Retail investors have until the end of the trading day on Friday, October 25, 2024, to purchase shares of Reliance Industries Ltd. to be eligible for the company's 1:1 bonus shares. The conglomerate's share price has fallen 11% in the past month.

This bonus issue's record date is Monday, October 28, 2024. The Mukesh Ambani-owned company has approximately 3.5 million shareholders. After the 1:1 bonus share is issued, these shareholders will double their shareholding without any additional investment.

To qualify for the bonus shares, investors must acquire RIL shares at least one day before the record date. Given India's T+1 settlement cycle, shares purchased on the record date itself will not be eligible for the bonus allocation. Therefore, investors should act quickly to secure their shares by the October 25 deadline.

For example, an investor currently holding 100 RIL shares will receive an additional 100 shares, resulting in a total of 200 shares post-bonus issue. However, it is essential to note that while the quantity of shares will increase, the total value of the investment will remain unchanged, as the share price will adjust to reflect the increased number of outstanding shares.

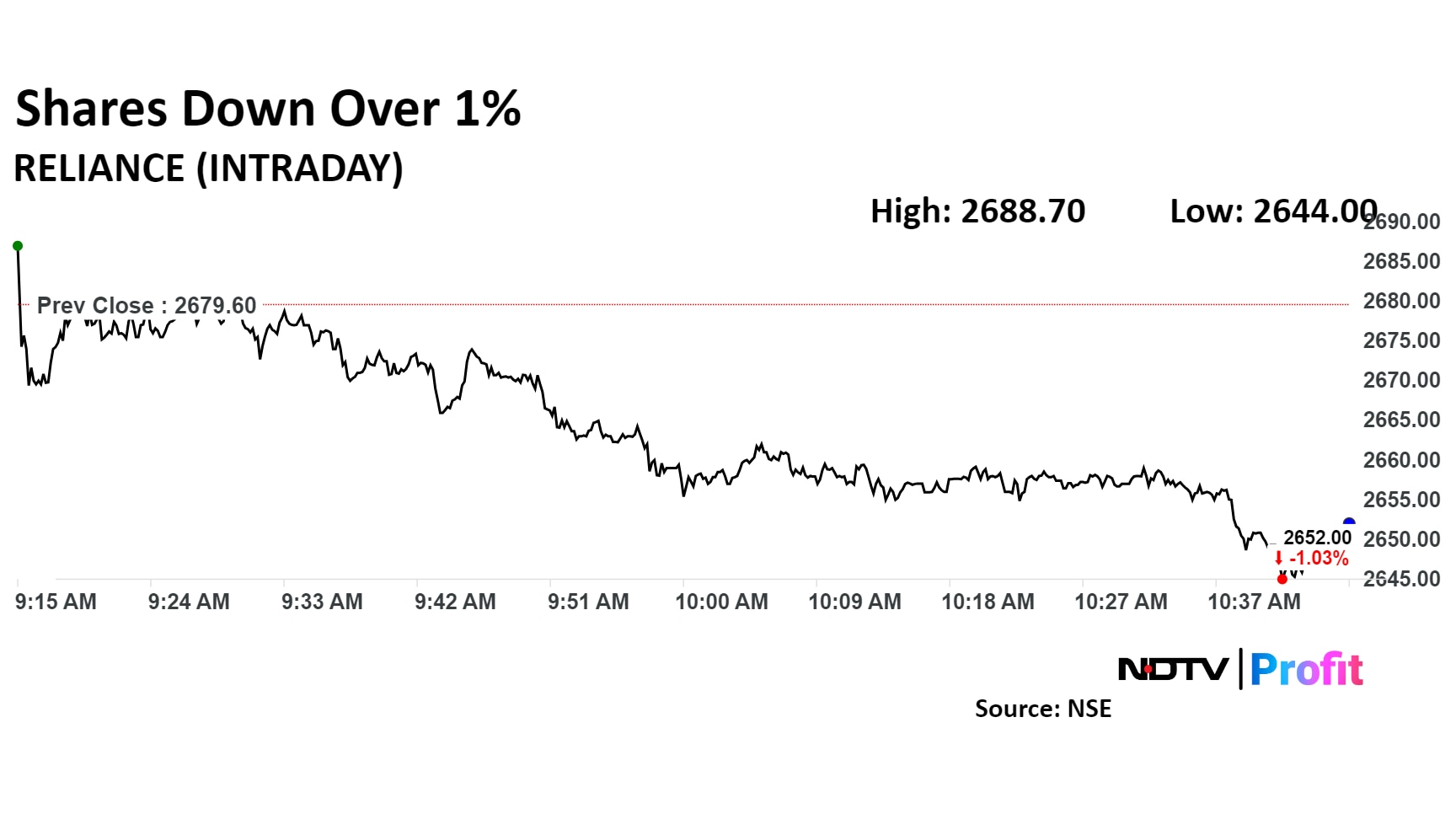

The scrip fell as much as 1.33% to 2,644 apiece. It pared losses to trade 1.30% lower at Rs 2,644.65 apiece, as of 10:43 a.m. This compares to a 0.86% decline in the NSE Nifty 50 Index.

It has risen 17.13% in the last 12 months. Total traded volume so far in the day stood at 0.35 times its 30-day average. The relative strength index was at 29.

RIL had issued a newspaper advertisement dated September 23, reminding holders of partly paid-up equity shares about the necessity of settling due payments to avoid forfeiture. The deadline for these payments has been extended to October 7, 2024. Shareholders who fulfill their payment obligations will not only be eligible for the bonus shares but will also gain equity shares of Jio Financial Services Ltd., which are currently held with the JFSL Trust-PPS.

Out of 38 analysts tracking the company, 30 maintain a 'buy' rating, five recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 21%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.