Shares of Raymond Ltd. gained over 3% in early trade on Thursday as its arm, Raymond Lifestyle Ltd., made a stellar debut on the stock exchanges. The Gautam Singhania-led company demerged its consumer lifestyle business to create a pure-play consumer branded apparel and textiles business.

Post the demerger, Raymond Lifestyle will have four key segments—wedding and ethnic wear, garments exports, branded apparel and textiles.

Shares of Raymond Lifestyle listed on the BSE at Rs 3,000 apiece, a premium of 99.5% over its base price of Rs 1,503.3 per share. On the National Stock Exchange, the stock debuted at Rs 3,020 per share, marking a premium of 93% against the base price of Rs 1,562.6 per share.

Raymond Lifestyle was demerged from the parent and shareholders were given four shares of the face value of Rs 2 for every five shares of Rs 5 face value of the parent. After the demerger, Raymond and Raymond Lifestyle will be the two listed entities of the group.

Raymond has also announced a vertical split to demerge its real-estate business.

The demerger plan aims to exploit the growth potential of the real estate business and attract a fresh set of investors and strategic partners to participate in it, Raymond said. The current promoter ownership of the Mumbai-based garment maker is 49.01%.

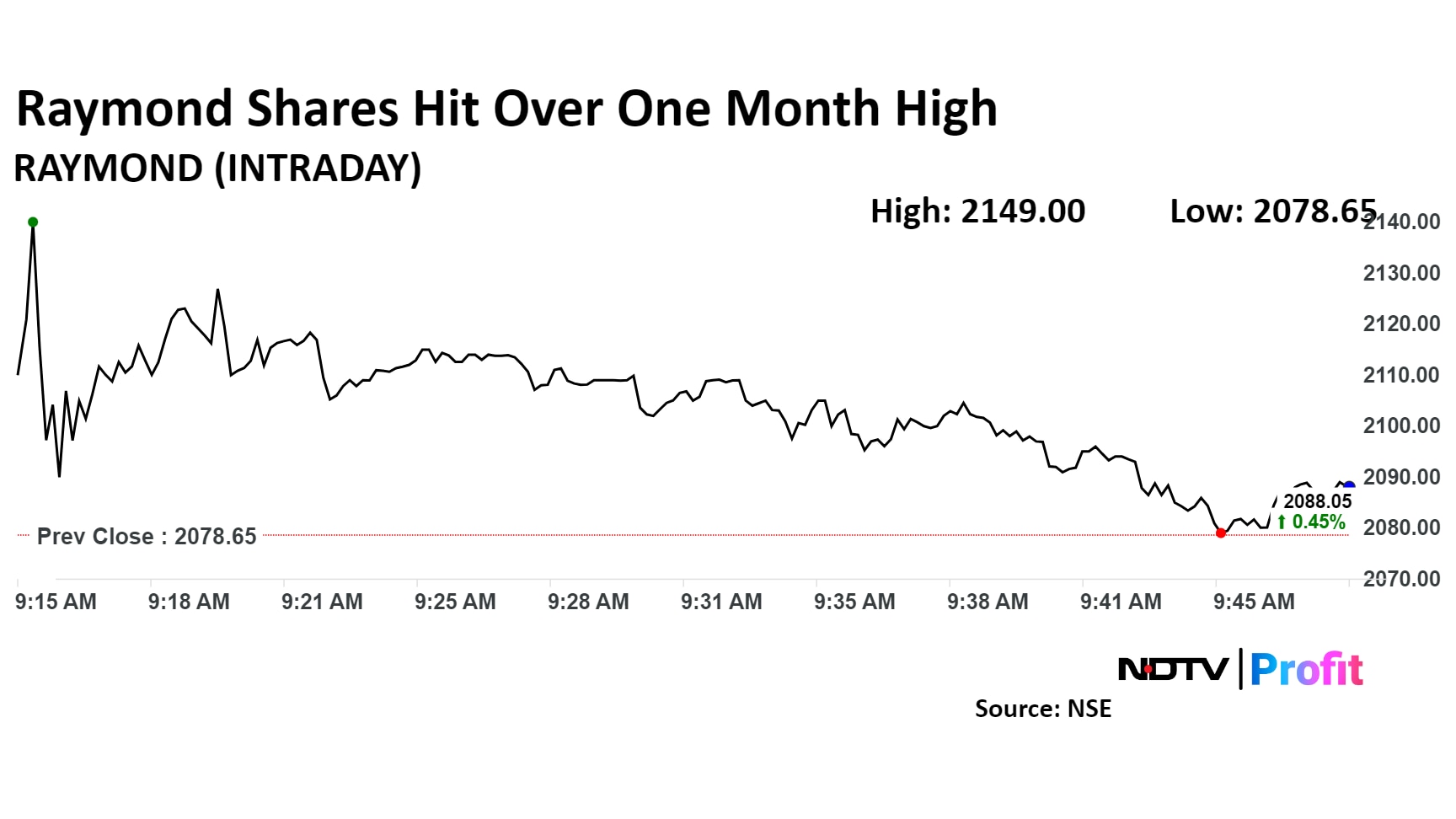

Shares of Raymond advanced 3.4%, the highest since July 29, before paring gains to trade 0.45% higher at Rs 2,088.05 per share as of 9:45 a.m. The benchmark NSE Nifty 50 was trading 0.29% lower.

The stock has risen 54% in the last 12 months and 95% year-to-date. Total traded volume so far in the day stood at two times its 30-day average. The relative strength index was at 59.

Of the six analysts tracking the company, four have 'buy' rating and two suggest a 'hold', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 7.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.