The week ahead will see global and domestic market action, with several key events likely to shape sentiment.

US Federal Reserve Chair Jerome Powell's speech at the National Association for Business Economics conference and China's Golden Week holiday are in focus, as Chinese markets close for seven days following a strong rally. Nike's earnings, coming shortly after a CEO shakeup, will also grab attention.

On the domestic front, a lacklustre week for the initial public offerings is expected, with only small and medium enterprise offerings on tap and no major mainboard listings. KPI Green Energy Ltd. will announce its dividend, while on Monday, the Controller General of Accounts will release government finance data for August.

Topping the week off, the US September jobs report will be released on Friday, a crucial indicator for the Fed as it navigates the impact of its recent 50-basis-point rate cut.

The week will observe one market holiday, and the Navaratri festival will kick off on Oct. 3.

Markets Last Week

This week, the Nifty gained 1.5% and Sensex added 1.2%. All sectoral indices, but Nifty FMCG, ended higher. Nifty Metal rose the most.

The NSE Nifty 50 snapped its six-session winning streak on Friday and the S&P BSE Sensex ended lower after two consecutive days of gains. Despite this, the Indian benchmarks managed to end higher for the third week in a row.

At close, the Nifty was 37.10 points or 0.14% down at 26,178.95 and the Sensex was 264.27 points or 0.31% lower at 85,571.85. Intraday, both the Nifty and Sensex gained around 0.2% to hit fresh highs of 26,277.35 points and 85,978.25 points respectively.

On the BSE, 12 sectors advanced, and eight declined out of 20. The BSE Realty declined the most, and the Oil & Gas rose the most.

Domestic Cues

On Monday, the Controller General of Accounts will release government finance data for August. while the Ministry of Commerce will announce core sector output for the same month.

The third and final phase of the Jammu & Kashmir Assembly elections will conclude on Tuesday. Additionally, S&P Global will release the HSBC Manufacturing PMI for September.

The Indian bourses will be closed on Oct. 2, marking Mahatma Gandhi Jayanti.

Global Cues

China's benchmark index, the CSI 300, surged 15.28%, marking its best weekly gain of the year last week and the best rally since 2008, according to Bloomberg. This came after the People's Bank of China cut one of its short-term policy rates, sparking speculation that officials are preparing to step up efforts to revive growth.

Additionally, the politburo reaffirmed its commitment to meeting the country's annual economic goals, calling for increased fiscal spending and a stronger push to implement interest rate cuts.

Following this strong performance, Chinese markets will be closed for seven days, starting Tuesday, Oct. 1 for Golden Week festivities, with holiday consumption in the world's second-largest economy in focus.

However, before the celebrations begin, China will release data on unemployment, industrial production, official PMIs, and Caixin PMIs on Monday, Sept. 30.

Across the globe, Fed Chair Powell is set to deliver a speech at the National Association for Business Economics conference in Nashville on the same day.

In addition, Egypt and the UK will announce their GDP figures, while Italy, Germany, Poland, and Sri Lanka will release their CPI data.

On Tuesday, UK S&P Global Manufacturing PMI data and US job openings will be released, along with Nike's earnings report, which comes just two weeks after the company announced it would replace its chief executive officer. The Bank of Japan will also issue a summary of opinions from its September meeting.

On Thursday, Oct. 3, US ISM services, factory orders, and initial jobless claims will be reported.

Finally, on Friday, the US Sept. jobs report will be released, a key indicator for the Federal Reserve as markets look for a balanced reading on the labor market.

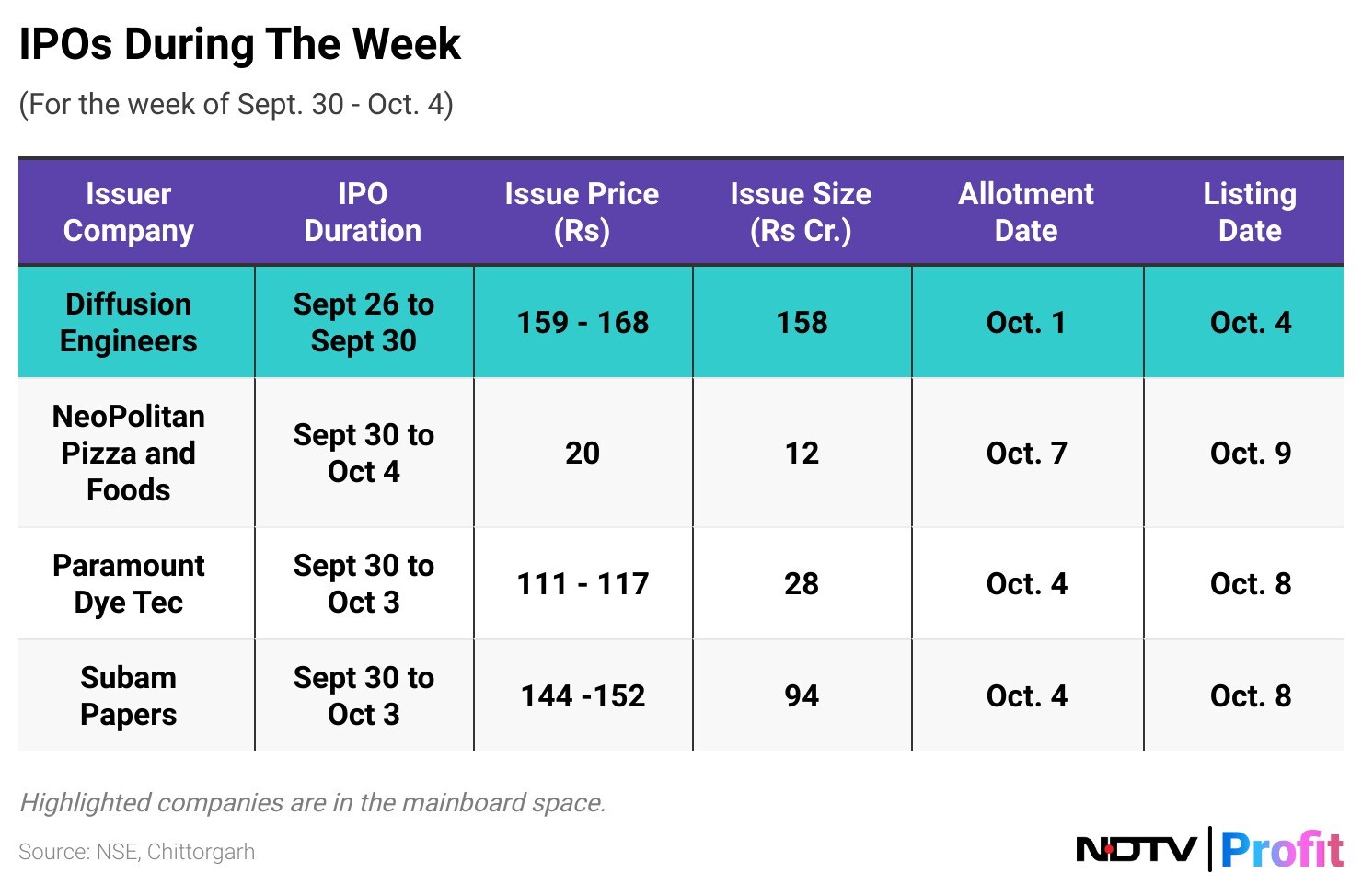

Primary Market Action

India's primary market will probably see the dullest week so far in the fiscal with only three small and medium enterprise IPOs up for grabs. After continued frenzy in the space and big listings such as Ola Electric Ltd., Bajaj Housing Finance Ltd., the primary market will experience a lacklustre week.

But, Hyundai MotoCorp, NTPC Green, and Swiggy's blockbuster mainboard IPOs are on the horizon and have all filed their respective draft red herring prospectus'.

NTPC Green Energy Ltd. plans to raise Rs 10,000 crore in its IPO, potentially reaching a market capitalisation of Rs 75,000 crore. Swiggy Ltd. aims to raise Rs 10,700 crore, and Hyundai Motor India has received approval from SEBI for a $3-billion pure offer for sale.

SEBI, the market regulator, has urged the BSE and the National Stock Exchange to tighten due diligence on merchant bankers involved in SME IPOs. This is because SEBI saw lax enforcement in clearing several SME IPOs and expressed concerns about certain companies' unrealistic claims.

NDTV Profit earlier reported that SEBI has already launched an investigation into over 12 merchant banks to look into flaws in their due diligence procedures for the SME IPOs.

India's primary market will probably see the dullest week so far in the fiscal with only three small and medium enterprise IPOs up for grabs.

Corporate Action Ahead

KPI Green Energy, ADS Diagnostic Ltd. and Accelya Solutions India Ltd. have record dates for their interim/final dividend in the coming week.

Integrated Industries Ltd., Godawari Power & Ispat Ltd. and Real Eco-energy Ltd. will undergo a stock split from the week starting Sept. 30.

Classic Electricals Ltd. and Shikhar Leasing & Trading Ltd. will issue bonus shares and Diligent Industries Ltd. will host an extraordinary general meeting during the week.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.