Indian equities could head towards profit-booking after a key support level for the benchmark Nifty 50 is breached, according to market analysts.

"Currently, we are at a make-or-break level. If the 22,900 level breaks and it sustains below that, then there could be more profit-booking," said Vaishali Parekh, vice president of technical research at Prabhudas Lilladher Pvt. "As long as that level is held, it could turn out to be a stock-specific or sideways move."

The key support level for Bank Nifty is 48,800, and a dip below that can see profit-booking as well, she said.

In terms of the broader market, which has also seen profit-booking, Parekh said an investor can partially sit on cash and wait for some clarity on the further trend.

The benchmark stock indices ended lower for the second consecutive session on Tuesday, tracking a decline in shares of Reliance Industries Ltd. and Bharti Airtel Ltd.

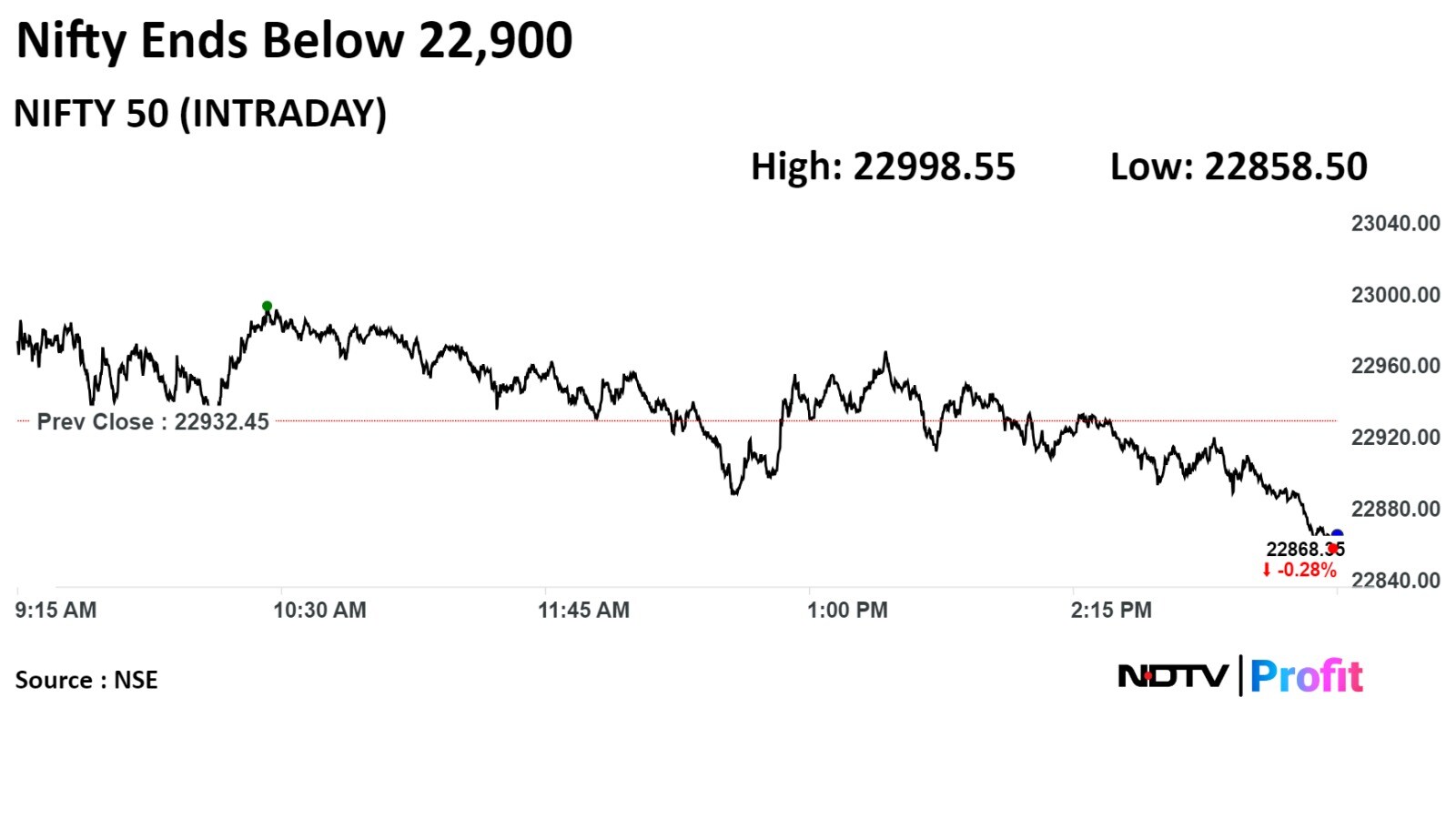

The NSE Nifty 50 closed 44.30 points, or 0.19%, lower at 22,888.15, and the S&P BSE Sensex ended 220.05 points, or 0.29%, down at 75,170.45.

During the day, the Nifty jumped 0.29% to 22,998.55, and the Sensex rose 0.26% to 75,585.40.

"There is time-wise consolidation happening in the market as India gets nearer to election results," said Dharmesh Kant, head of equity research at Chola Securites. "There is nothing negative in the market; the only thing that can go wrong is the election verdict."

There was range-bound activity and the up-move in the pharma index was mainly restricted by broader markets as the mid- and small-cap segments witnessed a sharp profit-booking correction, according to Aditya Gaggar, director of Progressive Share Brokers Pvt.

In the daily time frame, the index has formed another bearish candle, Gaggar said. "We hold our view of retesting a strong support of 22,780, while a level of 23,110 will be considered as immediate resistance."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.