Polycab India Ltd. is likely to report the highest revenue growth compared to peers in cable and wires space, while the KEI Industries Ltd. may post highest profit growth, HSBC Global Research said in note on Tuesday.

The brokerage retained a 'Buy' on Polycab India and hiked the target price to Rs 7,800 from Rs 7,000. The current target price implies 10.22% upside from Monday's closing price.

During July–Sept, Polycab India's revenue, operating profit, and net profit likely have grown by 20%, 5% and 1%, respectively, HSBC said. The brokerage forecasts Ebitda margin to fall 170 basis points year-on-year to 12.7% in the second quarter.

HSBC Global Research"High base and inferior mix are likely to weight on Polycab's Ebitda margin"

Polycab India share price rose 1.62% to Rs 7,191 apiece. It was trading 1.05% higher at Rs. 7,151.10 as of 10:11 a.m. as compared to a 0.07% advance in the NSE Nifty 50 index.

The stock gained 38.08% in 12 months, and 31.59% this year so far.

Out of 33 analysts tracking the company, 22 maintain a 'buy' rating, seven recommend a 'hold,' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.3%

For KEI Industries Ltd., HSBC has a 'Hold' rating and hiked the target price to Rs 4,350 from Rs 4,000. The current target price implies 5.89% upside from Monday's closing price.

HSBC Global Research expects KEI Industries' net profit to grow by 18% year-on-year during July–Sept. Its revenue and Ebitda are expected to grow by 18% and 19%, respectively, on annualised basis.

KEI Industries' Ebitda margin is expected to grow by 10.5%.

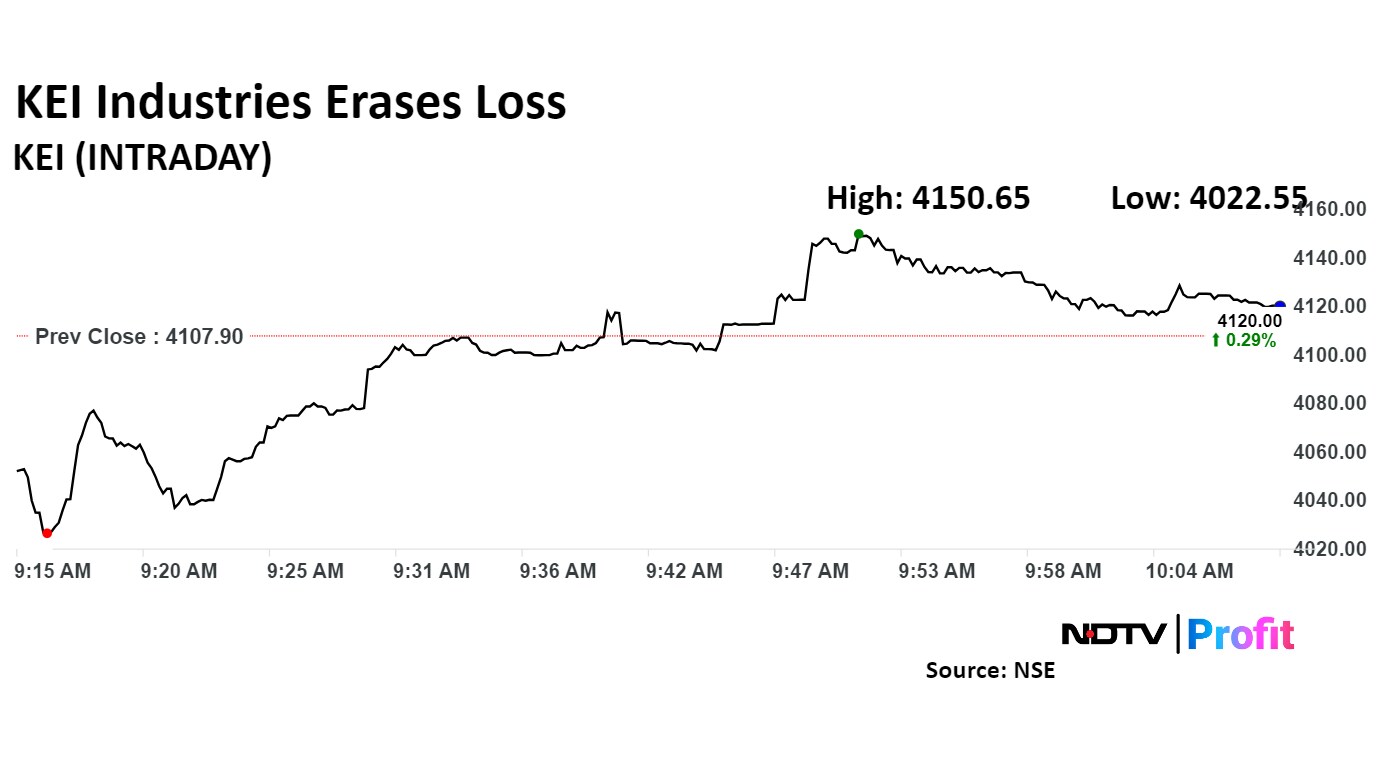

KEI Industries share price declined 2.08% to Rs 4,022.55 per share, the lowest level since Aug 7. It was trading 0.28% higher at Rs 4,119.30 as of 10:12 a.m., as compared to 0.07% advance in the NSE Nifty 50 index.

The stock gained 54.11% in 12 months, and 26.76% year-to-date. Total traded volume so far in the day stood at 2.6 times its 30-day average. The relative strength index was at 36.97.

Out of 18 analysts tracking the company, nine maintain a 'buy' rating, eight recommend a 'hold,' and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.7%

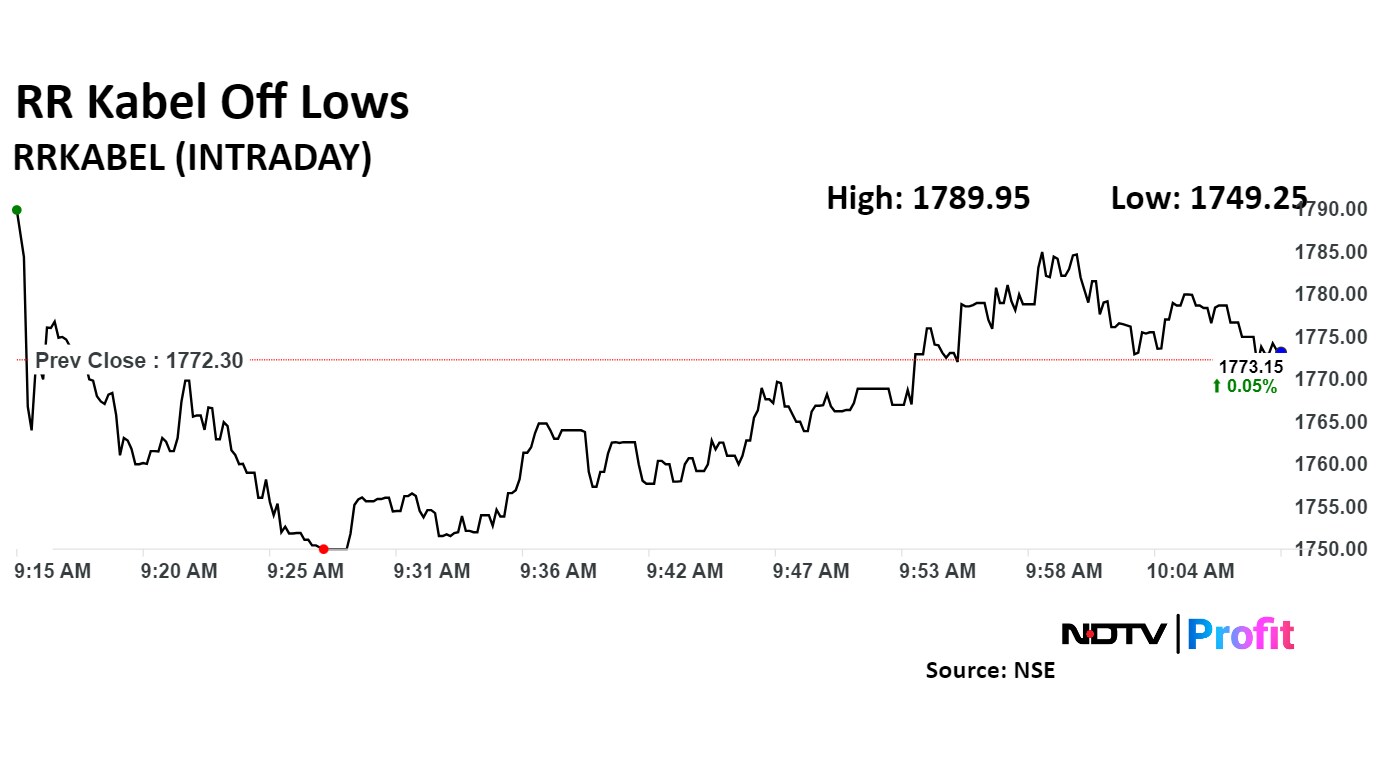

R R Kabel Ltd. is likely to post 19% revenue growth for second quarter, according to HSBC Global Research. The operating profit is expected to be flat. The Ebitda margin may decline 120 basis points on the year to 6.3%.

HSBC GlobalLower tax rate and higher other income should drive an 11% increase in PAT.

HSBC Global Sees 18–20% Growth For Industry

HSBC Global Research expects strong demand momentum due to tailwinds from the industry. Demand from buildings, factories end markets, and power distribution is driving growth in the industry.

HSBS Global Research expects 18–20% revenue growth for the industry. It estimates value growth in the industry to be around 5% or higher than the volume growth.

Cables are expected to outperform wires segment in the second quarter. The volatility in the commodity prices is likely to be reflected in the profitability of wire sub–segment, according to the brokerage.

However, as copper prices were inflationary towards the end of September, wires demand is also likely to see robust growth, HSBC Global Research said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.