The Indian rupee weakened to a fresh record low on Monday amid the unwinding of Yen carry trades, following which all Asian equity markets took heavy losses.

Adding to this, the rise in Brent crude added to the demand for the greenback, while the decline in the dollar index limited the gains.

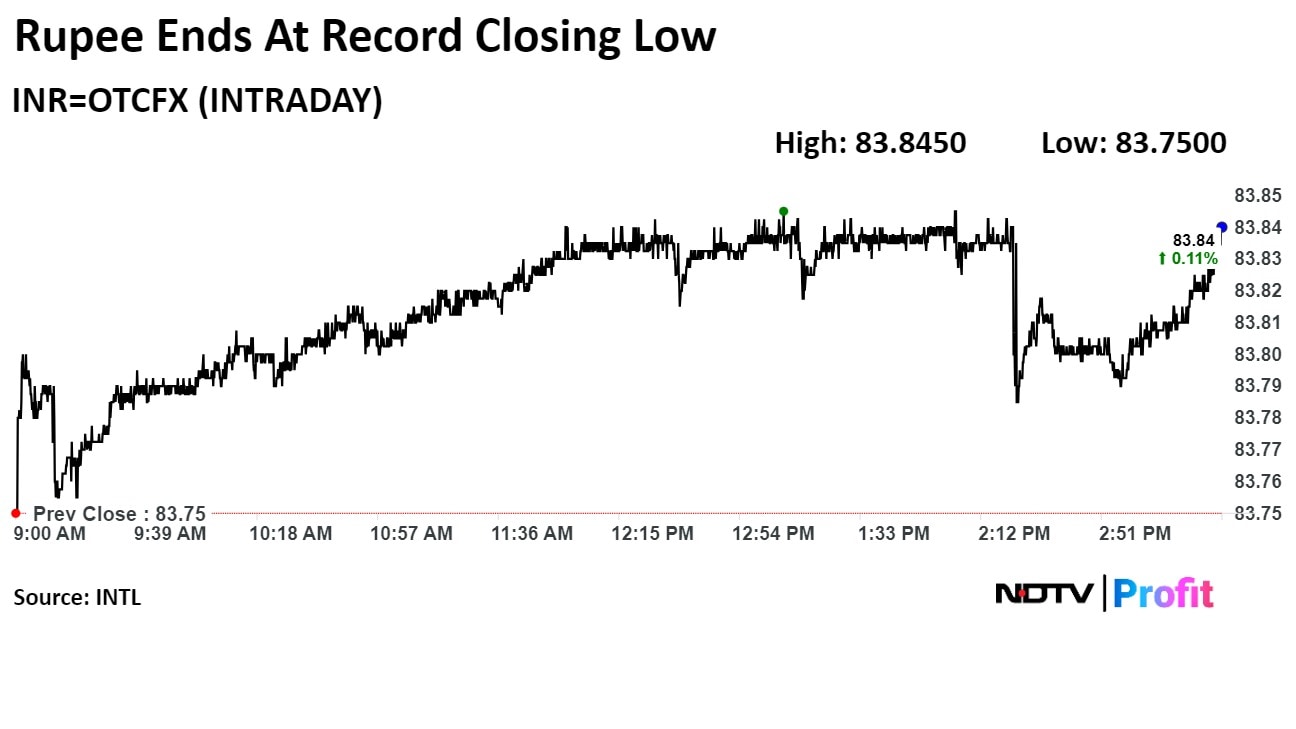

The local currency weakened 9 paise to end at a record closing low of Rs 83.84 after opening at Rs 83.79 against the greenback, according to Bloomberg. It had closed at Rs 83.75 on Friday. At 12:41 p.m., the rupee hit a fresh record low of Rs 83.85 against the dollar.

The Reserve Bank of India may have intervened through state-run banks that sold the greenback on behalf of the central bank to stabilise the Indian currency against the US unit, forex traders said.

"RBI probably protected the dollar against the fall, keeping it near Rs 83.83–83.85 for most of the time," Anil Bhansali, Executive Director of Finrex Treasury Advisors LLP, said.

"As Dow futures are indicating a downside open, we expect the rupee to open lower tomorrow within a range of Rs 83.80–84.00 with a close watch over the RBI," Bhansali said.

Japan stocks dipped after US jobless claims reached 2,49,000 for the week ending July 27, as compared to an estimate of 2,36,000. All major US markets closed lower this week as poor economic data pointed to an increased recession risk, with traders assessing the Fed's aggressive rate cuts. Goldman Sachs economists raised the probability of a recession in the coming year from 15% to 25%.

"USD-JPY fell to below 142 as carry trades were reversed before recovering a tad to 142.27. It was all due to recession fears in the US gripping the markets," Bhansali said. "Bond yields slid as investors rushed to safe haven assets and investors bet that the US would be required to cut interest rates sooner to spur growth."

Brent crude oil prices were $77.56 per barrel, while the US Dollar Index was at 103.22.

Brent crude had risen 0.49% to $77.19 a barrel amid geopolitical concerns as the market braces for a possible strike on Israel by Iran and regional militias in revenge for the assassinations of Hezbollah and Hamas officials.

"The dollar index was down, while the Chinese Yuan and South Korean Won, or KRW, were up, as was the Japanese Yen, which rose to 145.19. The Yuan rose to 7.1477, while KRW was up to 1,360 during early Asian trade," Bhansali said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.