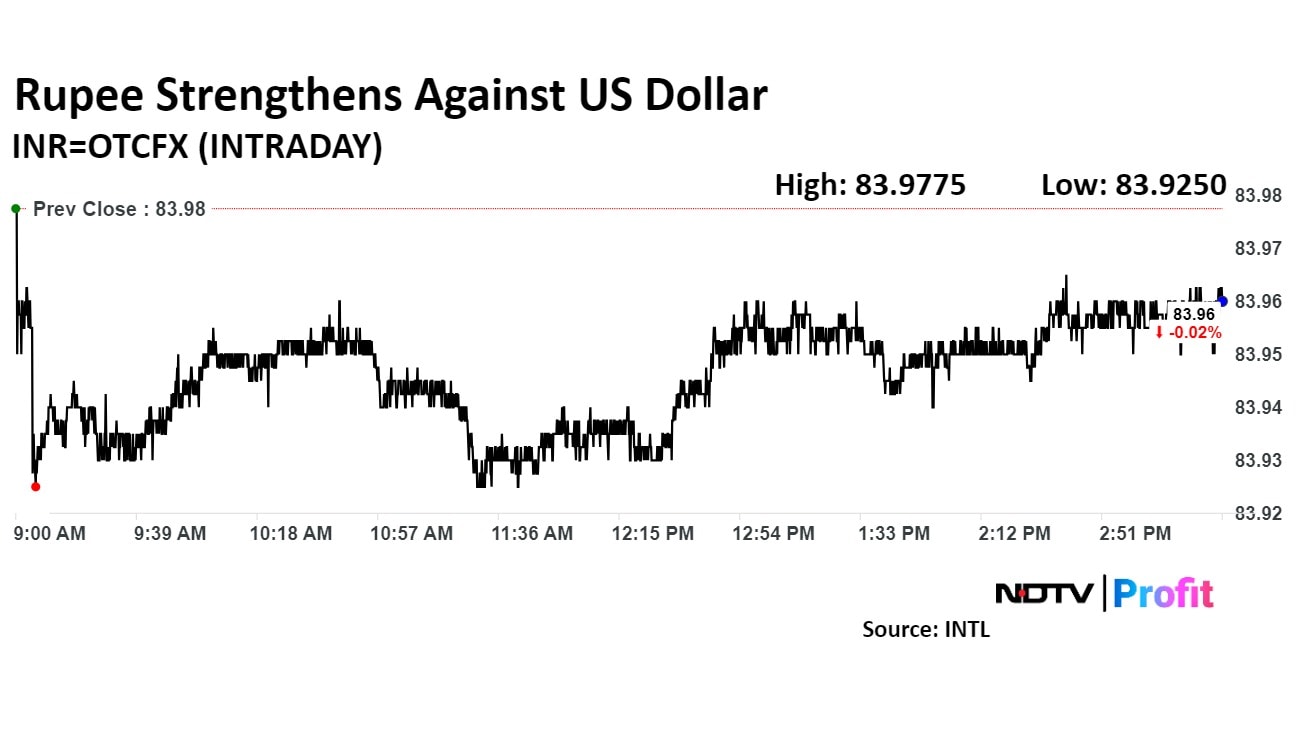

The Indian rupee closed 2 paise higher at 83.96 against the US dollar on Tuesday, gaining some strength after closing at 83.98 on Monday.

The local currency strengthened as both the dollar and Brent crude dipped, with traders booking profits after recent rallies driven by escalating tensions in the Middle East. The dollar index slipped by 0.15% to 102.3840, while Brent crude prices fell 2.08% to $79.25 per barrel.

"The dollar edged lower, retreating from its high of 102.38, as traders mulled over the Federal Reserve's outlook for monetary policy in the wake of last week's strong jobs report," noted Anil Kumar Bhansali, head of treasury and executive director at Finrex Treasury Advisors LLP.

The benchmark 10-year Treasury yield stayed elevated above 4%, reflecting less aggressive expectations, while the two-year yield hovered near its highest in over a month, he said.

The rupee saw a slight rise following remarks from the Commerce Minister, who suggested the rupee should strengthen amid growing inflows into the country, he added. Bhansali also noted the possibility of an RBI warning to banks to avoid short rupee positions. "Despite this, the rupee managed only a modest 5 paise increase from yesterday's close, as dollar buying remained consistent throughout the day," he said.

He expects the rupee to trade within a range of 83.90 to 84.05 on Wednesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.