Sagility India Ltd's share price jumped to hit its upper circuit limit a day after the company detailed its earnings for the September quarter. Net profit for the September quarter jumped by 236% year-on-year.

The company's consolidated net profit for the reporting quarter came in at Rs 117 crore as against Rs 35 crore in the same quarter a year ago. Revenue rose 21.1% to Rs 1,325 crore and Ebitda was 28.2% higher at Rs 300 crore. Ebitda margin came in at 22.6% as against 21.4%.

"Our runway for growth is long and is backed by a combination of favorable industry dynamics, our strategic investments in advanced technologies including AI and a strong orientation towards creating value for our clients," the company said in a media statement.

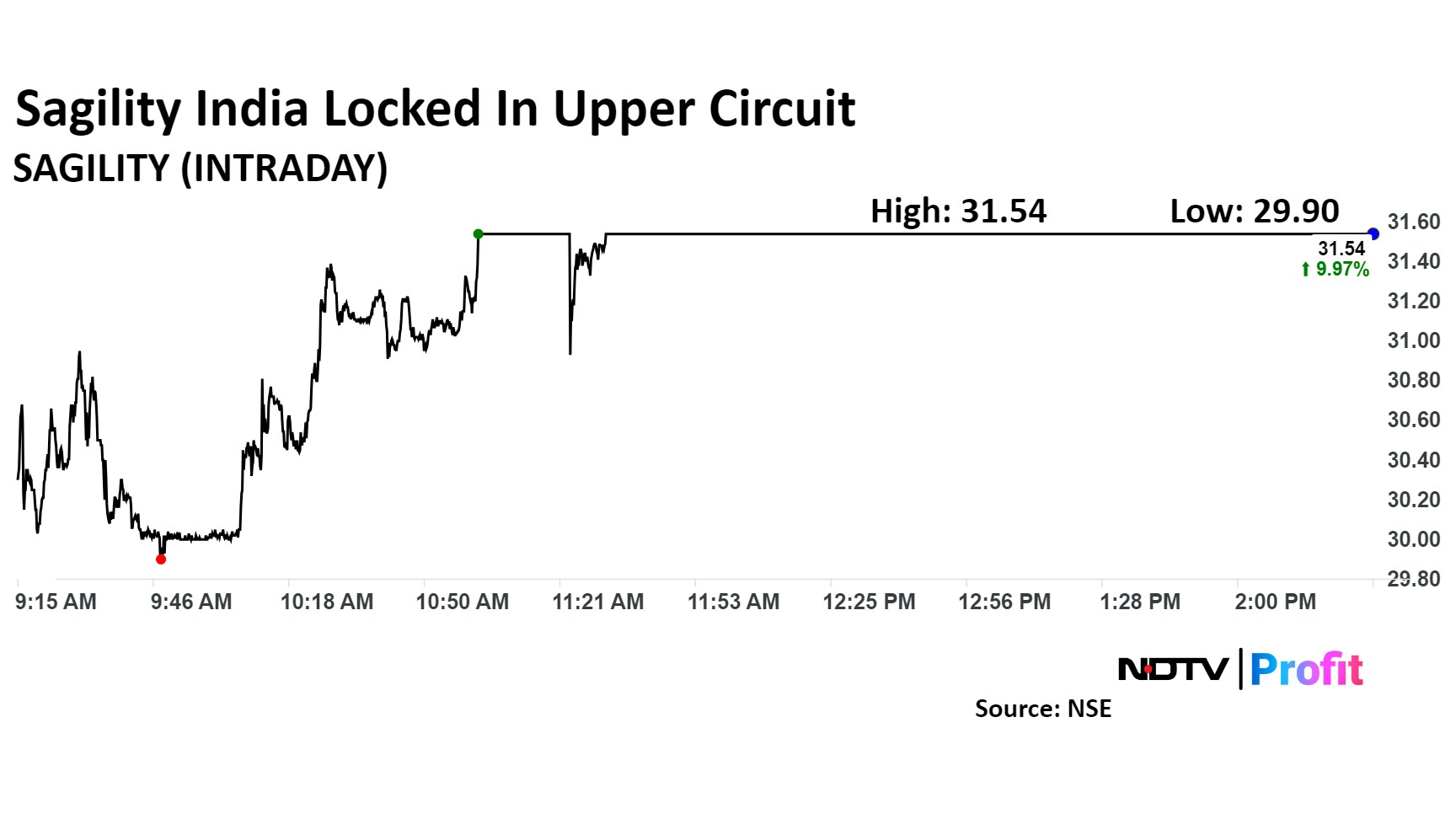

The scrip rose as much as 9.97% to Rs 31.54 apiece. It was locked in its upper circuit as of 2:33 p.m. This compares to a 0.2% fall in the NSE Nifty 50 Index. It has risen 7.6% over its closing price on its listing day earlier this month.

Previously known as HGS Healthcare and earlier known as one of the most profitable ventures of Hinduja Global Solutions, nearly doubled in valuation during its debut on November 12 since the control changed hands.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.