The Indian rupee ended at record closing low for the second day in a row on Wednesday on likely foreign funds outflow from stocks after the government hiked capital gain tax in the Budget 2024.

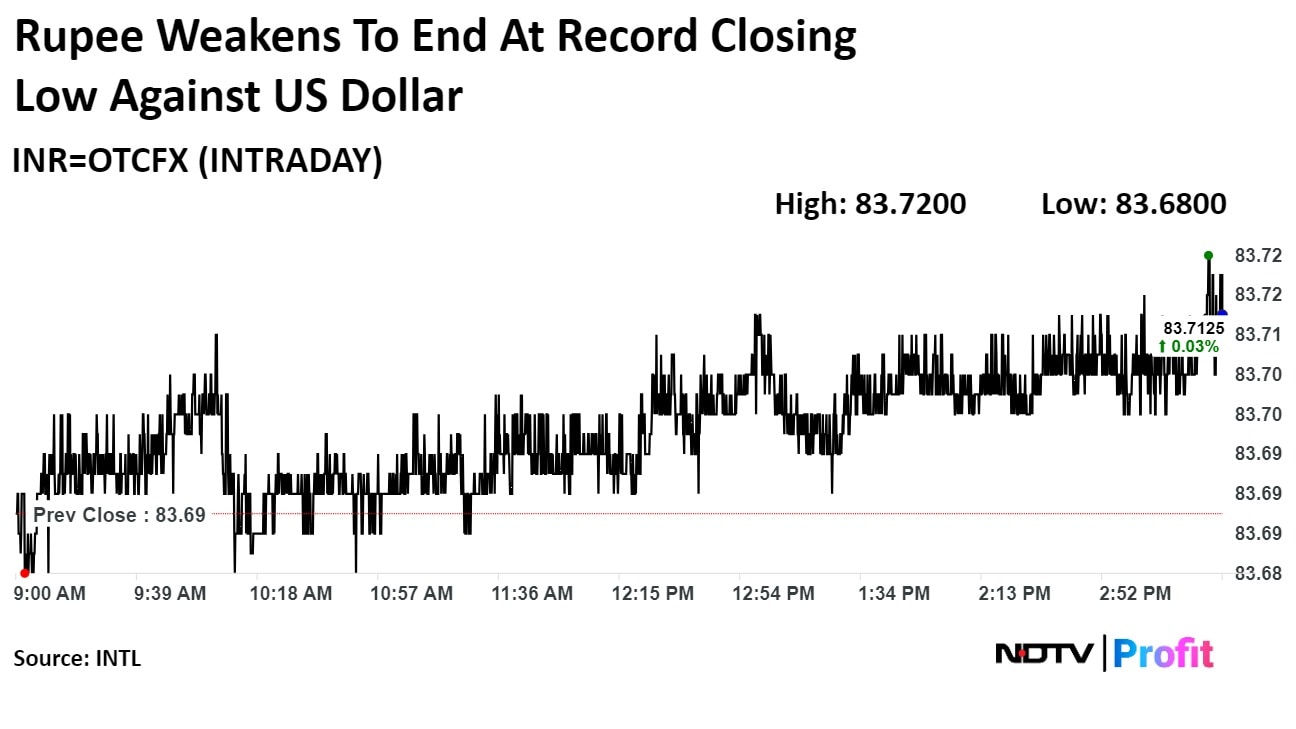

The local currency closed at Rs 83.71 after opening at Rs 83.69 against the greenback on Wednesday, according to Bloomberg. On Tuesday, it closed at a record low of Rs 83.69.

Benchmark equity indices fell for a fourth consecutive session on Wednesday logging their worst streak since five consecutive sessions of fall till May 30. The Nifty closed at 24413.50, down by 0.27% or 65.55 points and the was Sensex at 80148.88, down 0.35% or 280.16 points.

"Yesterday, the increase in capital gains tax and the removal of the indexation benefit were the main reasons for dollar buying as FPI's sold stocks," said Anil Kumar Bhansali, head of Treasury and executive director of Finrex Treasury Advisors LLP.

It appears that after the elections, the Reserve Bank of India has decided to allow some weakness to creep into the rupee to ensure the country is competitive enough for its exports, he said.

On Wednesday, Bhansali expects the rupee to trade in the Rs 83.60–8.80 range, with exporters on the watchful side for hedging. He advised importers to buy the dollar at dips or trigger stop losses at Rs 83.70.

The dollar index, on the other hand, rose ahead of the release of US GDP data on Thursday and personal consumer expenditures data on Friday. Falling US inventories and the possibility of an imminent cease-fire agreement in the Middle East kept Brent prices stable.

The dollar index was at 104.44, and Brent crude was at $81.66 per barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.