.png?downsize=773:435)

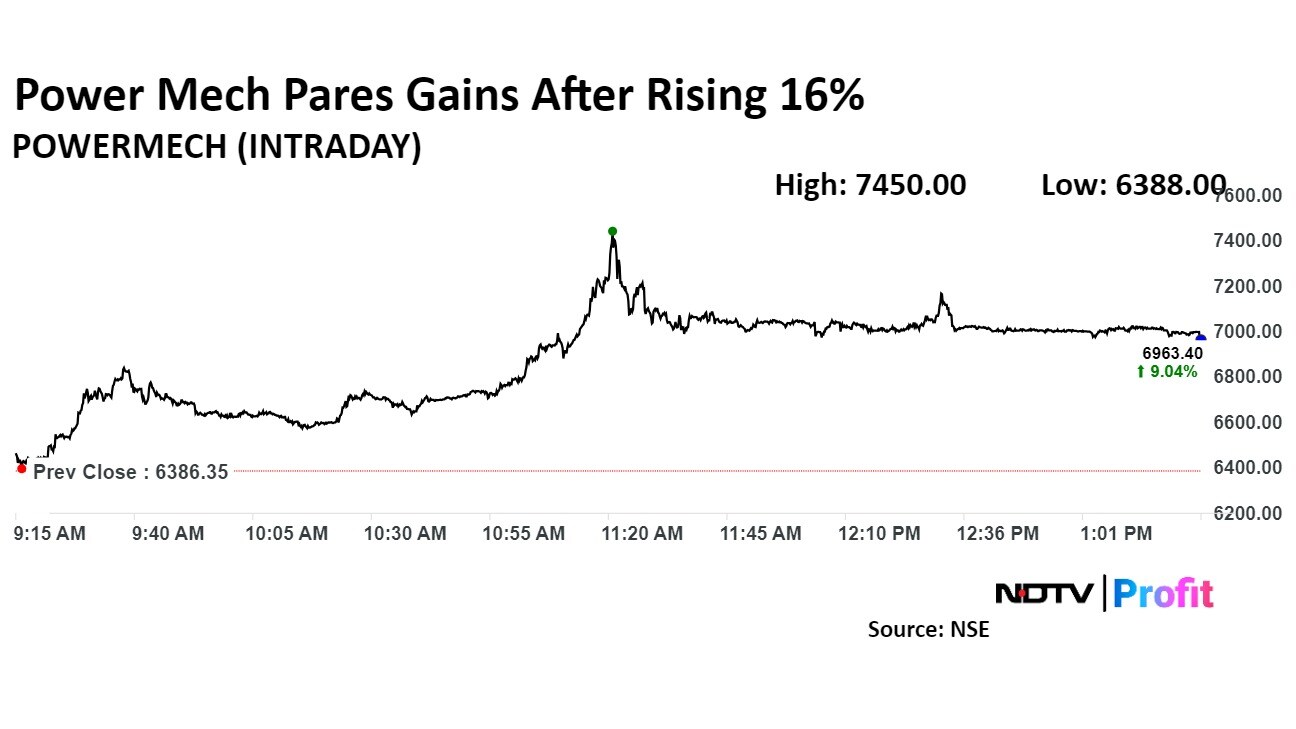

Shares of Power Mech Projects Ltd. jumped nearly 17% on Friday after its board fixed Sept. 28 as the record date for its bonus issue. The company said on Aug. 22 that it will issue bonus shares in a 1:1 ratio, pending shareholder approval at the upcoming AGM.

“The board has approved the fixation of Saturday, Sept. 28, 2024, as the record date to determine the eligibility of shareholders and beneficial owners who are entitled to receive bonus shares, subject to approval of the bonus issue by the shareholders at the ensuing AGM,” the company said in an exchange filing.

"This stock has been a remarkable multibagger, rising over 17 times since early 2021. Its long-term uptrend remains intact," said Kush Bohra, founder of KushBohra.com, an investment advisory firm. "Recently, the stock consolidated before rebounding from its 50-day moving average. It has resumed its uptrend, breaking above the previous peak of Rs 6,500. Strong volume action supports the surge. The stock is now poised for a move towards Rs 8,500 and higher levels. The previous resistance level of Rs 6,500 is now a near-term support."

Order Book and Projects

Power Mech's order book stood at approximately Rs 57,085 crore as of August 2024. The unexecuted order book, excluding mine developer and operator (MDO) projects, was approximately Rs 18,115 crore. For fiscal 2025, the company is targeting 25–30% revenue growth. As the MDO business ramps up, the company expects margins to remain stable and further improve.

They are aiming for an order book of Rs 11,000 crore, with a focus on industrial plant operations, maintenance, railways, and water projects. Moving forward, O&M and MDO businesses will provide significant revenue and margin stability.

Outlook

Power Mech aims for 25–30% revenue growth in fiscal 2025 and hopes to achieve Rs 7,000 crore in revenue by fiscal 2026. The tax rate is projected to be 26–27% in fiscal 2025 and 2026.

Power Mech has planned a regular capex of Rs 100 crore, which will be funded through term loans. Additionally, they have allocated Rs 240 crore for washery capex, which will be funded through a QIP, the company said in its fourth-quarter results con call.

Shares of Power Mech were trading 9.41% higher at Rs 6,987.20 apiece after having jumped 16.65% to hit intraday high of Rs 7450 apiece early on Friday. That compares with 0.06% gains in the benchmark Nifty 50.

Two analysts tracking the company have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 10%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.