. (Photo_ Vijay Sartape_ Source_ BQ Prime).jpg?downsize=773:435)

State Bank of India's share price rose on Friday as Jefferies reiterated the stock as its top pick in the segment. The lender is likely to insulate its net interest income because of its higher share of marginal cost of funds based lending rate loans, in case of slow reduction in policy rate.

Jefferies has a 'buy' rating on the stock, with a target price of Rs 1,030 per share, which implies a 32% upside from Thursday's closing price.

SBI plans to improve deposit growth and align the incremental growth between loans and deposits, the state–owned lenders' top management said in an interaction with the brokerage. Jefferies hosted SBI's chairman and top management for a roadshow in UAE.

The bank's asset quality is holding up and recoveries will also aid earnings in the second half, Jefferies said. The management has retained guidance of 14–16% growth in credit and 10–11% growth in deposits in near term. "It's domestic LDR at 68% still offers headroom to optimise asset mix."

SBI is not planning to raise capital or monetise or list stakes in the subsidiaries, Jefferies said. "SBI Cards and Payment Services Ltd. has seen higher credit costs and may look to review their business platforms to build more resilience."

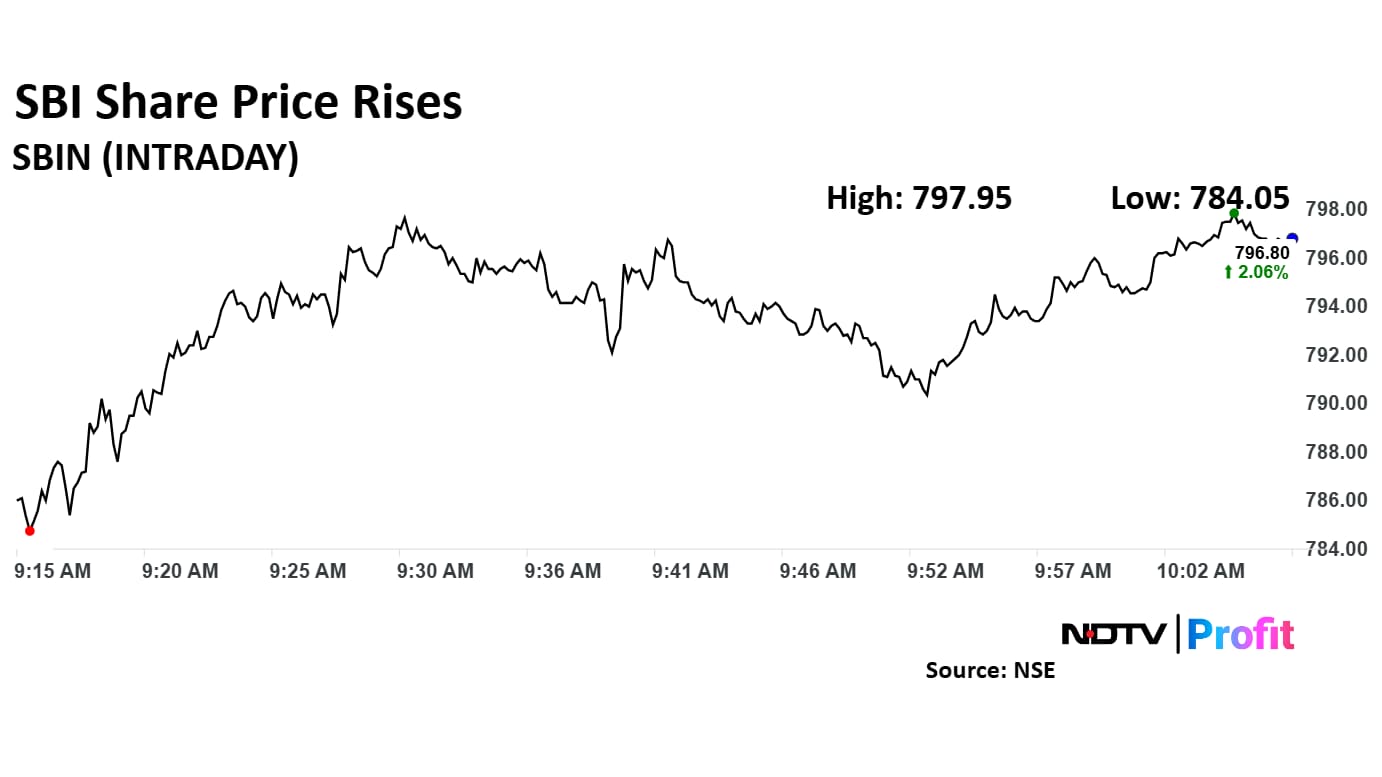

State Bank Of India Share Price Today

SBI share price rose 2.06% to Rs 796.80 apiece.

State Bank of India's share price rose 2.20%. It pared some gains to trade 2.02% higher at Rs 796.50 apiece as of 10:05 a.m., compared to a 0.88% advance in the NSE Nifty 50.

The stock gained 42.50% in 12 months, and 24.23% year-to-date. Total traded volume on NSE so far in the day stood at 0.26 times its 30-day average. The relative strength index was at 44.71.

Out of 50 analysts tracking the company, 39 maintain a 'buy' rating, six recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 22.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.