Shares of RailTel Corporation of India Ltd. gained nearly 5% on Tuesday after it won a work order worth Rs 186.81 crore from the Ministry of Railways.

The order involves design, development, implementation, operations and maintenance of the Health Management Information System and an Integrated Empanelled Hospital Referral Portal for Indian Railways, according to an exchange filing

The Ministry of Railways owns 72.84% stake in RailTel Corp. as on date. The contract is to be executed within four years.

The Miniratna state-run company reported a total income of Rs 852 crore for the last quarter of 2023-24 against Rs 707.29 crore in the year-ago period.

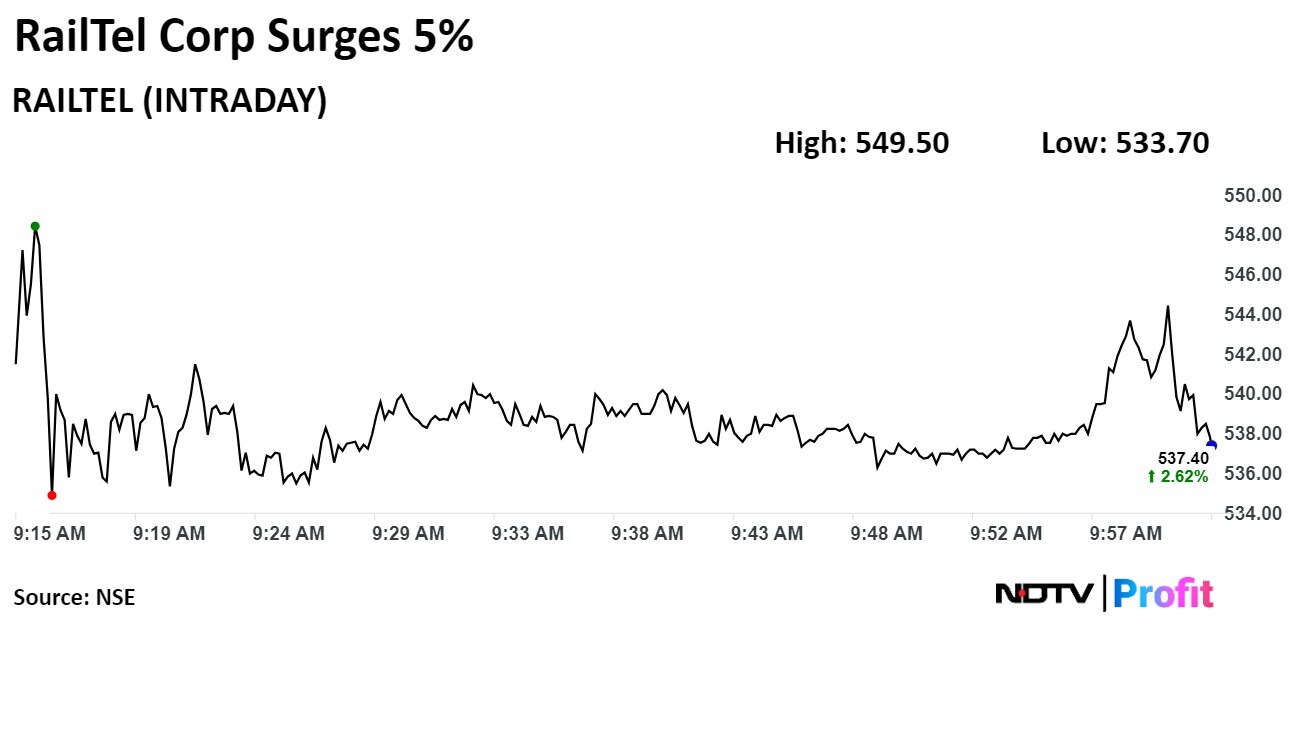

Shares of RailTel Corp. of India Ltd. rose as much as 4.93% during the day to Rs 549.50 apiece on the NSE. It was trading 3.53% higher at Rs 542 apiece, compared to a 0.15% decline in the benchmark NSE Nifty 50 as of 10:01 a.m.

The stock has risen 238.15% in the last 12 months and 59.23% on a year-to-date basis. The total traded volume so far in the day stood at 1.5 times its 30-day average. The relative strength index was at 59.04.

One out of the three analysts tracking RailTel Corp have a 'buy' rating on the stock and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 56%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.