Shares of Rail Vikas Nigam Ltd. surged nearly 11%, leading the gains among railway public sector undertakings, on Monday. The rally came on the back of Cabinet Committee on Economic Affairs approval for eight Ministry of Railways projects with a collective estimated cost of Rs 24,657 crore on Friday.

These projects are expected to be completed by the fiscal ended March 2031.

The design of these new railway line proposals aims to offer direct connectivity, enhance mobility, lower logistics costs, decrease oil imports, and decrease CO2 emissions. Aligned with Prime Minister Narendra Modi's vision of a New India, these initiatives aim to empower the people of the region, making them "Atmanirbhar" through comprehensive development, which will improve employment and self-employment opportunities, a press release by PIB stated on Friday.

Shares of Ircon International Ltd., Indian Railway Finance Corp., and RailTel Corp. of India Ltd. were also trading in green. RailTel rose more than 5%, followed by Ircon with 4.31% gains. IRFC rose almost 4% ahead of its quarterly results, which are due later this evening.

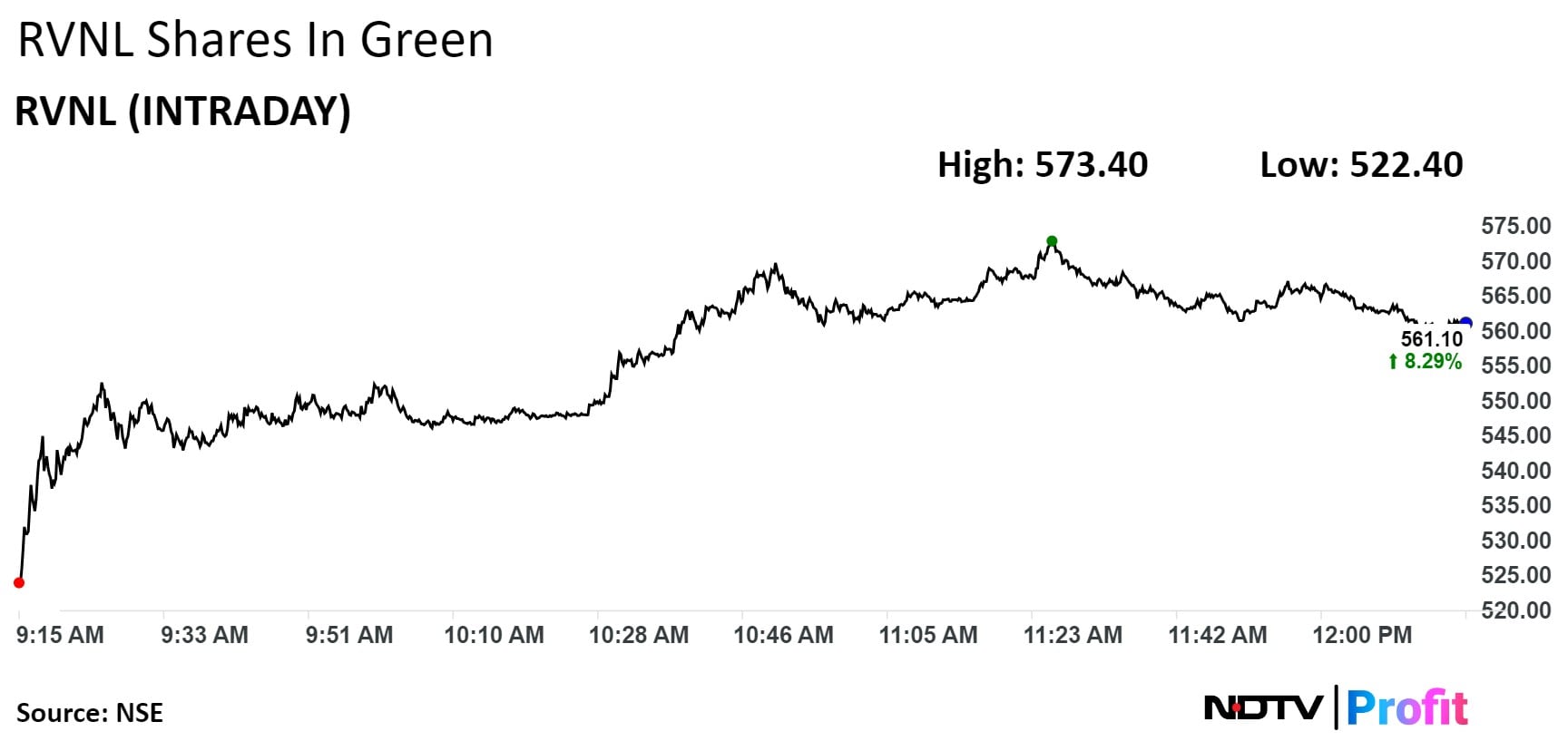

Shares of RVNL rose as much as 10.66% to Rs 573.40 apiece, the highest level since Aug. 8. It pared gains to trade 9.22% higher at Rs 565.90 apiece as of 12:11 p.m. This compares to a 0.43% advance in the NSE Nifty 50 Index.

The stock has risen 351.82% in the last 12 months and 379.80% higher so far this year. Total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 52.4.

All the three analysts tracking the company recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an downside of 38.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.