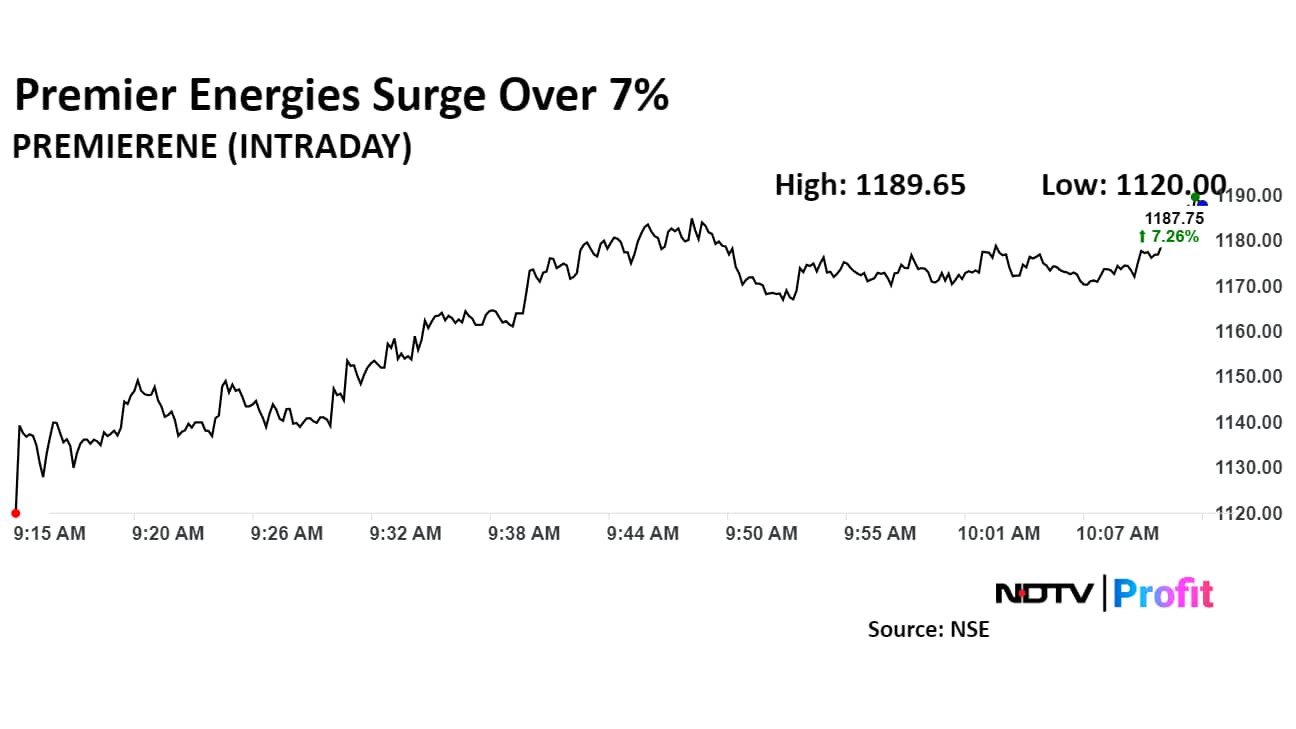

Premier Energies Ltd.'s share price rose over 7% on Monday after its subsidiaries bagged orders worth Rs 765 crore for the supply of solar photovoltaic cells and modules.

Premier Energies International Pvt. and Premier Energies Photovoltaic Pvt. received multiple orders from various customers amounting to a total value of Rs 765 crore, it said in an exchange filing on Monday.

The company received multiple orders from eight domestic customers and one foreign customer, it said. These orders comprise Rs 632 crore for solar modules and Rs 133 crore for solar cells.

Premier Energies manufactures integrated solar cells and solar panels and is the second-largest player in India as per capacity. As of March, it has a 16.2% market share in the total solar cell-installed capacity in India.

The company has five manufacturing units in Hyderabad. Its total annual installed capacity for solar cells stands at 2 GW, while its solar module production capacity is 4.13 GW.

Premier Energies stock rose as much as 7.1% during the day to Rs 1,186 apiece on the NSE. It was trading 6.19% higher at Rs 1,176 apiece, compared to a 0.57% advance in the benchmark Nifty 50 as of 10:11 a.m.

The stock has risen 40% since its listing on Sept. 3. The total traded volume so far in the day stood at 1.1 times its 30-day average. The relative strength index was at 69.

One analyst tracking the company has a 'hold' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 11%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.