The rupee closed slightly weaker on Tuesday, tracking the movement of the dollar index following Federal Reserve Chair Jerome Powell's slightly hawkish speech. However, easing oil prices limited the demand for the greenback.

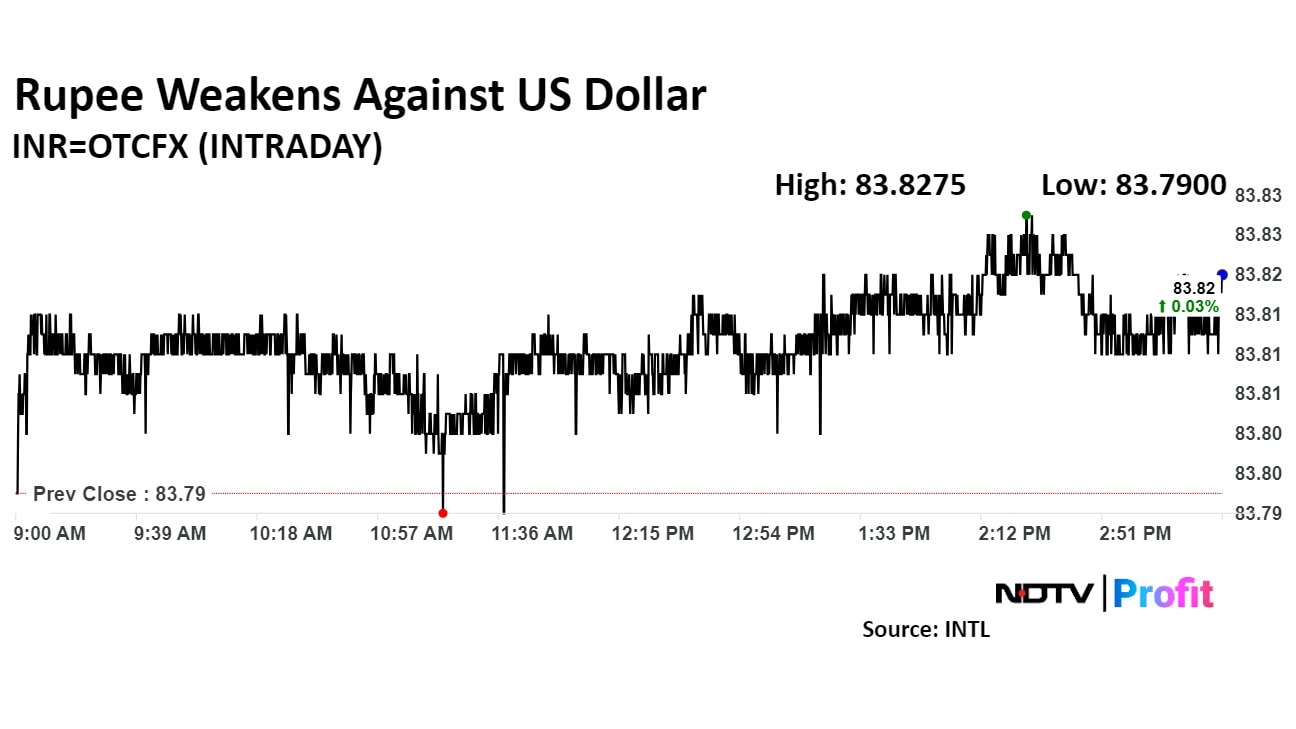

The Indian currency depreciated 2 paise to close at Rs 83.82 against the US dollar. It had closed at Rs 83.80 on Monday, according to Bloomberg data.

"Rupee fell to Rs 83.8325 before closing at Rs 83.82 as RBI sold dollars at 83.83 levels after buying them at 83.43. FPIs seemed to be the main buyers while oil companies stepped in to buy their requirements," said Anil Kumar Bhansali, head of treasury and executive director at Finrex Treasury Advisors LLP.

Kumar expects rupee to trade in the range of Rs 83.70-84.00 range on Thursday after the market holiday on Wednesday.

The dollar index inched up 0.28% to 101.0570, while Brent crude prices fell 1.59% to $70.56 per barrel. However, the buying interest emerged from lower levels, according to Jateen Trivedi, VP Research Analyst - Commodity and Currency, LKP Securities

"China's economic revival continues to support riskier assets, but market participants will remain focused on key upcoming data, particularly Friday's non-farm payrolls and unemployment figures, which will offer insights into the Fed's stance on managing unemployment without significant hikes," said Trivedi.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.