(Bloomberg) -- The Indian rupee's most appealing trait for traders is fast deteriorating, helping turn the currency into emerging Asia's worst performer over the past month.

Twelve-month implied rupee yields — typically a reflection of interest rate differentials with the US — fell to the lowest since 2009 last week. That's bad news for carry traders, who seek profits from capturing the difference between the rates of high-yielding versus low-yielding currencies.

With the Reserve Bank of India widely expected to end a rate-hike cycle early next year, and the Federal Reserve seen peaking toward the middle, the interest-rate differentials are expected to worsen, further pressuring the carry trade and ultimately the rupee.

“Such lower forward premiums could become self-perpetuating for the rupee, making carry trades less attractive for foreign investors, implying fears of unwinding these trades,” said Madhavi Arora, an economist at Emkay Global Financial Services Ltd.

The rupee is down 2.3% over the past month to around 82.70 per dollar Tuesday and is seen falling to 84 per dollar next quarter, according to the likes of Australia and New Zealand Bank and Barclays Plc.

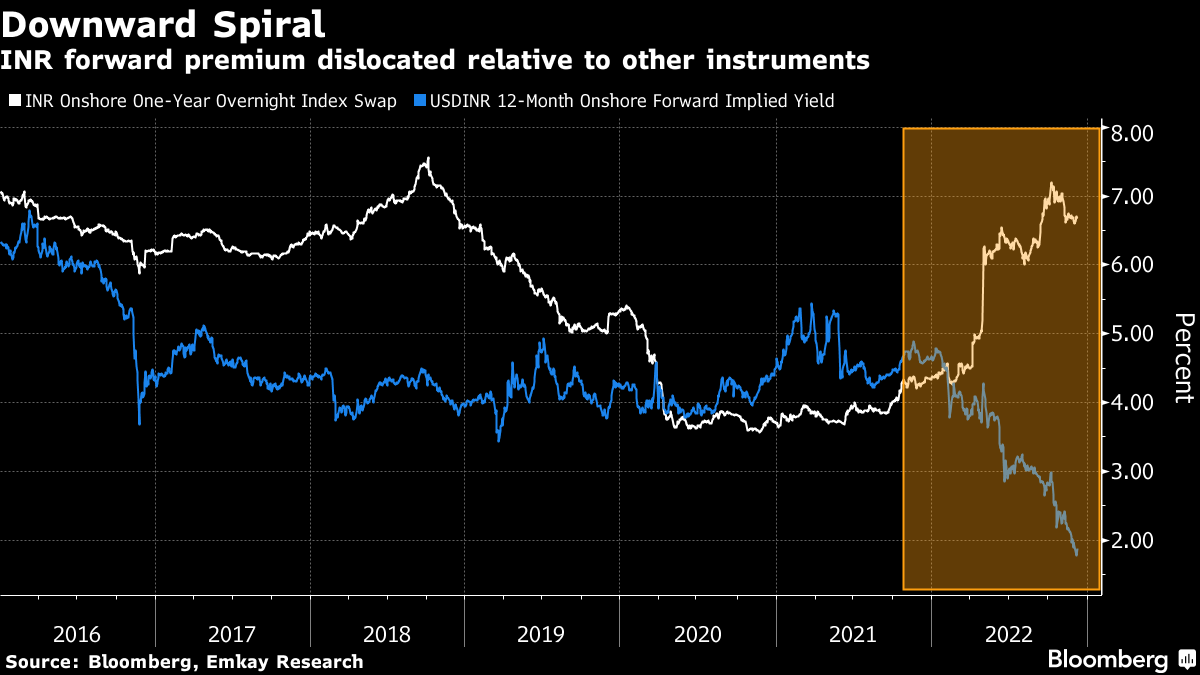

The following charts show the dislocations that have impacted the carry trade:

Dwindling Dollars

A shortage of dollars and the RBI's intervention in the FX market have also led to lower premiums, according to Gaura Sen Gupta, an economist at IDFC First Bank. The RBI's forward dollar book fell to $10.4 billion in September from $65.8 billion in March — the lowest since 2020.

“The combination of global risk-off sentiment and reducing interest rate differentials between India and US supports our expectation that the rupee should weaken against the dollar next year,” she added.

Market Deviation

Shorter tenor rates in the money and FX markets tend to follow each other. However, a higher-than-usual trade and balance-of-payment deficit have exacerbated the cash dollar shortage and the forward premia have deviated from other money markets like onshore rate swaps, said Emkay's Arora.

High Volatility

Rupee's historical volatility continues to climb, with the one-month measure now well above the level that marked Russia's invasion of Ukraine in February. That can weigh on demand from some carry investors.

(Updates rupee levels in the fifth paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.