Catch all the latest updates ahead of Powell's press conference on our US Fed Meeting Live Blog here.

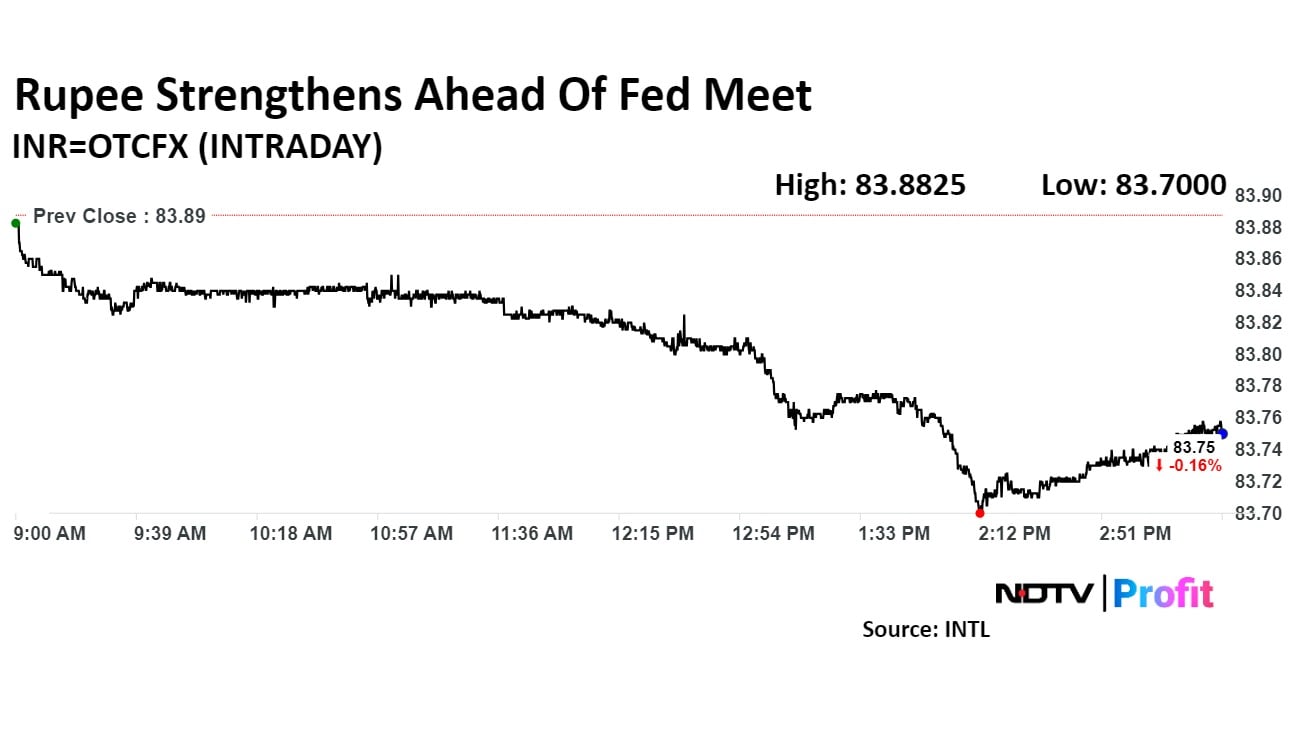

The Indian rupee closed stronger on Tuesday after a muted open as traders await the Federal Reserve's interest rate decision to be announced the next day.

The local currency strengthened by 12 paise to close 83.76 against the US dollar after it opened flat at Rs 83.87, according to Bloomberg data. It had closed at Rs 83.88 on Monday.

Market participants await the Fed's decision on cutting US interest rates for the first time in four years. As the Fed meeting begins on Tuesday, opinions remain divided among brokers, analysts, and investors over the potential quantum of the rate cut, with expectations ranging from 25 basis points to 50 basis points.

On Monday, RBI Governor Shaktikanta Das emphasised the stability of the rupee, noting it has been the least volatile since 2023. He stressed that excessive volatility does not benefit the economy and that a stable rupee promotes confidence among market participants and the wider economy.

"The RBI, which has been engaged in the FEX market to manage fluctuations in the rupee, sold substantial amount of dollar to stabilise the rupee, which had been facing pressures from rising US interest rates and capital outflows," said Anil Bhansali, executive director at Finrex Treasury Advisors LLP.

Banks like HSBC, Barclays, and BofA are expecting a 25-basis-point reduction in interest rates, while JPMorgan anticipates a 50-bps cut to better position the Fed against future economic risks, he said.

Oil prices extended gains on Tuesday, driven by concerns over US output in the aftermath of Hurricane Francine and expectations of lower US crude stockpiles. The US dollar index stood at 100.70, down 0.06%, while Brent crude closed flat at $72.75 per barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.