Shares of Polycab India Ltd. rose on Friday after the company denied receiving communication from the Income Tax Department regarding the outcome of the search. The shares were locked in a lower circuit of 20% on Thursday.

While the IT department had initiated the search proceedings at some premises of Polycab between Dec. 22 and Dec. 30, the company did not receive any written communication from the IT department, Polycab said in an exchange filing.

It further added that it "understands that there is a press release titled ‘Income Tax Department conducts search operations in Mumbai' but the release "does not specifically name any company". It also said that it will continue to fully cooperate with the tax department and that "there is no material adverse impact on the financial position of the company".

The statement released by the finance ministry states that a company indulged in unaccounted cash sales of Rs 1,000 crore, cash payments for unaccounted purchases of Rs 400 crore, non-genuine transport and sub-contracting expenses for suppression of its taxable income.

The IT department has also identified non-genuine expenses that total Rs 100 crore. The company also inflated the purchase account through authorised distributors, aggregating to Rs 500 crore.

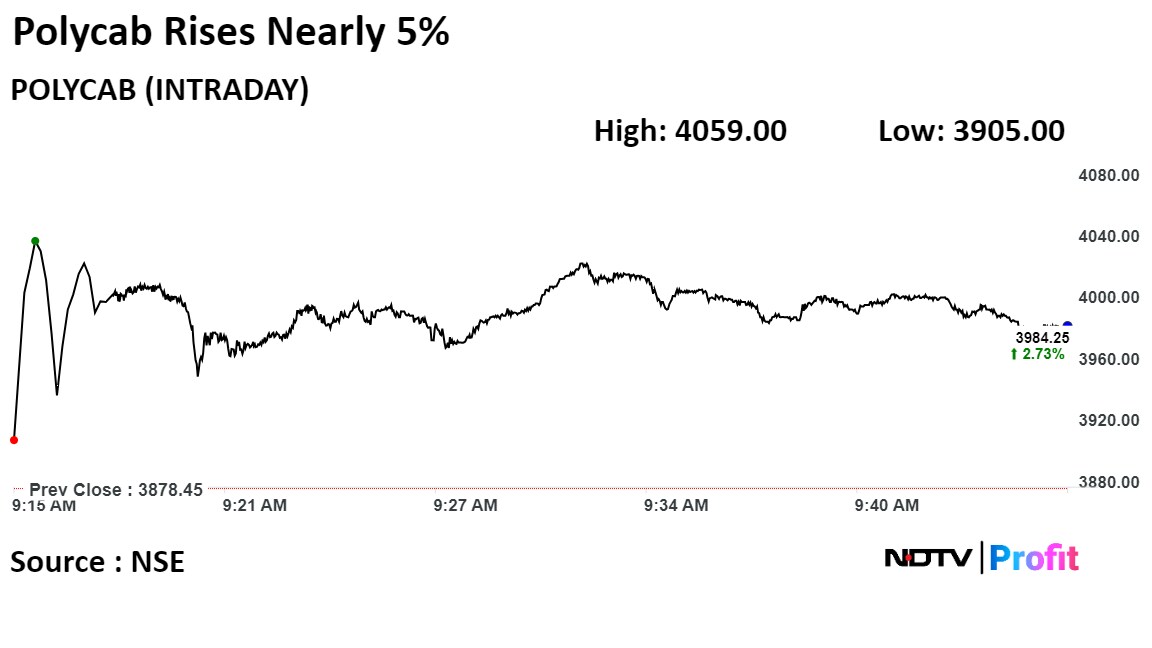

Shares of the company rose as much as 4.66% to 4,059 apiece, the highest level since Jan. 11. It pared gains to trade 3.15% higher at Rs 4,000.75 apiece, as of 9:39 a.m. This compares to a 0.44% advance in the NSE Nifty 50 Index.

It has risen 49.45% in the last 12 months. Total traded volume so far in the day stood at 24 times its 30-day average. The relative strength index was at 20 indicating that it was underbought.

Out of 31 analysts tracking the company, 19 maintain a 'buy' rating, six recommend a 'hold', and six suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 49.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.