Shares of Senco Gold Ltd. surged over 9% on Tuesday after its first-quarter profit nearly doubled, beating analysts' estimates. The jeweller's net profit rose 82% year-on-year to Rs 51 crore in the quarter ended June 2024, according to its stock exchange. This compares with the consensus estimate of Rs 32 crore given by analysts tracked by Bloomberg.

The company's revenue grew by 7.6% year-on-year to Rs 1,404 crore. According to Bloomberg analysts, the top line was Rs 1,492 crore.

Operating income, or earnings before interest and tax depreciation and amortisation, grew 60.3% on a yearly basis to Rs 109 crore, while the Ebitda margin expanded to 7.8% from 5.2% in the corresponding quarter of the last fiscal. The analyst consensus estimates for Ebitda and Ebitda margin tracked by Bloomberg stood at Rs 81 crore and 28.2%, respectively.

"Akshay Tritiya's (first 41 days of the quarter) sales performance was on expected lines, with impressive year-on-year growth of 21% despite challenges like extreme heat, Lok Sabha elections, and fewer wedding days," said Chief Executive Officer and Managing Director Suvankar Sen.

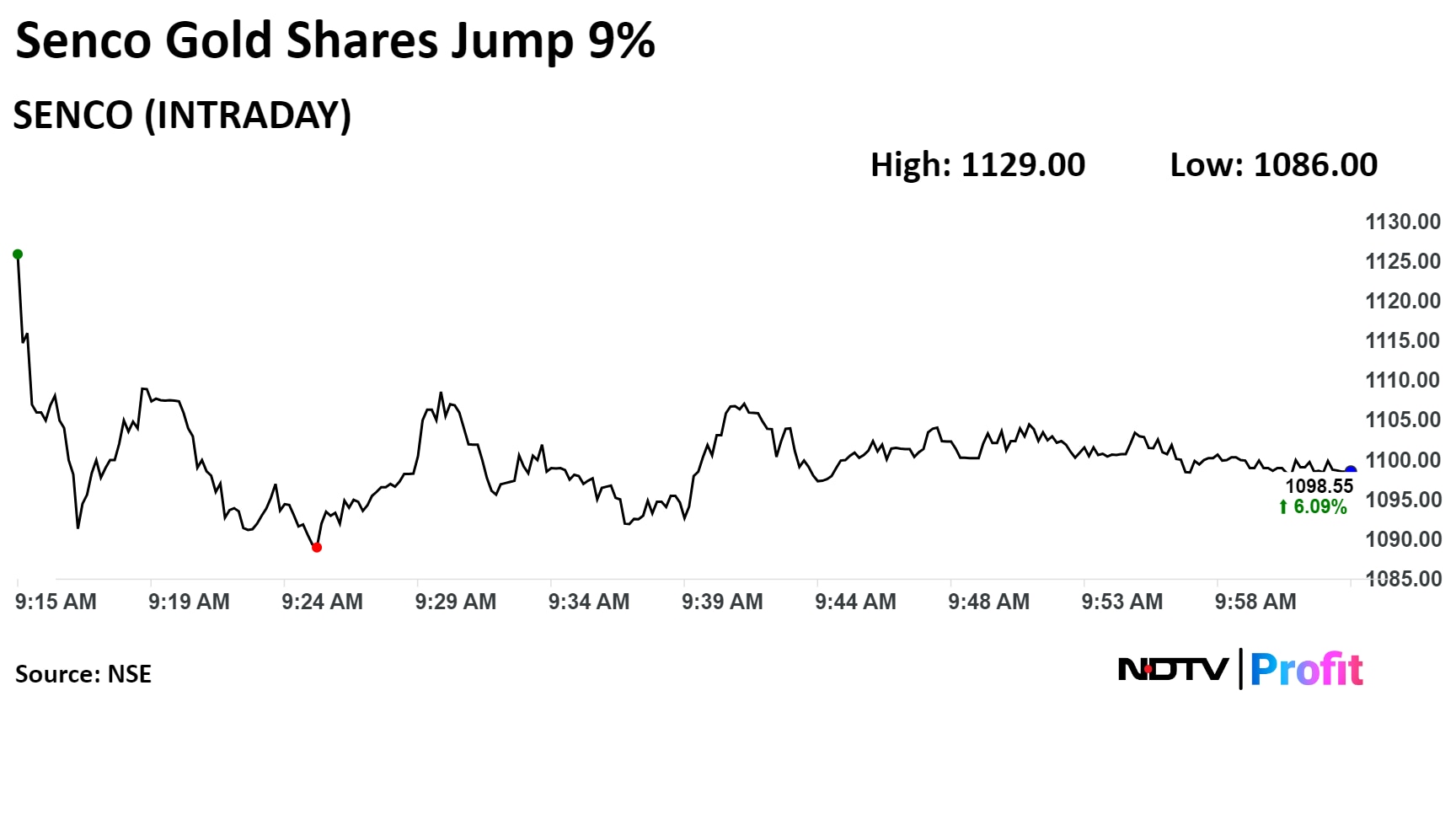

Shares of the company rose as much as 9.03% to Rs 1,129 apiece, the highest level since July 2. It pared gains to trade 5.94% higher at Rs 1,097.1 apiece as of 10:10 a.m. This compares to a 0.12 decline in the NSE Nifty 50 Index.

The stock has risen 57.57% on a year-to-date basis. Total traded volume so far in the day stood at 0.83 times its 30-day average. The relative strength index was at 71.13.

All four analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 2.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.