The benchmark indices snapped their two-session rally and closed lower as heavyweights HDFC Bank Ltd., Reliance Industries Ltd. and Infosys Ltd. dragged.

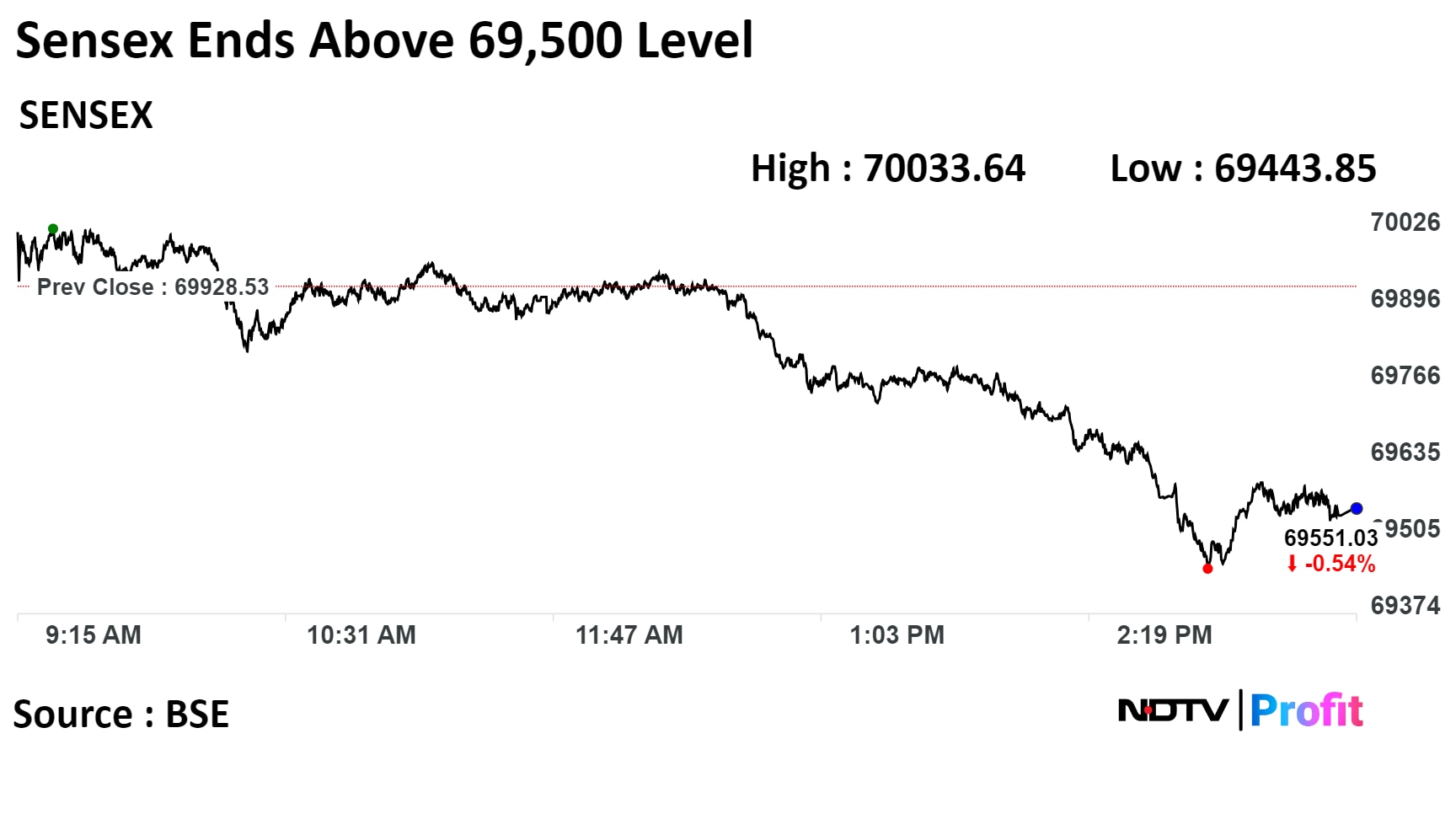

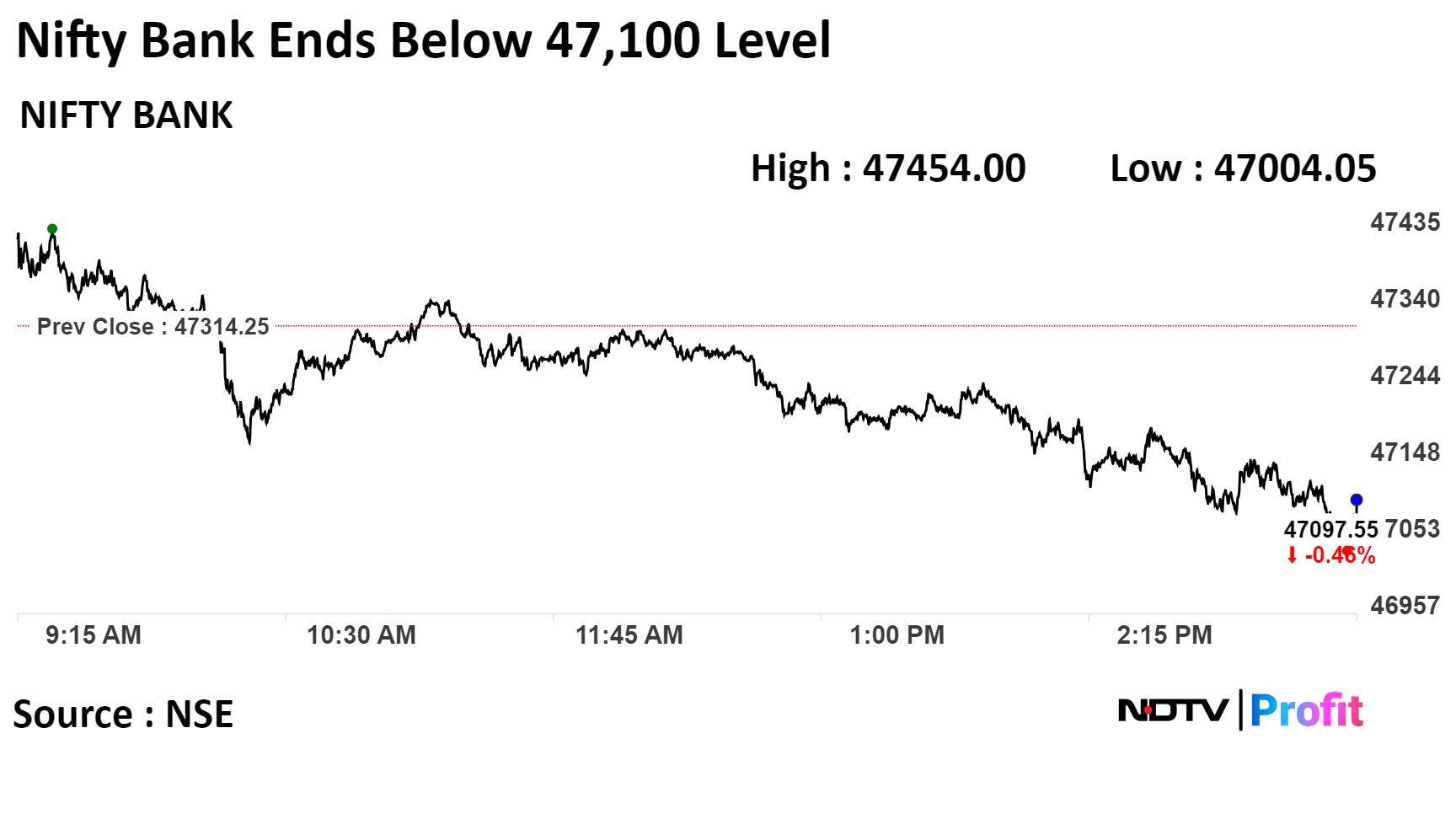

The NSE Nifty 50 closed 91 points or 0.43% lower at 20,906.40, while the S&P BSE Sensex was 378 points or 0.54% down at 69,551.03.

Intra-day, the Nifty hit a record high of 21,037.90 points and the Sensex rose to 70,033.64, crossing the 70,000 level for the second consecutive session.

"While the Sensex reaching 70,000 is a significant milestone, it's important to remember that investing is a long-term journey," Nitin Rao, chief executive officer of InCred Wealth, said in a note. "Resist chasing short-term gains and avoid investing based on emotions."

"Don't be lured by stocks with attractive prices but lack underlying strength. Always prioritise companies with strong financials and long-term prospects," Rao said.

"The index trended lower throughout the trading session as the selling pressure kept intensifying and ended the trading day with the formation of a bearish engulfing pattern on a relatively higher volume," Avdhut Bagkar, technical and derivatives analyst at StoxBox, said. "This potentially indicates a temporary arrest on the upside unless the high of 21,037 is decisively taken out."

Global Cues

Globally, indices were higher ahead of the release of U.S. inflation data due later in the day. Most European markets opened higher after the U.K. wage growth for the three months ending October was slower than expected.

Indices in Asia also closed higher, led by Hong Kong's Hang Seng, as investors await decisions from a meeting of the Chinese economic policymakers that may indicate how much stimulus to expect next year.

HDFC Bank, Reliance Industries, Larsen & Toubro Ltd., Infosys Ltd. and Kotak Mahindra Bank Ltd. dragged the index lower.

Axis Bank Ltd., HDFC Life Insurance Co., Tata Consultancy Services Ltd., UltraTech Cement Ltd. and Bajaj Auto Ltd. cushioned the fall.

All sectoral indices fell, except the Nifty Media and Metal, declined. The Nifty PSU Bank ended flat. The Nifty Realty, Energy and Oil & Gas ended over 1% lower.

The broader markets also fell, with the BSE MidCap falling 0.4% and the SmallCap declining 0.27%. Three out of the 20 sectors compiled by the BSE advanced, while 17 declined.

The market breadth was skewed in the favour of the sellers. As many as 2,035 stocks declined, 1,753 advanced and 117 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.