Big information technology companies will not see rerating in the short-term as growth outlook in key Western markets remain uncertain, according to Avinash Gorakshakar of Research Profitmart Securities Pvt.

"Unless the markets see a strong earnings growth from frontline IT companies, the headwinds from Western markets will continue. We need more clarity," Gorakshakar, the head of research at the brokerage, told NDTV Profit.

"The US economy is picking up, that could translate into better order book and better positioning for IT companies," he said. "It's still a long way before we can see some rerating in larger companies."

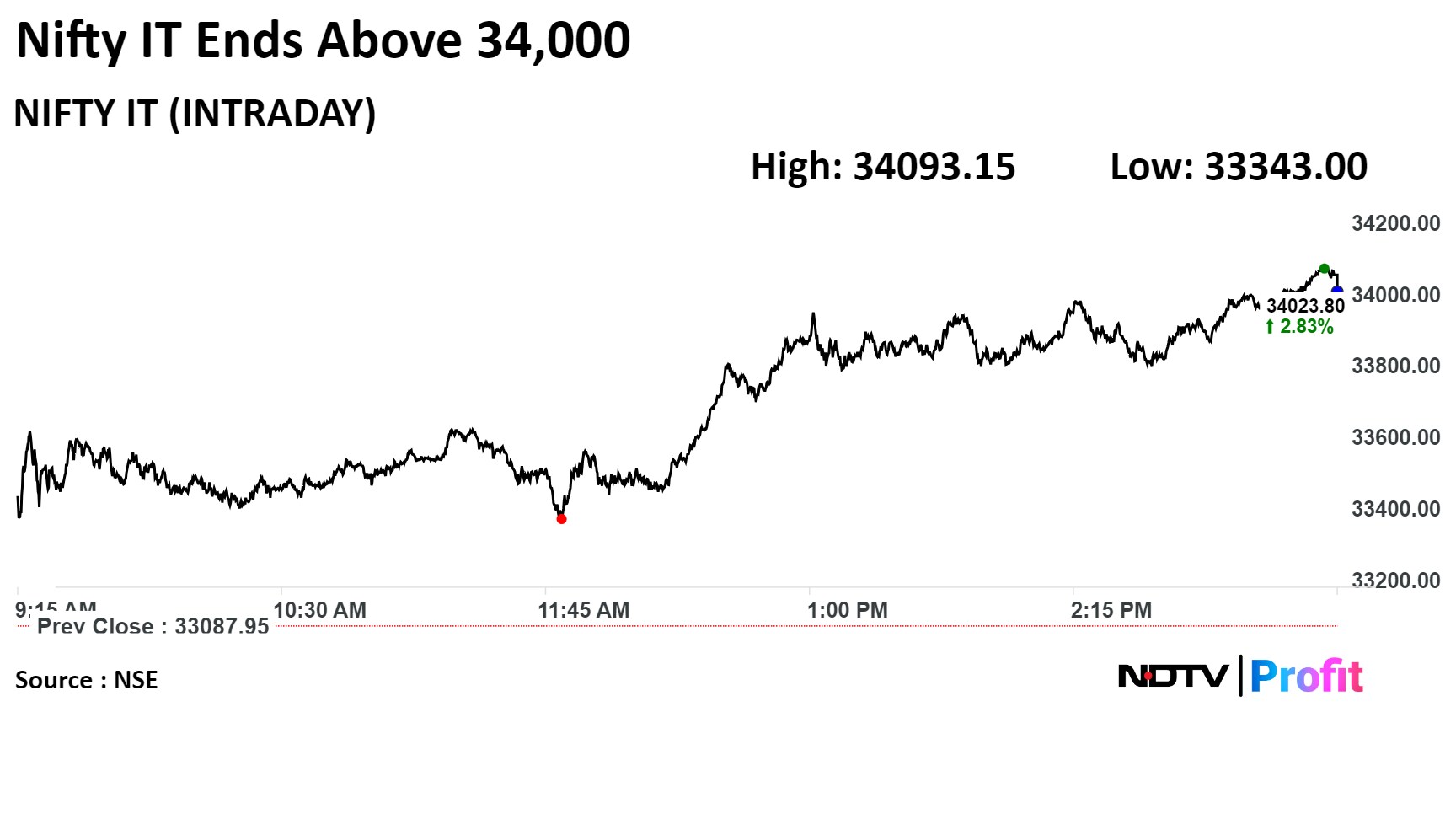

The Nifty IT index was the fourth best performer among sectoral indices on Thursday, closing 2.83% higher.

The overall trend so far from December 2023 is "higher top, higher bottom" and in terms of trend following, it is comfortable at the present level, according to Kunal Rambhia, founder of The Street.

He said the 22,200 to 22,250 level is a good support for the Nifty 50, with a resistance at 23,000. Rambhia also said state-run banks are poised for a new rally.

On Thursday, benchmark equity indices extended their recovery for a second consecutive session, after the steep fall they witnessed on the counting day. The NSE Nifty was around 400 points below its highest-ever close and the Sensex was nearly 1,400 points below its highest close.

The Nifty closed 231.40 points up, or 1.02%, at 22,851.75, and the Sensex rose 692.27 points, or 0.93%, to end higher at 75,074.51.

Gorakshakar expressed interest in public-sector undertakings. "Companies like Garden Reach, Mazagon Dock, Cochin Shipyard have good order books. There is assured revenue visibility. One could definitely cherry-pick these stocks on any decline," he said. "We're positive on them."

Companies like Larsen & Toubro Ltd. and Cummins India Ltd. have strong growth trajectory, he said. "The latter can benefit from a new hydrogen policy likely to be announced by the new government."

The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.