.png?downsize=773:435)

Shares of Power Mech Projects Ltd. recovered from the day's lows on Thursday after the company announced that it has bagged a Rs 227-crore order in Gujarat.

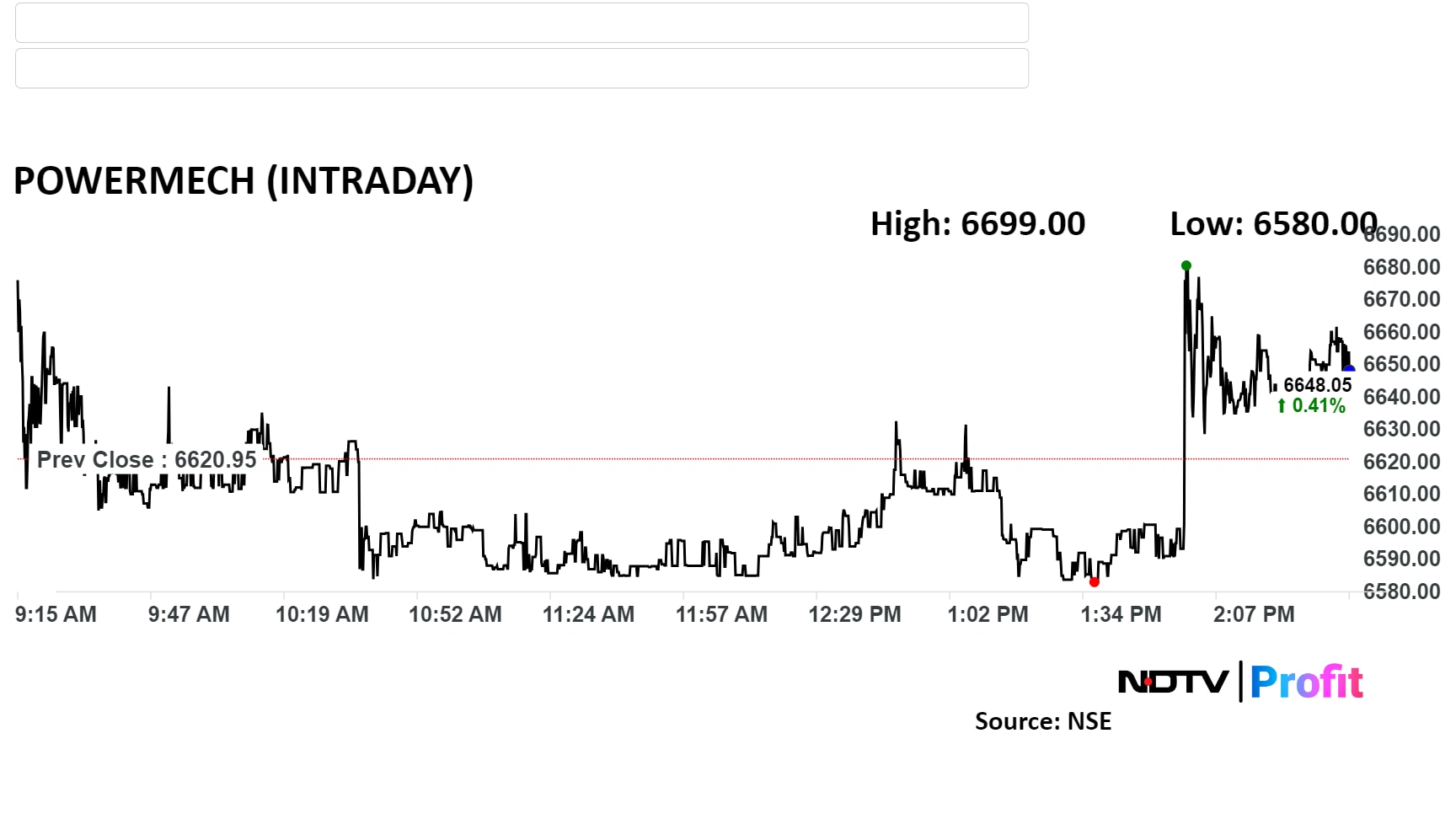

The company's stock was trading in the red during a major portion of the day's trade. However, after the deal win was notified to the exchanges, the shares climbed 1.18% to a high of Rs 6,699 apiece on the NSE.

The order has been issued to Power Mech by the state-run Gujarat Mineral Development Corporation Ltd., an exchange filing stated.

As part of the deal, Power Mech would operate, maintain and repair the company's 250 (2X125) MW Akrimota Thermal Power Station and all its equipment for power generation for a period of three years, it added.

The three-year contract would tentatively come into effect from Dec. 16, 2024, Power Mech further noted.

The development comes a week after the company won a Rs 865-crore order from Talwandi Sabo Power Ltd., a subsidiary of Vedanta Ltd., for the operation and maintenance of a 3x660 MW supercritical thermal power plant in Punjab's Mansa.

Power Mech was also in news last month after the company's board announced a 1:1 bonus issue of shares. It has fixed Sept. 28, 2024 as the record date for the issue.

At 2:34 pm, Power Mech's shares were trading 0.44% higher at Rs 6,660 apiece on the NSE, compared to a 0.48% rise in the benchmark Nifty 50.

Year-to-date, the company has risen by 55.3% on the bourses, whereas the surge has been sharper at 62.3% over the past 12 months. The stock's relative strength index stood at 56.8.

Two analysts tracking the company have a 'buy' rating on the stock, whereas none suggest a 'hold' or 'sell', as per Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.