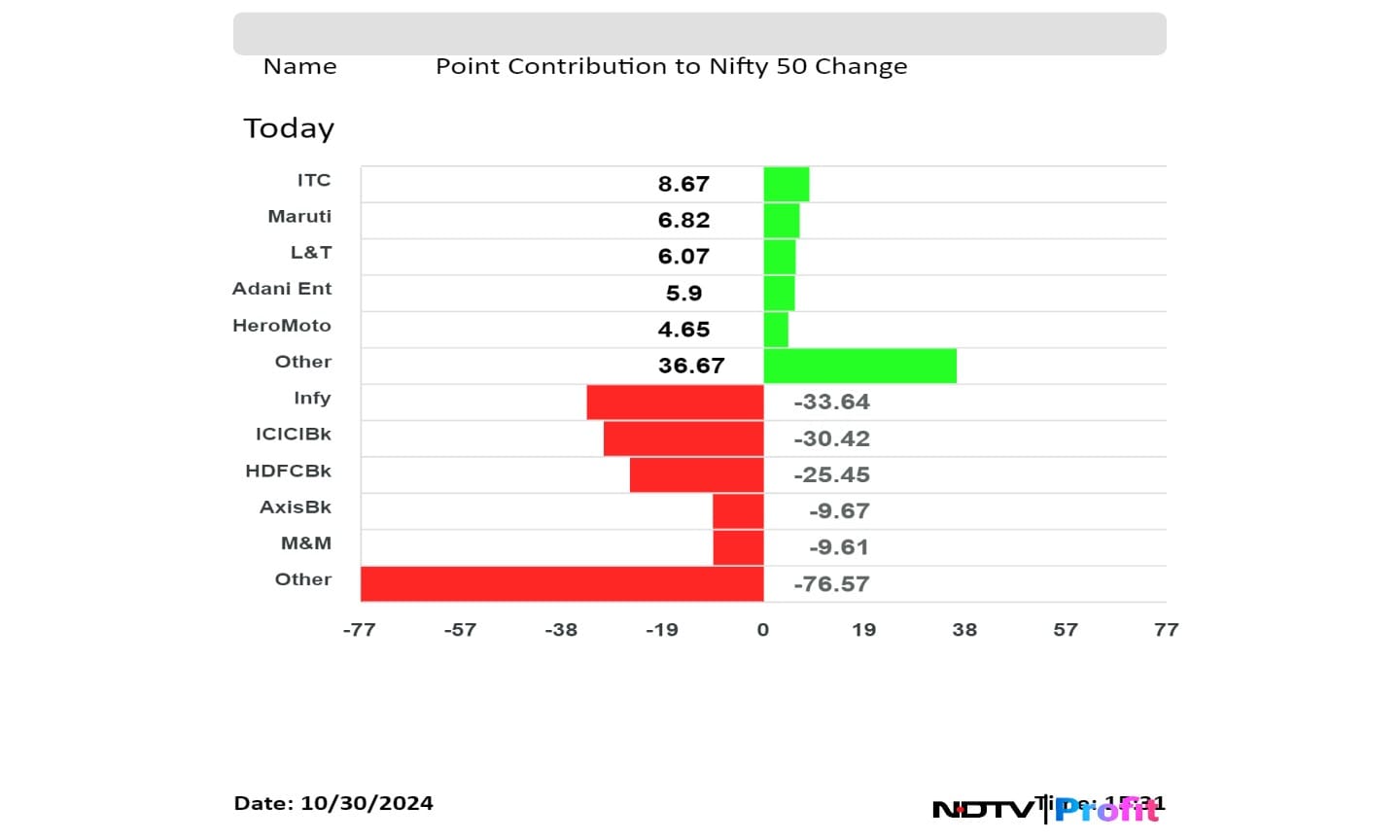

Shares of ITC Ltd., Maruti Suzuki India Ltd., Larsen & Toubro Ltd., Adani Enterprises Ltd., and Hero MotoCorp Ltd. cushioned the fall in the Nifty.

While those of Infosys Ltd., ICICI Bank Ltd., HDFC Bank Ltd., Axis Bank Ltd., and Mahindra & Mahindra Ltd. weighed the index.

Top contribution to the Nifty 50 index.

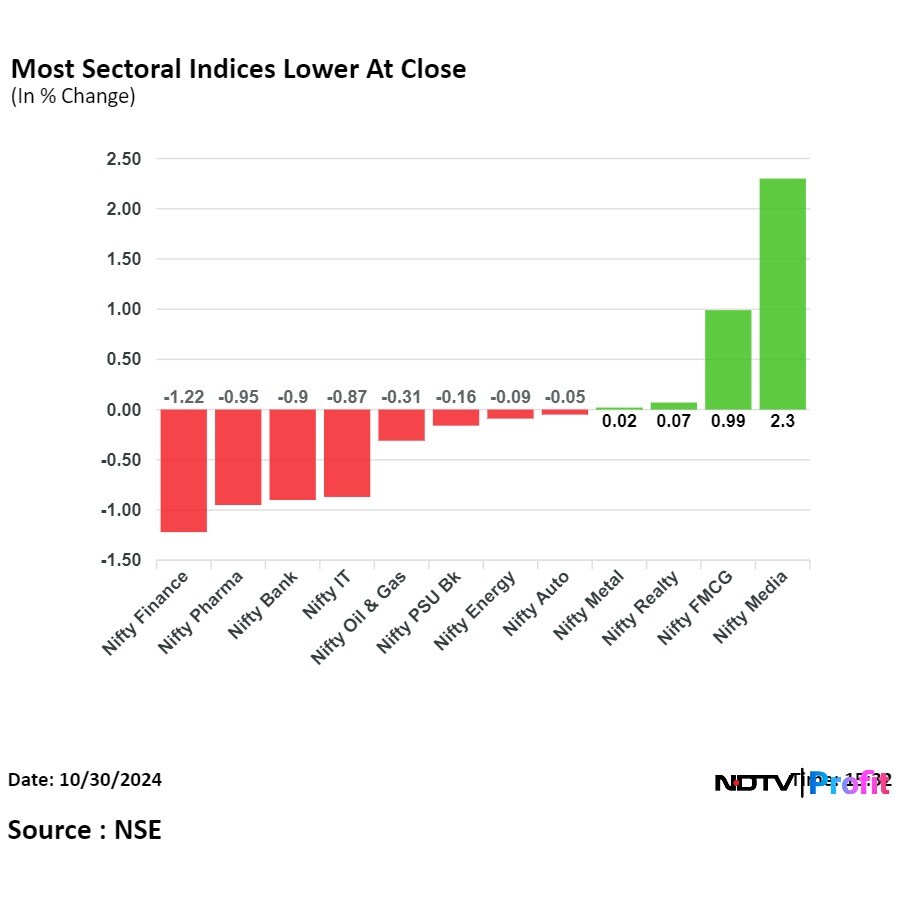

On NSE, eight out of 12 sectors ended lower, three advanced, and one remained largely flat. The NSE Nifty Finance declined the most, and the Nifty Media rose the most.

Most sectoral indices ended lower.

Broader indices outperformed with BSE Midcap ending flat and BSE Smallcap closing 1.5% higher.

Four out of 20 sectoral indices on BSE ended lower and 16 rose. BSE Services rose the most.

Market breadth was skewed in the favour of buyers. As many as 2,892 stocks rose, 1,040 stocks fell, and 79 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.