PSP Projects Ltd. share price rose after on Tuesday aftet the company announced that it has received a work order worth Rs 270 crore for the construction of a residential tower in GIFT City. Following this order receipt, the total order inflow for fiscal 2024–25 to date is Rs 1,715 crore, according to an exchange filing.

The work order includes the construction of a high-rise residential tower 'SIBAN' at GIFT City, Gandhinagar. The project is to be completed within 31 months.

The company further confirmed that the award of an order does not fall within the purview of related party transactions. The work order is received from domestic entities and will be executed within the country, the filing said.

On Sept. 23, the company announced that it has secured work orders worth Rs 555 crore across its business verticals. The orders include the construction of Gold Stone Hotel and Commercial Towers in Bengaluru worth Rs 389.29 crore in the institutional category and the construction of residential towers in Ahmedabad valued at about Rs 165.04 crore, as per the company's exchange filing.

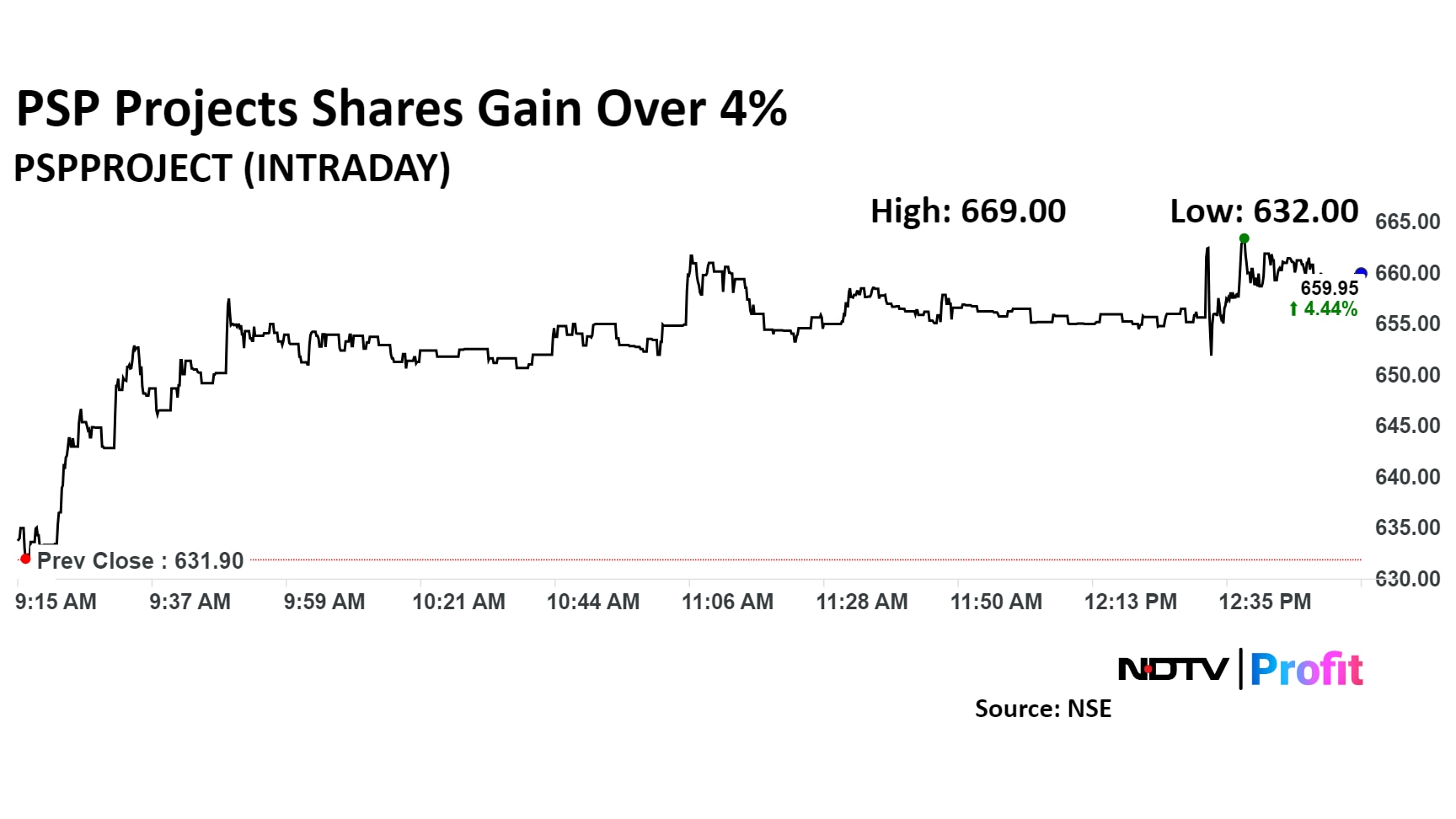

Shares of PSP Projects were trading 4.45% higher to Rs 660 apiece, compared to 0.72% advance at the benchmark NSE Nifty 50 at 1:11 p.m.

The stock has declined 16.17% in the last 12 months and 14.18% on a year-to-date basis. The total traded volume so far in the day stood at 0.08 times its 30-day average. The relative strength index was at 31.84.

Nine out of the 11 analysts tracking the company have a 'buy' rating on the stock, one recommends a 'hold' and one suggests a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 19.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.