After a week of record breaking highs, the Indian markets will be watching out for key macro economic data in the week starting August 5. All eyes will be on the Reserve Bank of India rate decision on Thursday. Meanwhile, India's equity markets will also be guided by June quarter earnings and data on India's Service PMI for July.

When it comes to quarterly earnings, the upcoming week will see Bharti Airtel Ltd., BEML Ltd., Brigade Enterprises Ltd., Oil And Natural Gas Corporation Ltd., Tata Chemicals Ltd., Bosch Ltd., Fortis Healthcare Ltd., post their first-quarter earnings, setting the tone for market sentiment.

"Investors will be cautious next week with the RBI monetary policy and potential market sentiment impact due to a sharp decline in the Asian and US markets," according to said Avdhut Bagkar Technical and Derivatives Analyst, StoxBox.

"Currently, most stocks and indices are close to important resistance levels, and we may see consolidation for a few days or weeks. This happens whenever the indices move too far away from the short-term averages," said Amol Athawale, VP-Technical Research, Kotak securities.

The primary market will see subdued action this week with five mainboard initial public offerings and 12 listing. The market will see this week with nine SME IPOs.

Globally, all eyes will be on US as its ISM Services Index data is expected on Monday. The Euro Zone will also be releasing its retail sales data, Japan cash earnings on Tuesday, while US trade data is said to be published on the same day.

Market Last Week

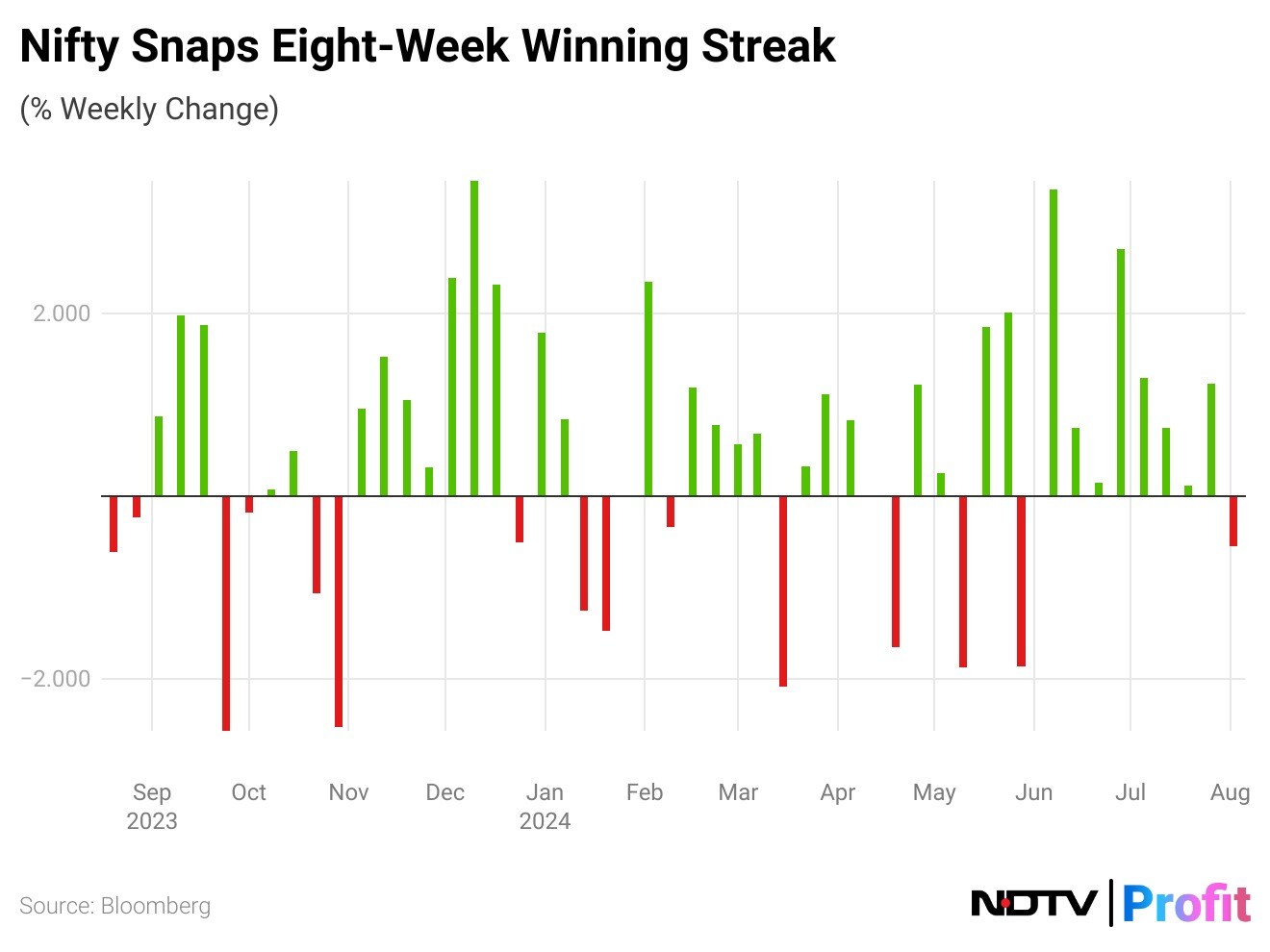

India's benchmark equity indices reversed five consecutive sessions of gains to close lower on Friday, snapping a weekly gaining streak of eight weeks to end at their lowest closing since July 25.

The impressive winning streak in the benchmark index came to an end after eight consecutive weeks of gains. The Nifty50 index achieved a significant milestone during the week, but the last-day sell-off, influenced by weak global cues, acted as a spoiler, resulting in a negative closure.

Weekly, Nifty fell by 0.40%, while Sensex was down by 300 points. Realty, Auto, and IT fell by over 2% weekly, while the Nifty Pharma index was up nominally.

Market breadth remained unfavourable, with all sectors recording losses except for the pharmaceutical and healthcare index.

"As a result, in the short term, 25,080 and 82,130 will act as stiff resistance for Nifty and Sensex, respectively. On the downside, 24,600 and 24,500 will provide significant support for the Nifty, while 80,500-80,400 will act as support for the Sensex in the immediate term," said Hrishikesh Yedve, AVP Technical and Derivatives Research at Asit C. Mehta Investment Interrmediates Ltd.

Domestic Cues

All eyes will be on the Reserve Bank of India's MPC's third meeting for monetary policy for 2024-25 on Aug 6 to 8.

HSBC Services and Composite PMI for July, by S&P Global is expected to be released on Monday. India's Service PMI was at 60.5, growth expanded at a faster pace, up from May's five-month low, amid a strong rise in new orders and an unprecedented expansion in international sales.

Global Cues

Reserve Bank of India rate decision will take center stage on Aug 8 as the bank is likely to maintain hawkish bias following an increase in June inflation.

While, the US ISM Services Index and China Caixin Services PMI will be announced on Monday. The Eurozone retail sales, Japan cash earnings, and US trade data is said to be published on Tuesday.

The China trade figures, forex reserves, France trade data, and US consumer credit data will be released on Wednesday. While the China PPI and CPI, France unemployment rate, Germany CPI, Italy CPI, and Japan money stock, will be announced on Friday.

Q1 Earnings This Week

BEML Ltd., Bharti Airtel Ltd., Brigade Enterprises Ltd., Century Plyboards Ltd., will post their first-quarter earnings, setting the tone for market sentiment.

The other companies to announce their results in the coming week include Oil And Natural Gas Corporation Ltd., Orient Cement Ltd., Schneider Electric Infrastructure Ltd., Tata Chemicals Ltd., Bosch Ltd., Fortis Healthcare Ltd.

Primary Market Action

The primary market will see subdued action this week with five mainboard initial public offerings and 12 listing. The market will see this week with nine SME IPOs.

Ola Electric Mobility Ltd. which opened on Friday aims to raise Rs 6,146 crore via a fresh issue of stock of 72.37 crore shares, worth Rs 5,500 crore and an offer-for-sale by existing shareholders—8.49 crore shares, that will test investor appetite for electric mobility in the world's largest two-wheeler market. The IPO will close on Aug 6 and list on Aug 9.

Corporate Actions Ahead

Alembic Ltd., Andhra Paper Ltd., Berger Paints India Ltd., Britannia Industries Ltd., Chambal Fertilisers & Chemicals Ltd., Gandhi Special Tubes Ltd., Greenply Industries Ltd., Hercules Hoists Ltd., Linde India Limited and Welspun Living Ltd., will have record dates for their dividends in the coming week.

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.