Reliance Industries Ltd.'s share price has been under pressure in recent days, with analysts expressing concerns over the company's new energy segment lagging behind expectations for financial year 2024. Probal Sen of ICICI Securities highlighted that the complexity of RIL's new energy goals has contributed to the challenges the company is facing.

Sen noted that while the new energy business is falling short of initial projections, he does not foresee these delays significantly impacting the stock's long-term prospects. He emphasised that Reliance is ramping up capital expenditure in its new energy ventures, although momentum in the retail segment appears to be slowing.

Furthermore, he pointed out margin volatility in the oil business as an area of concern. Sen expects the contribution of the Oil-to-Chemicals segment to overall Ebitda to decrease to around 28%-29% in the future, which he believes would be beneficial if RIL can successfully execute this transition.

Sen cautioned that the future earnings momentum may come at a cost, noting that the return on equity (RoE) and return on capital employed (RoCE) for RIL are currently below 10%. He also mentioned that the slowdown in the capex run rate has been slower than anticipated.

Adding to it, Deven Choksey, Managing Director of DRChoksey FinServ, advised investors to consider RIL's business in two segments: industrial products and consumer-centric divisions. He stated that Reliance's retail businesses are cash accretive and do not show signs of degrowth, contrary to some market perceptions. Choksey attributed the recent pullback in RIL's stock price to broader market technical factors rather than fundamental weaknesses.

Earlier on Thursday, Ambit Capital Pvt. retained its "sell" rating on Reliance Industries Ltd., citing that it sees "no inflection point" amid "long gestation and uncertain investments" for the conglomerate. End-game like monetisation of deleveraging via InvITs remains unclear, it said. Reliance Group's entities other than fossil fuel and consumer businesses are "earning no returns," the brokerage said.

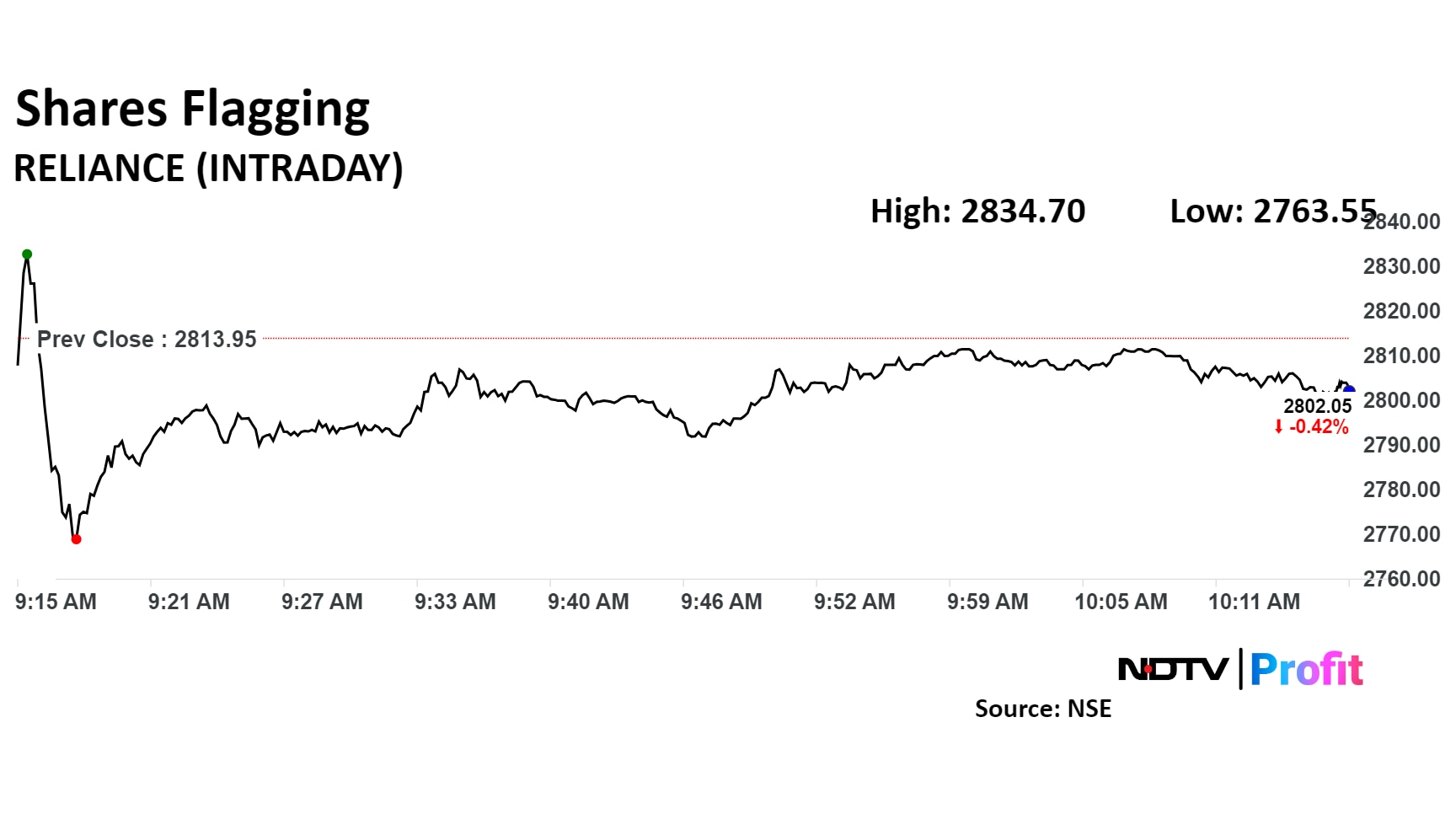

The scrip fell as much as 1.79% to Rs 2,763.55 apiece. It pared losses to trade 0.27% lower at Rs 2,806.25 apiece, as of 10:14 a.m. This compares to a 0.16 decline in the NSE Nifty 50 index.

It has risen 21.26% in the last 12 months. Total traded volume so far in the day stood at 5.1 times its 30-day average. The relative strength index was at 31.

Out of 36 analysts tracking the company, 25 maintain a 'buy' rating, eight recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.