11_07_24.jpg?downsize=773:435)

The Indian rupee weakened to a record low against the US dollar on Tuesday, ahead of key policy announcements by US Federal Reserve and Bank of Japan later this week.

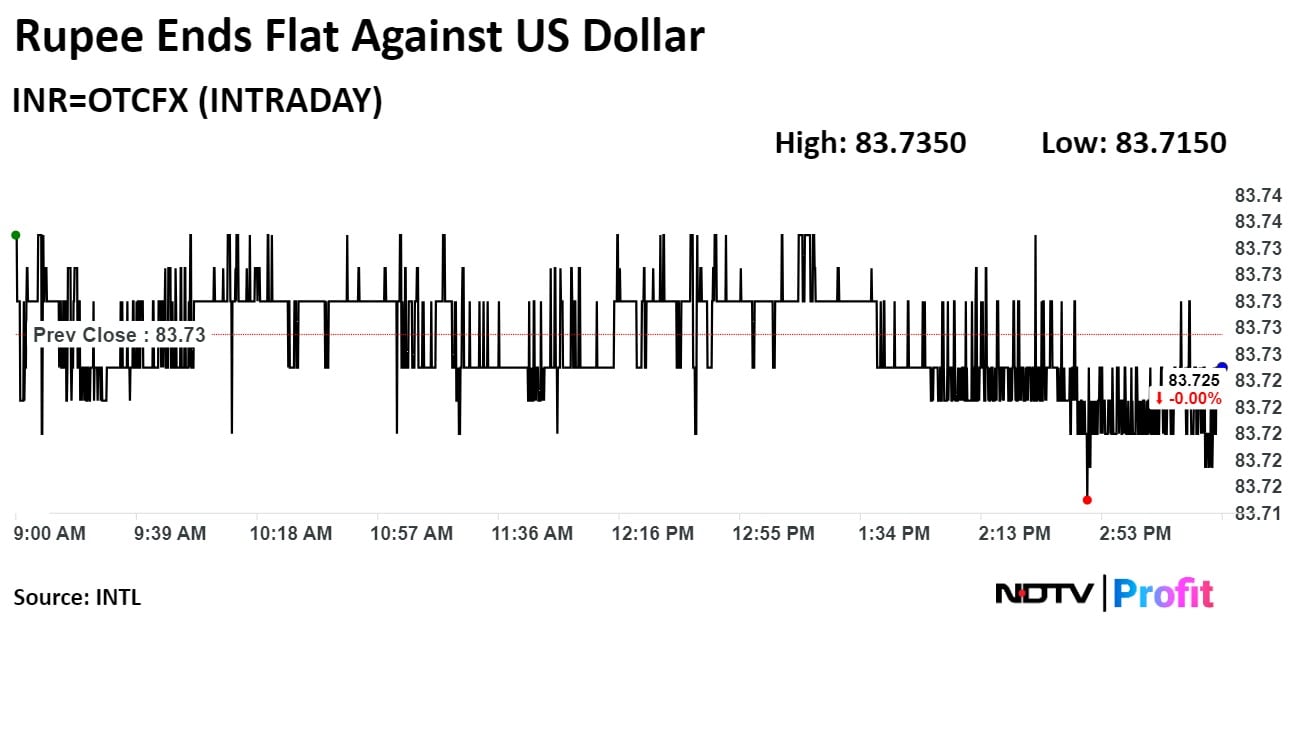

The Indian currency closed at Rs 83.72 after dipping to Rs 83.7438 against the greenback in early trade, before paring loss to trade at Rs 83.7363 at 10:04 a.m, according to Bloomberg. The local unit opened at Rs 83.73, unchanged from Monday's closing.

The US Dollar Index was at 104.56 and Brent Crude was at $79.02 per barrel.

The dollar index was down 0.01% to $104.55, while Brent crude prices were trading 0.41% lower at $79.45 per barrel so far today.

Month-end dollar demand from oil importers may limit the impact of any inflow into Indian stocks.

Meanwhile, the Federal Reserve officials are expected to begin reducing interest rates in the coming months, and that could be indicated by Jerome Powell on Wednesday, according to Bloomberg. The rate decisions in Japan and the UK would also be observed keenly.

Despite a decline in Brent oil prices, the Indian rupee continued to weaken, said Anil Kumar Bhansali, head of Treasury and executive director at Finrex Treasury Advisors LLP. The end-of-month purchasing by oil companies did not lead to a decrease in dollar demand, he said.

"We wait for inflows in bond market today, which if not absorbed by RBI could bring the pair down."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.