The Indian rupee closed flat against the US dollar on Wednesday after the Monetary Policy Committee held the Reserve Bank of India's repo rate unchanged at 6.5%, while changing the policy stance to 'neutral'.

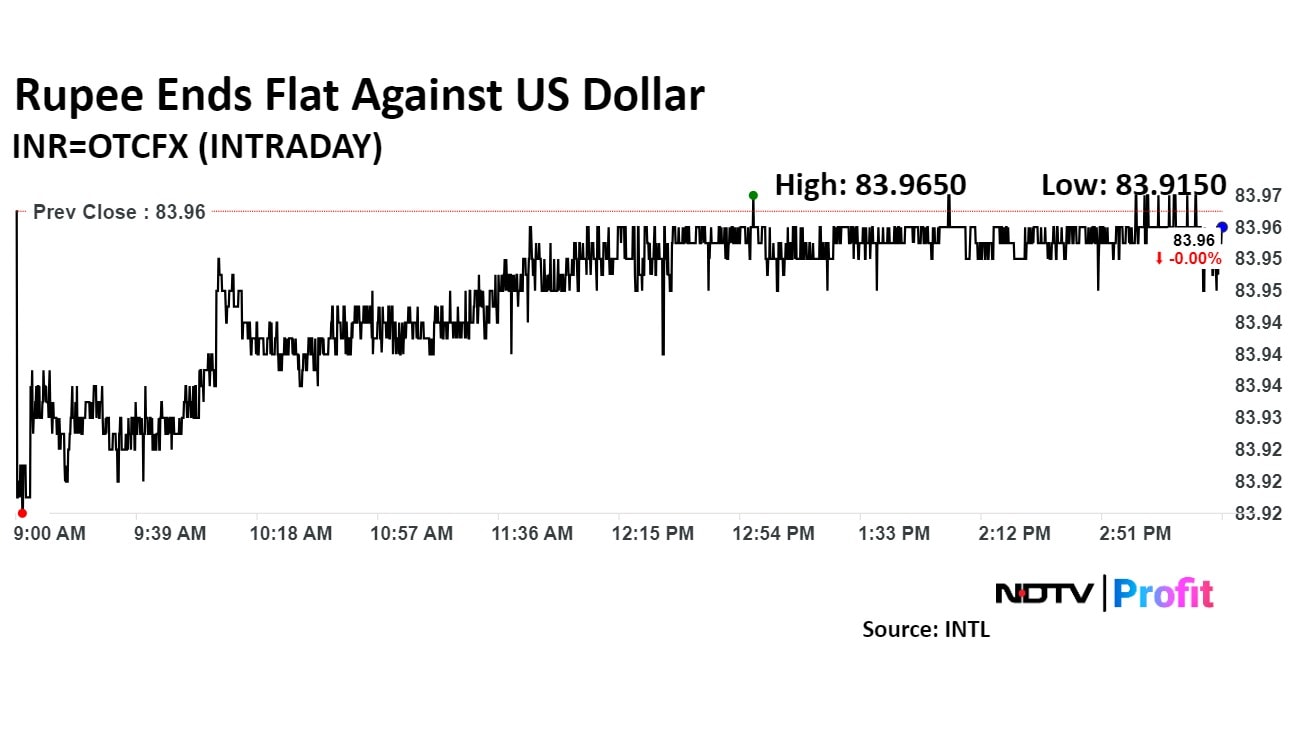

The currency closed at Rs 83.96, unchanged from Rs 83.96 at close on Tuesday, according to Bloomberg data.

The dollar index was up 0.14% at 102.619, and Brent crude oil prices edged 0.83% higher to $77.82 per barrel, as market participants awaited updates from the Middle East and the latest US inventory data.

"The policy did surprise with a change in stance being unanimously passed. This does indicate that a rate cut will be in the offing in the future, provided key economic data turns out to be acceptable. Interestingly, the RBI has projected inflation at 4.8% for the third quarter, which is among the highest for the four quarters this year," said Madan Sabnavis, chief economist at Bank of Baroda.

"This gives a sense that the earliest that we can see a rate cut will be in February, given the three major inflation risks highlighted by the governor: weather, geopolitics, and global commodity prices," he said. "The fact that growth is on a stable path provides comfort that there is no urgent need to lower the rates at this point in time."

"The Indian rupee rose earlier to Rs 83.90 as the FTSE announcement came but fell as FPIs continued to remain buyers of the currency pair while RBI kept a close watch on the pair, not allowing rupee to go across Rs 84.00 levels," stated Anil Kumar Bhansali, head of treasury and executive director at Finrex Treasury Advisors LLP.

"The rupee moved in a narrow range of Rs 83.9175-83.97 in the session as the dollar index rose. Next week we may expect some flows from the Hyundai IPO and also a $1.3 billion stake sale by Adani Enterprises, but we will have to wait and watch whether we are able to get some rupee appreciation out of it. The range for tomorrow is expected between Rs 83.85 and Rs 84.05," Bhansali said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.