Rallis India Ltd.'s share price logged its best jump since March 7 to hit its all-time high, after the company's net profit rose 20% year-on-year to Rs 98 crore in the second quarter of fiscal 2025.

The company's second quarter performance was driven by “strong domestic demand with above normal monsoon and better commodity prices", along with volume recovery in international market although pricing continues to be muted, it said in a press release.

"We had a strong Q2 FY25 performance helped by double digit growth in the domestic market, both in the Crop Care and Seeds business," the company said.

Revenue for the period rose 12% year-on-year to Rs 928 crore, Ebitda grew 25% to Rs 166 crore and Ebitda margin was at 17.9%, as against 15.9%.

Going ahead, the company's focus will be on customers, while product base expansion will remain a focus for international business. "On a long-term basis, customer centricity will be a key thrust, and we will continue to offer differentiated solutions to solve varying farmer needs," it said. "We will further intensify our efforts to build capabilities in digital and leverage collaborations and alliances."

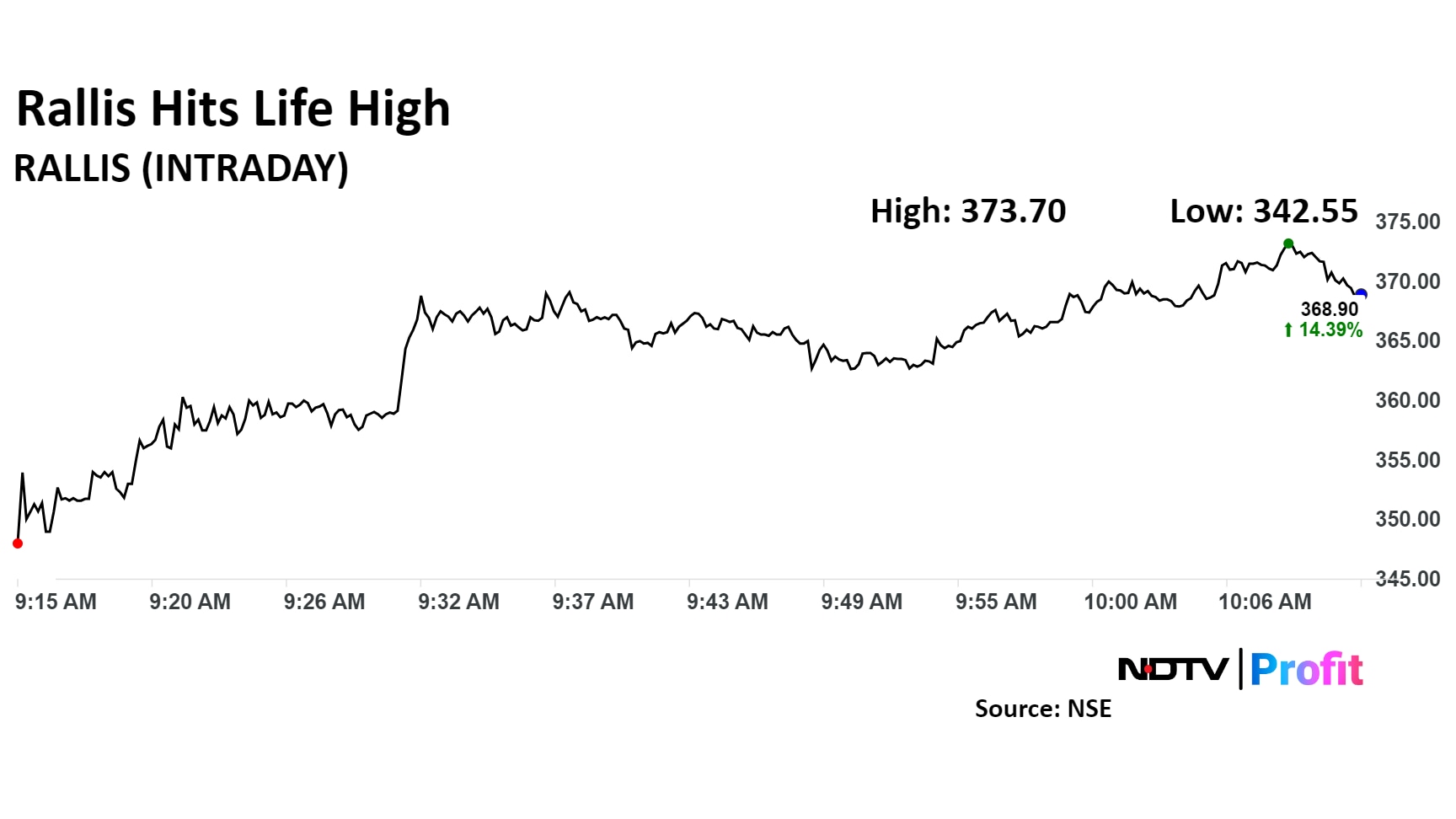

Rallis India Share Price Today

Rallis India's share price rose as much as 15.88%, the highest level in seven months, before paring gains to trade 14% higher at Rs 368.20 apiece, as of 10:14 a.m. This compares to a flat NSE Nifty 50.

The stock has risen 7.1% on a year-to-date basis and 13.5% in the last 12 months. Total traded volume so far in the day stood at 43 times its 30-day average. The relative strength index was at 73, indicating that the stock may be overbought.

Of the 15 analysts tracking the company, two maintain a 'buy' rating, two recommend a 'hold' and 11 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 30.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.