11_07_24 (1).jpg?downsize=773:435)

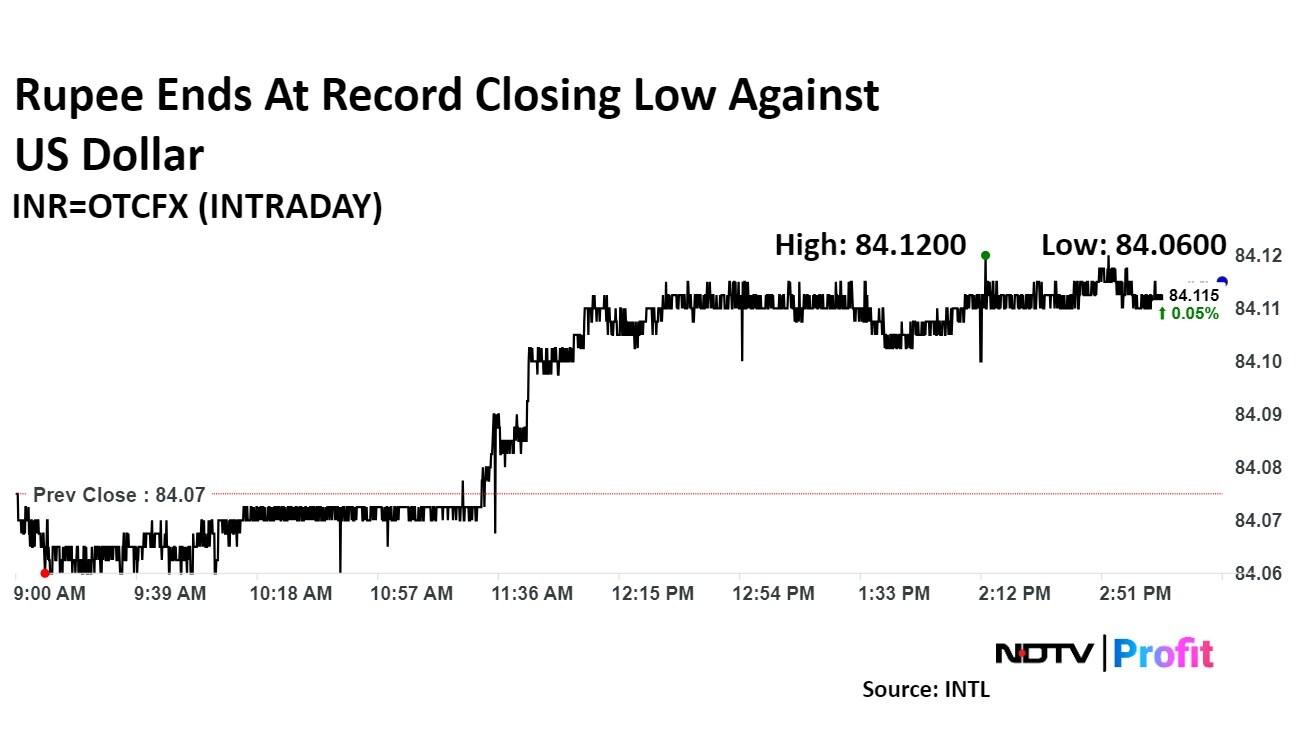

The Indian rupee weakened by 3 paise on Monday to close at a record low of 84.11 against the US dollar, continuing a downward trend. Earlier in the day, the rupee dipped to an all-time low of 84.12 before slightly recovering.

The local currency closed at 84.08 on Friday, but ongoing pressure from foreign institutional investors has pushed the rupee further down.

In recent weeks, global funds have offloaded more than Rs 1.25 lakh crore from Indian equities, contributing significantly to the rupee's slide. The currency crossed the 84 mark on Oct. 11, 2024, and has since struggled to regain strength amid persistent selling.

On Monday, the rupee briefly appreciated to 84.06 in early trading but failed to maintain momentum, as foreign fund outflows and a slump in domestic equities weighed heavily.

Anil Kumar Bhansali, head of treasury and executive director at Finrex Treasury Advisors LLP, noted that the rupee hit a low of 84.1125, driven by continued equity sales by foreign portfolio investors buying dollars, while RBI sold dollars to curb the fall. The same is expected today also.

Forex traders anticipate that the rupee will continue to trade within a narrow range, influenced by a strong dollar and rising crude oil prices. The RBI's actions may provide some support for the rupee at lower levels, but with the current trend, significant recovery seems challenging.

Last week saw a relatively quiet period in India due to Diwali celebrations, with low volatility and limited market movement, said Amit Pabari, managing director of CR Forex Advisors. The USDINR pair continued to trade within a familiar range, as the RBI effectively capped the upside at the 84.10 level.

This week, however, brings heightened interest as a lineup of IPOs unfold, with Swiggy's anticipated listing in the spotlight as it aims to raise Rs 11,327 crore. This could lend some support to the Rupee, with expectations for the USDINR pair to trade within a range of 83.80 to 84.20, with a downside bias.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.