RBL Bank share price tumbled 14% on Monday after the company's net profit declined 24% in the September quarter as asset quality challenges emanated from credit cards and microlending books.

The bank reported a net profit of Rs 223 crore against Rs 294 crore in the same quarter a year ago, even as net interest income rose 9% to Rs 1,615 crore. The profit was impacted by a sequential increase in gross non-performing assets to 2.88% from 2.69% and net NPA to 0.79% from 0.74%.

RBL Bank Chief Executive and Managing Director R Subramaniakumar told reporters that the stress in the microfinance book is due to industry-wide issues, but the same on the credit-card front, where the regulator has been flagging risks for the industry, is on account of internal aspects.

"While we remain mindful of certain near-term challenges, our core operations continue to show resilience," the bank said in a press release. "Our cross-sell initiatives and ‘One Bank' approach are beginning to deliver tangible results, enhancing customer engagement across multiple product lines," it said.

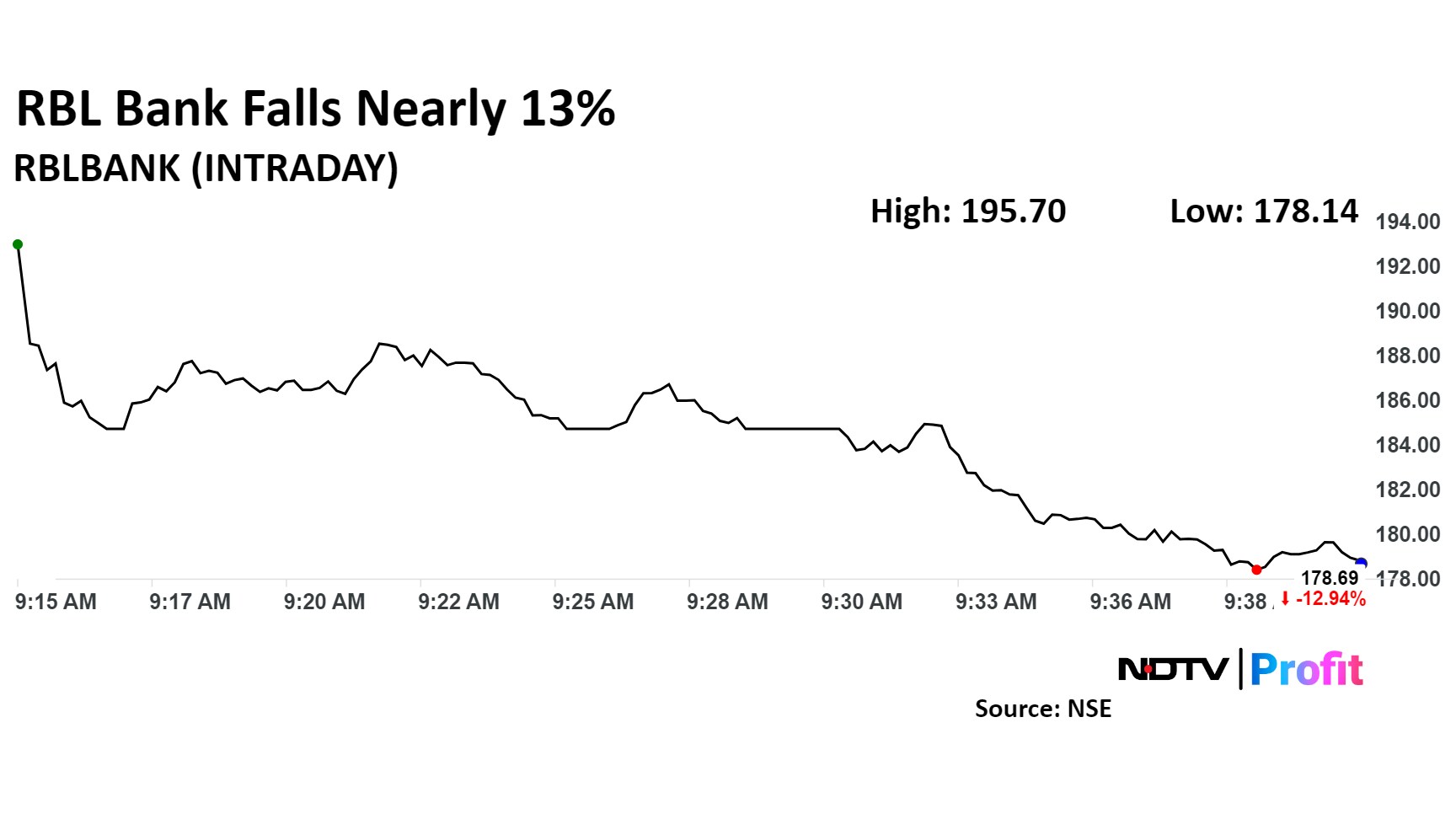

Shares of the private lender fell as much as 14% to Rs 176.50 apiece, the lowest level since June 2023. The stock pared losses to trade 13% lower at Rs 178.20 apiece as of 9:51 a.m. This compares to a 0.6% decline in the NSE Nifty 50 Index.

The stock has fallen 36.2% on a year-to-date basis and 19% in the last 12 months. Total traded volume so far in the day stood at 4.23 times its 30-day average. The relative strength index was at 28.7, indicating that the stock may be overbought.

Out of 22 analysts tracking the company, 12 maintain a 'buy' rating, five recommend a 'hold,' and five suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 36.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.