India currency, money, rupee.jpeg?downsize=773:435)

The Indian rupee ended at a fresh record low on Thursday after having opened marginally stronger amid a surge in the dollar index during overnight trade as Donald Trump's victory might lead to higher US interest rates, aggressive policies, and tariff threats.

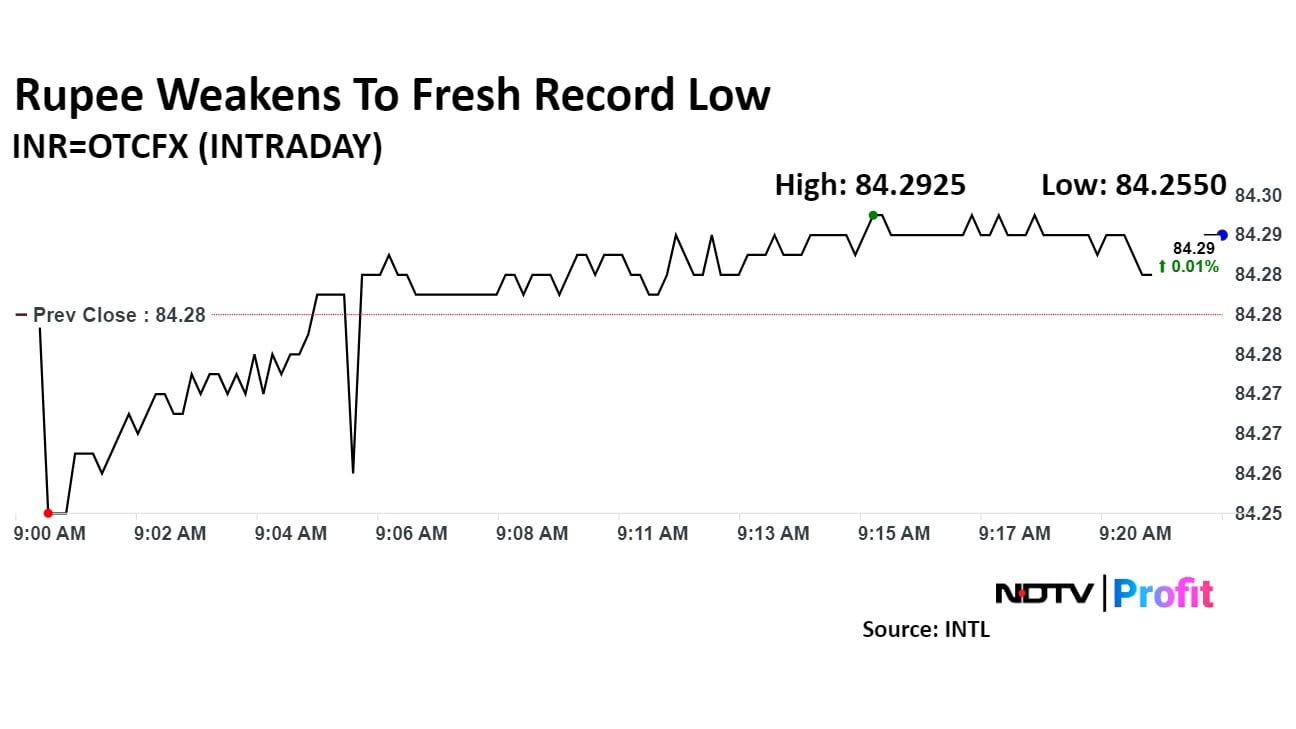

The domestic currency depreciated 9 paise to close at Rs 84.376 after opening 2 paise stronger at Rs 84.26 on Thursday. It closed at Rs 84.28 on Wednesday, according to Bloomberg data.

On Wednesday, the rupee plunged 18 paise, hitting its lowest point in four and a half months, amid growing fears of a stronger US dollar and potential economic fallout from a Trump presidency.

The surge in the dollar was driven by bets that Trump's victory would lead to higher US interest rates and more aggressive trade policies, including renewed tariff threats. This led to a selloff in the Chinese yuan and other Asian currencies.

The dollar index, which tracks the movement of the greenback against a basket of six major currencies, was trading at 104.98 during Asian trade

On Wednesday, the rupee's drop reflected a broader decline in Asian currencies amid growing uncertainty over the potential impact of a Trump presidency.

"Trump's victory has strengthened the dollar, putting pressure on the rupee, but signs point to a potential long-term decline for the DXY," said Amit Pabari, managing director of CR Forex Advisors.

He further added that Trump's proposed tax cuts without reducing spending may initially boost the dollar, but rising debt could erode confidence over time.

"Tariffs, particularly on China, could raise consumer prices, disrupt exports, and reduce global demand for the dollar," he said.

Pabari also noted that Fed rate cuts in 2025 may diminish the dollar's yield advantage, contributing to a bearish outlook for the dollar index in the medium term. While Trump's policies may strengthen the dollar in the short-term, they could weaken it in the long run.

The Indian rupee fell to its lowest yesterday at Rs 84.28 and is expected to continue with its fall as RBI allows a weaker rupee with FPIs continuing their selling mode in equities. The RBI protected the rupee for some time but left the protection as pressure on buying dollars was immense after a rise in the dollar index, a fall in Asian currencies, and a rise in US yields. Need to watch what RBI does during the day today, said Anil Kumar Bhansali, head of treasury and executive director, Finrex Treasury Advisors LLP.

Rupee volatility is expected to continue, with Rs 84.20-84.40 seen as the likely trading range today, according to Bhansali.

The Japanese Yen fell the most by 1.2%, followed by a similar depreciation in the Malaysian Ringgit. China's offshore currency, the Singapore Dollar, and Thailand's Bhat fell over 1% on Wednesday.

Analysts expect the rupee to remain volatile with downward pressure in the near term, influenced by global factors like US election uncertainties, foreign portfolio investor outflows, and a rising dollar index. The Reserve Bank of India has largely refrained from intervening to support the rupee, as the demand for dollars remains high, exacerbated by declining Asian currencies and rising US yields.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.