Shares of Power Finance Corp. surged in early trade on Monday as the company traded ex-dividend. PFC has announced an interim dividend of Rs 3.50 per equity share on the face value of Rs 10.

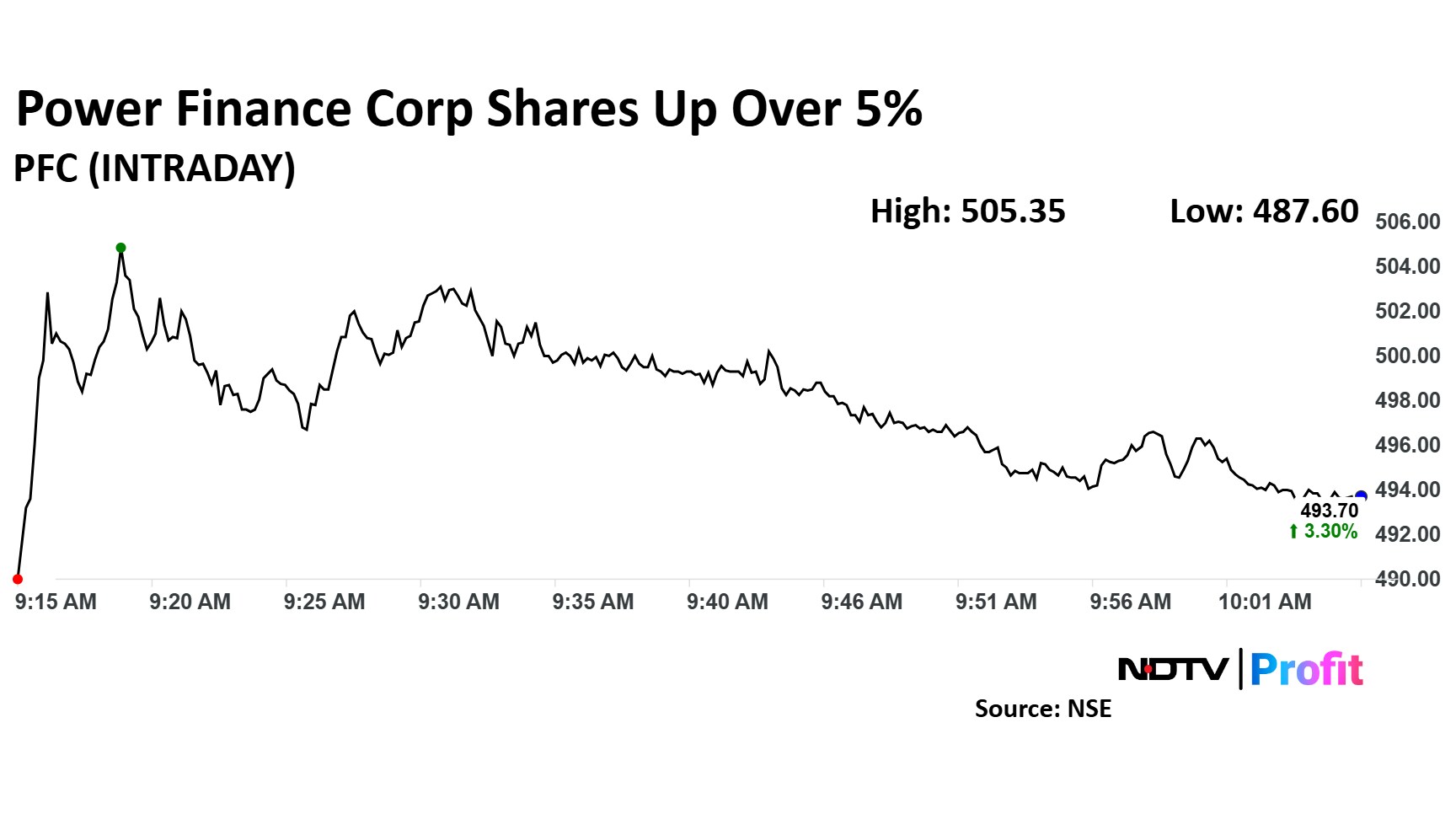

PFC's share price advanced as much as 5.73% to hit Rs 505.35 apiece on Monday, reaching its highest level in over two months. Shares of the company were trading 4.50% up at Rs 495.80 apiece as of 10:00 a.m.

The infrastructure-finance company saw its shares exchange hands in a large trade on Monday, with 1.16 lakh shares traded at Rs 493.85 per equity share.

This development follows Macquarie Equity Research's recent coverage on the Indian power sector, with initiation of coverage on four key companies: Power Finance Corp., REC Ltd., Power Grid Corp., and NTPC Ltd., assigning them an 'outperform' rating.

The firm highlights several positive trends in the Indian power sector over the last decade, noting a favorable shift for electric utilities and power lenders. There is an expected rebound in capital expenditure in power generation and transmission after a period of sluggish growth.

Additionally, improved health of power distribution utilities has alleviated significant sector concerns, and the power demand-supply balance now favors suppliers, said Macquarie. Key growth drivers for the sector include increasing demand for data centers, the rise in EV adoption, and evolving weather patterns, they add.

PFC share price rose as much as 5.73% to Rs 505.35 apiece, the highest level since Sept. 13, 2024. It pared gains to trade 2.64% higher at Rs 490.55 apiece, as of 10:13 a.m. This compares to a 1.52% advance in the NSE Nifty 50 Index.

It has risen 25.95% on a year-to-date basis. Total traded volume so far in the day stood at 2.9 times its 30-day average. The relative strength index was at 57.70.

10 analysts tracking the stock maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 22.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.