061020.jpeg?downsize=773:435)

Shares of RBL Bank Ltd. declined to nearly a two-month low on Thursday after Hong Kong-based Baring Private Equity Asia offloaded its entire stake in the lender through an open market transaction.

About 4.95 crore shares, or 8.16% equity, of RBL Bank changed hands in early trade, according to Bloomberg. The buyers and sellers were not known immediately.

Earlier, NDTV Profit reported that the foreign portfolio investor, through its vehicle Maple II BV, has offered to sell 4.78 crore shares, or 7.9% stake, at a floor price of Rs 226 per share. The share sale amounts to Rs 1,081 crore. IIFL Securities Ltd. will be the sole broker in the deal.

Last week, RBL Bank reported a 29% rise in net profit on-year to Rs 372 crore for the quarter ended June 2024, meeting Bloomberg's estimate of Rs 344.5 crore. The lender's net interest income advanced 20% to Rs 1,700 crore.

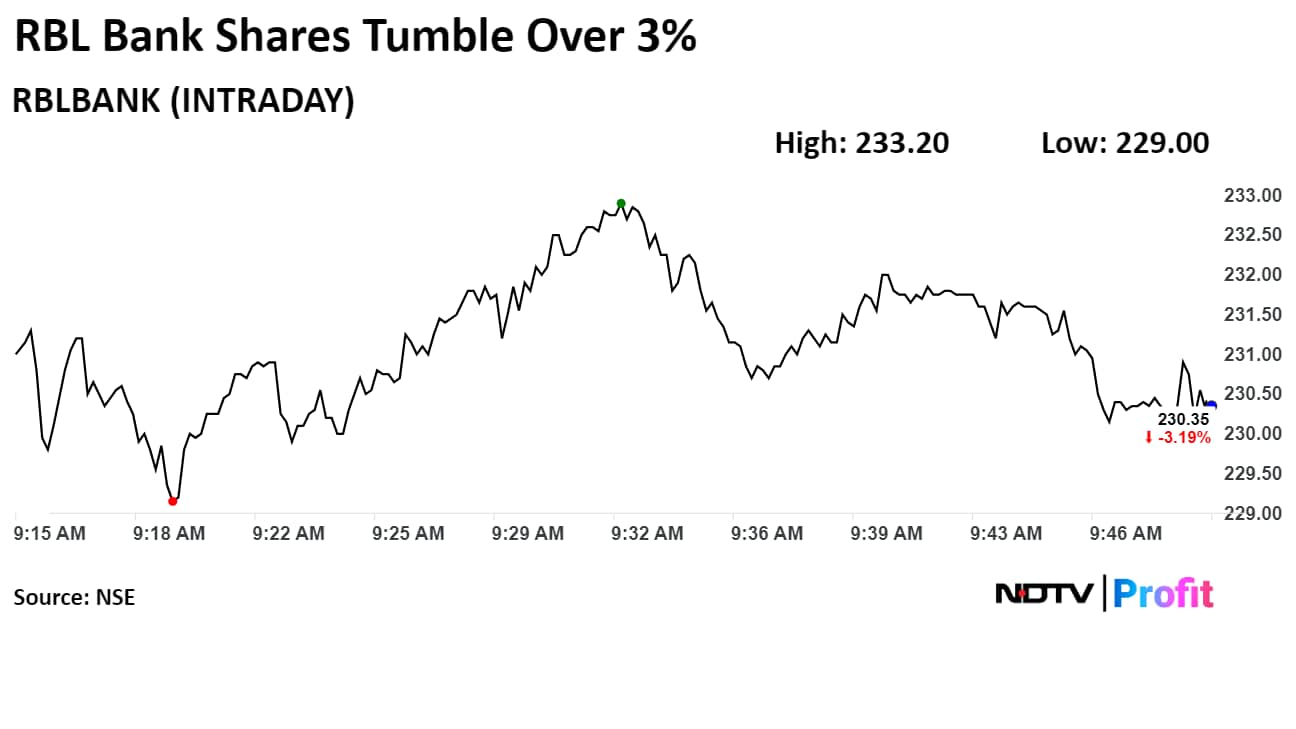

Shares of RBL Bank fell as much as 3.76% to Rs 229.05 apiece on the NSE, the lowest since June 4. It was trading 2.69% lower at Rs 231.5 apiece, compared to a 0.57% decline in the benchmark Nifty 50 as of 09:46 a.m.

The stock has risen 3.76% in the last 12 months and decline 17% on a year-to-date basis. The total traded volume so far in the day stood at 74 times its 30-day average. The relative strength index was at 33.

Fifteen out of the 22 analysts tracking the company have a 'buy' rating on the stock, three recommend a 'hold', and four suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 20%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.