India's benchmark stock indices erased intraday gains to extend their losing streak to the fourth session on Thursday as Axis Bank Ltd., ICICI Bank Ltd. and HDFC Bank Ltd. dragged. The benchmarks have now recorded the longest losing streak since Oct. 26. The NSE Nifty 50 closed 152.05 points or 0.69%, lower at 21,995.85 and the S&P BSE Sensex ended 454.69 points or 0.62%, lower at 72,488.99.

The Nifty slipped below 22,000 for the first time since March 26. Intraday, the Nifty rose as much as 0.81% to 22,326.50 and the Sensex rose 0.73% to 73,473.05.

The intra-day volatility was higher in the markets ahead of the domestic quarterly results and due to global market volatility and geopolitical tensions, according to Vikas Jain, senior research analyst at Reliance Securities.

"Extreme volatility swings were seen on the weekly expiry day, with the morning trade dominated by bulls, followed by a steep decline in the mid-session," Aditya Gaggar, director of Progressive Share Brokers Pvt., said. "Follow-up selling dragged the index further lower to trade below the psychological support of 22,000."

With a bearish engulfing candlestick pattern, the index has broken its 50-day simple moving average and long trendline support, but currently, it is placed at the lower end of the rising channel. The activity of the upcoming day will decide the continuation or reversal of the trend, Gaggar said.

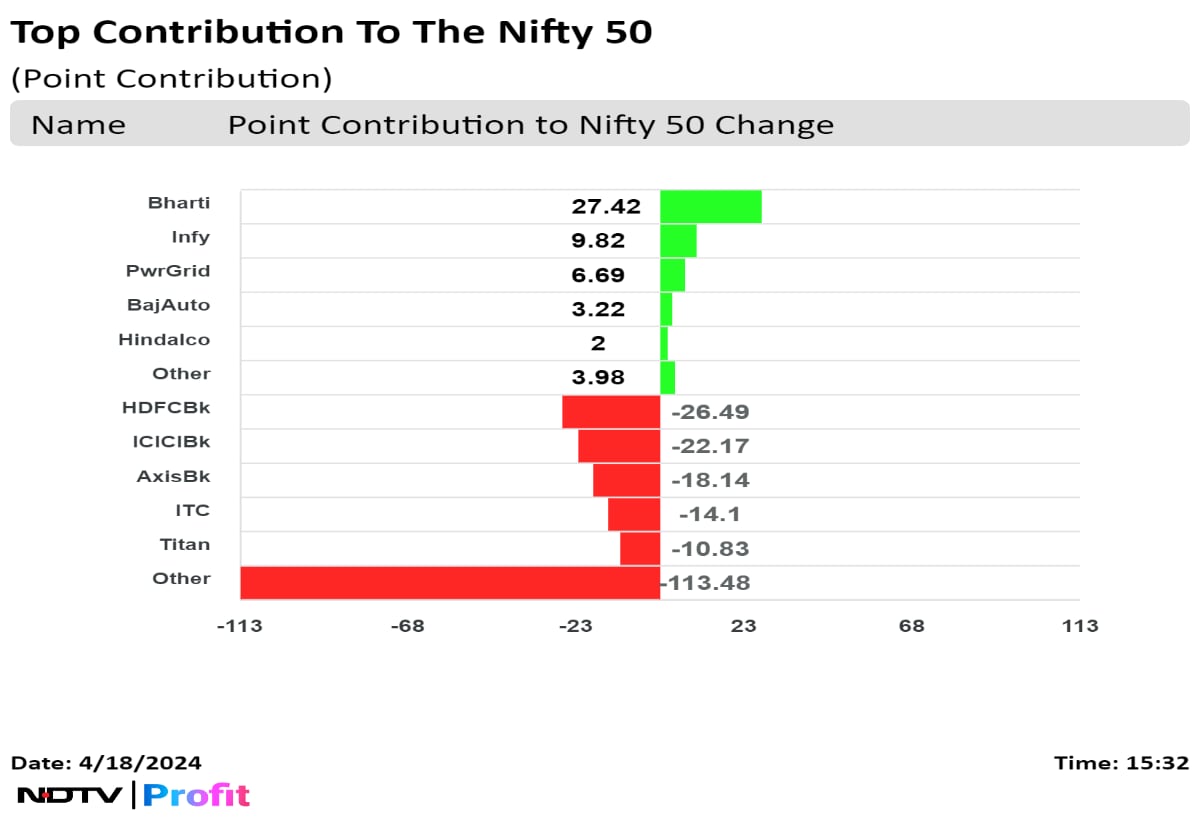

HDFC Bank Ltd., ICICI Bank Ltd., Axis Bank Ltd., ITC Ltd., and Titan Co. dragged the most.

Bharti Airtel Ltd., Power Grid Corp., Bajaj Auto Ltd., and Hindalco Industries Ltd. led the gains.

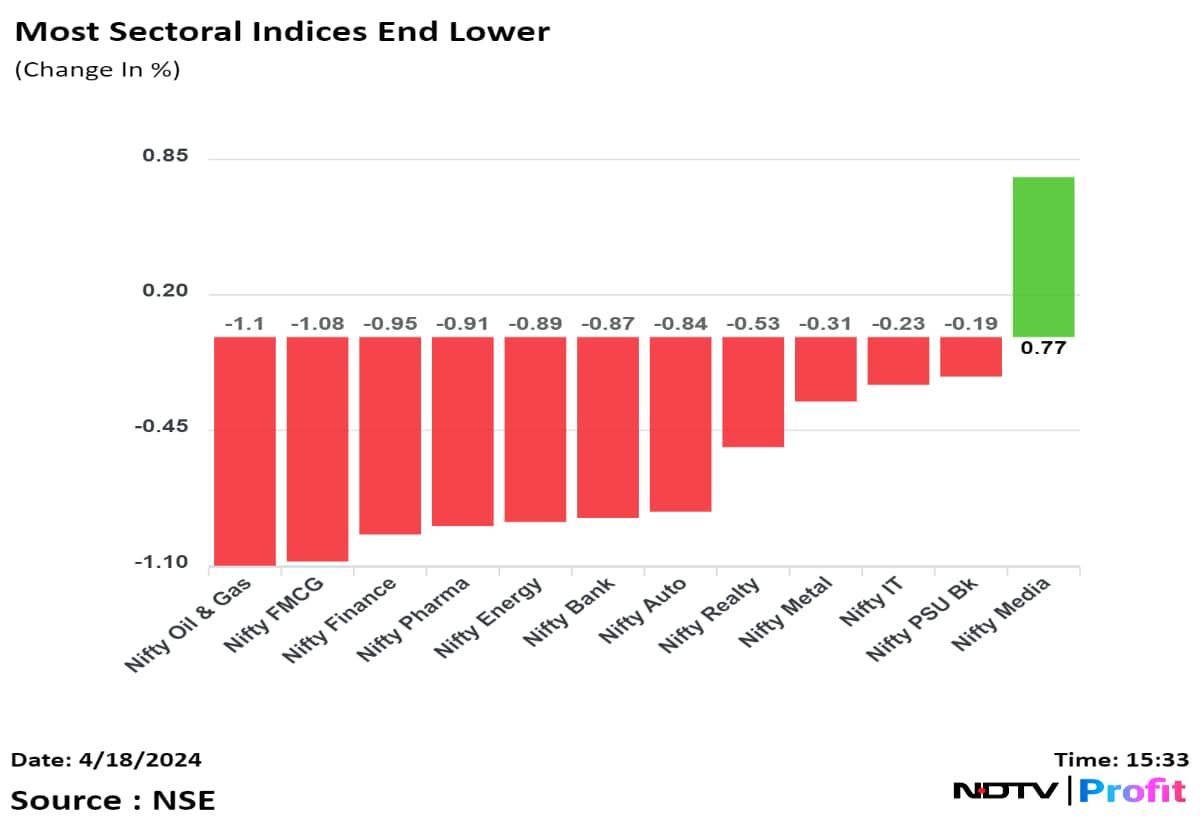

On the NSE, 11 out of the 12 sectors ended lower. The Nifty Oil & Gas sector declined the most.

The broader markets ended on a mixed note. The BSE MidCap settled 0.39% lower and the BSE SmallCap ended 0.06% higher.

On the BSE, 10 sectors declined and as many advanced. The BSE Consumer Durables sector declined the most and the BSE Telecommunication rose the most among sectoral indices.

The market breadth was split evenly between buyers and sellers as 1,904 stocks advanced, 1,894 declined and 131 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.