The benchmark indices settled largely flat on Wednesday, ahead of the outcome of the US Federal Reserve's two-day policy meeting.

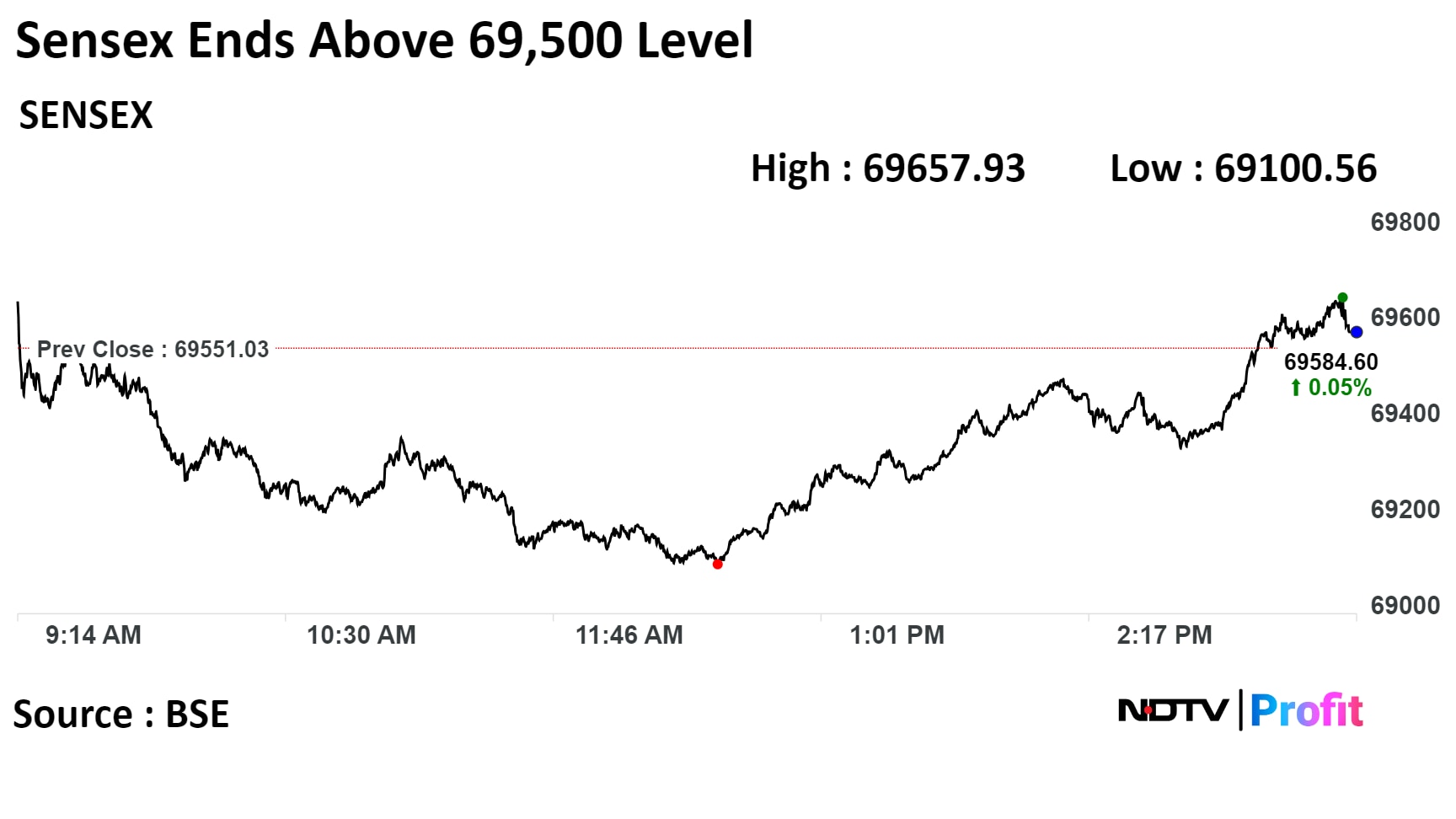

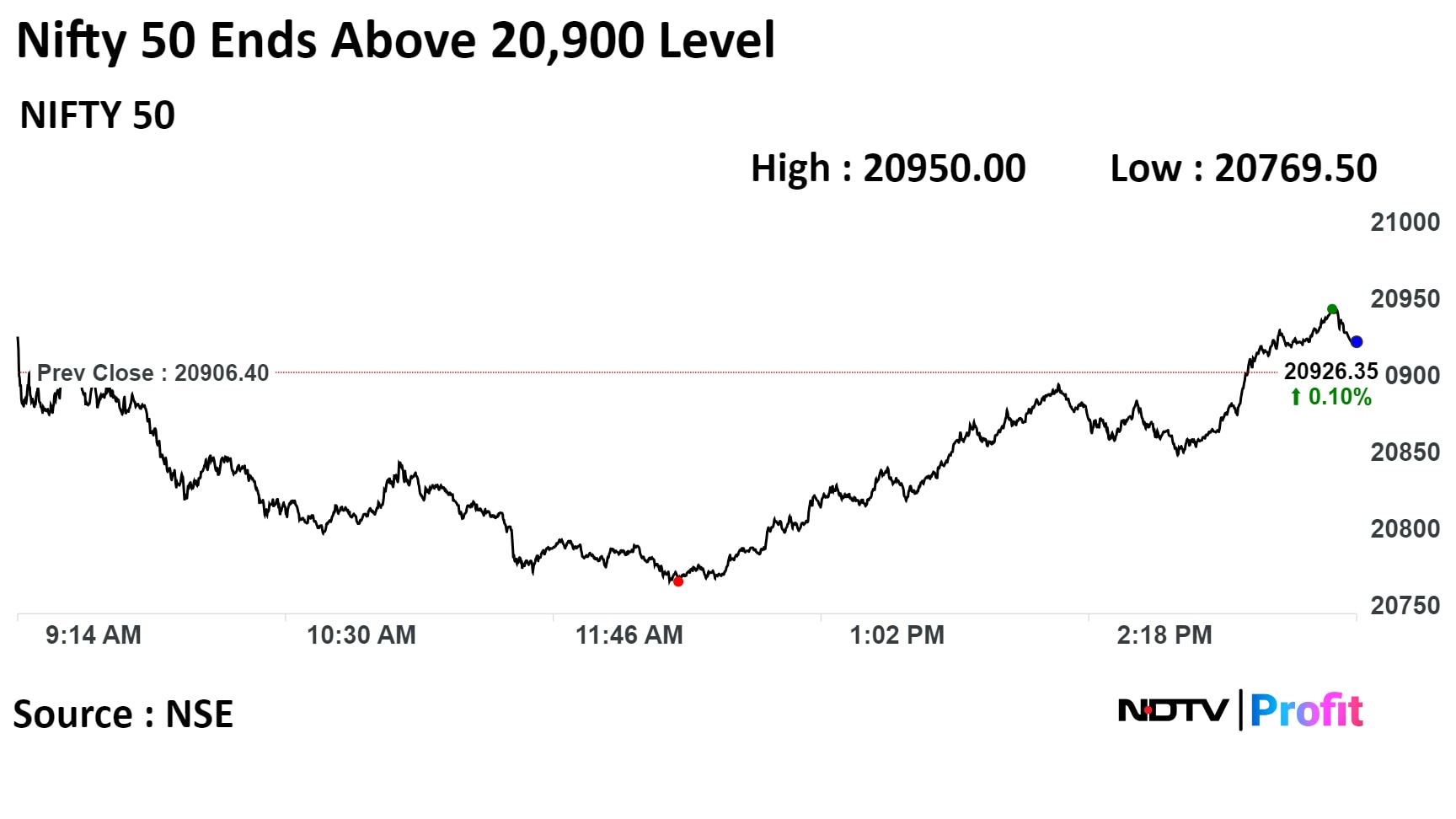

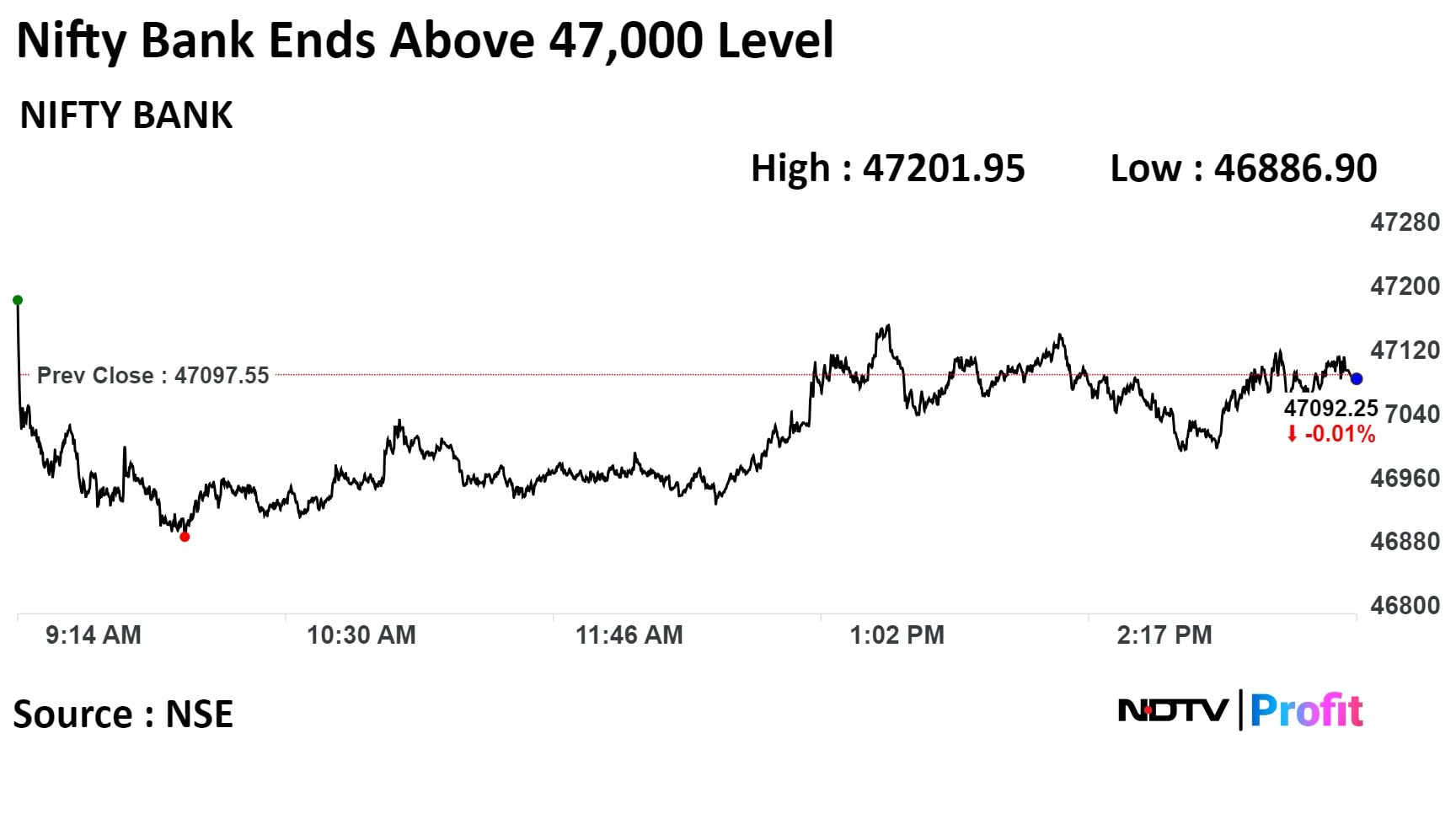

The NSE Nifty 50 ended 20 points or 0.1%, higher at 20,926.35, while the S&P BSE Sensex settled 34 points or 0.05%, higher at 69,584.60. Both benchmark indices fell as much as 0.65% during the day as traders booked profit.

Market participants exercised caution before the outcome of the Federal Open Market Committee's policy meeting, which is due later on Wednesday.

"We are of the view that the short-term market texture is still range bound and for the bulls now, 21,030 would act as a crucial resistance zone," Shrikant Chouhan, head of equity research at Kotak Securities, said.

Investors largely expect the Fed to keep the benchmark federal fund rate steady at its current level of 5.25–5.50%. The highlight of the key event will be Fed Chair Jerome Powell's speech.

The US Consumer Price Index rose 0.1% on a sequential basis in November after being unchanged in October, sparking fears among investors that the Fed may not start cutting rates aggressively.

Larsen & Toubro Ltd., NTPC Ltd., Hindalco Industries Ltd., ITC Ltd., and the State Bank of India were leading the gains in the Nifty.

Infosys Ltd., Axis Bank Ltd., Tech Mahindra Ltd., Tata Consultancy Services Ltd. and UltraTech Cement Ltd. weighed on the indices.

Ten out of 14 sectors on the NSE rose, while four declined. The Nifty PSE rose the most and the Nifty IT fell the most.

The broader market outperformed the benchmark indices, with the BSE MidCap rising 1.06% and the SmallCap gaining 0.73.

Fifteen out of the 20 sectors on the BSE advanced, while five declined. realty and power rose the most.

The market breadth was skewed in favour of the buyers. As many as 2,179 stocks advanced, 1,597 declined and 114 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.