11_07_24.jpg?downsize=773:435)

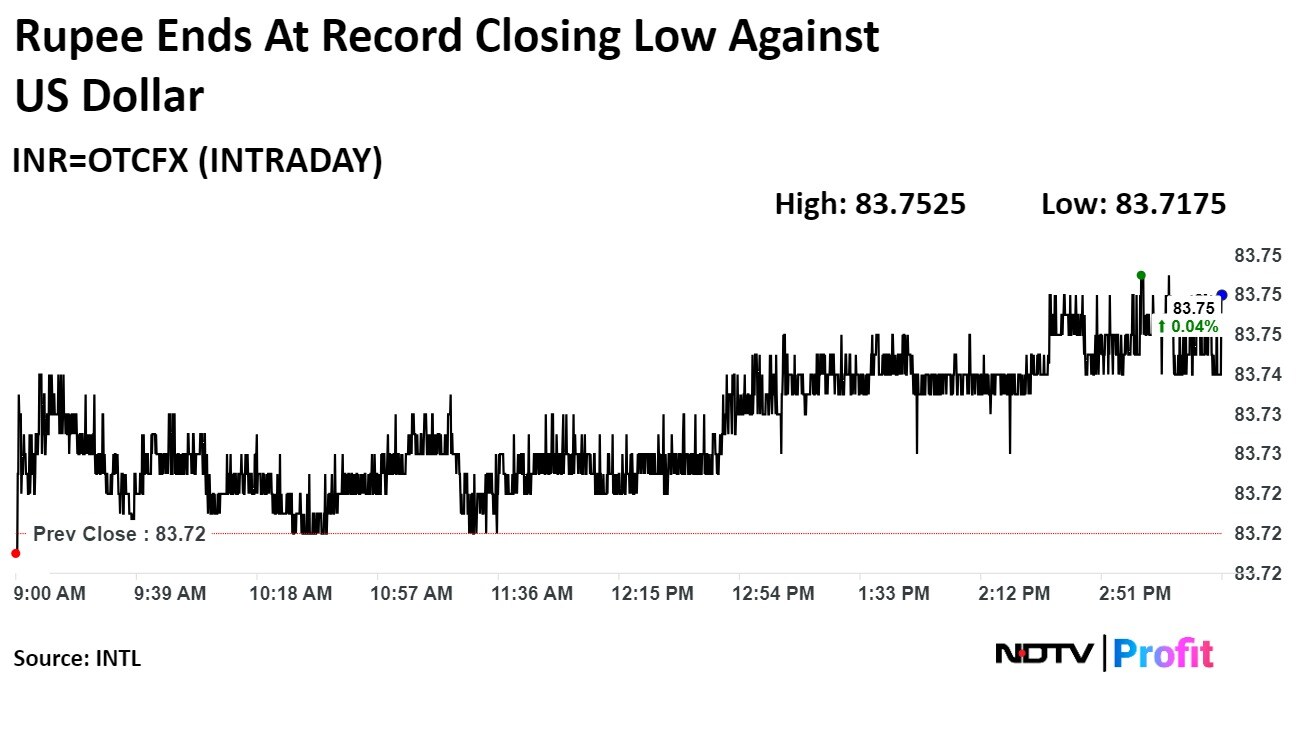

The Indian rupee closed at a record closing low against the US dollar on Friday after stock indices crashed over 1%, tracking their global peers amid rising geopolitical tension and weak economic data from the US.

The Indian currency depreciated 3 paise to end at a record closing low of Rs 83.75 after opening at Rs 83.73 against the greenback, according to Bloomberg. It closed at Rs 83.72 on Thursday.

India's benchmark equity indices reversed their five consecutive sessions of gains to end lower, with the Nifty closing 1.22% lower at 24,704 and the Sensex falling 1.08% to settle at 80,981.

Brent crude prices were trading at $79.74 per barrel given the rising geopolitical tensions in the Middle East, while the US dollar index was at 104.11.

Analysts attribute the rupee's low value to the Reserve Bank of India's regulation of the domestic currency. They stated that they would need to reduce their intervention pace to mitigate the dip.

"Yesterday's slight dip saw an influx of buyers, creating significant buying pressure. This trend appears persistent as the RBI seems reluctant to let the rupee appreciate to its fair value, despite strong fundamentals and the stock market reaching new highs, with the Nifty 50 touching the 25,000 mark," Amit Pabari, managing director at CR Forex Advisors, said.

Asian shares and US Treasury yields slid, while Swiss franc and yen rose on safe-haven bids after weaker-than-expected US factory data sparked fears of a worsening economic outlook and forced traders to question the Federal Reserve's decision to delay interest rate cuts until September, according to Anil Kumar Bhansali, head of Treasury and executive director of Finrex Treasury Advisors LLP.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.