Morgan Stanley has hiked the target price of PNB Housing Finance Ltd. by 48.29%, pricing in the possibility of long-term growth with respect to loan growth, asset quality, and return on capital. The housing finance company is also the preferred pick in the mid- and small-cap companies, according to the New York-based investment bank.

Morgan Stanley has an 'overweight' rating on PNB Housing Finance and hiked the target price to Rs 1,520 apiece from Rs 1,025 apiece, implying an upside of 37% from the previous close.

In the next three years, PNB Housing Finance expects to become the only finance company across retail, formal, and informal segments after repairing its balance sheet and rebuilding its franchise. This position will help the housing finance company increase loan growth, enhance asset quality, return on capital, and lessen the frequency of equity raises, Morgan Stanley said.

Morgan Stanley also raised earnings per share estimates by 2% for financial year 2025-26 and by 5% for 2026-27. The brokerage likes PNB Housing Finance's margin of safety in valuation and fundamentals, which might be best placed even as system-wide bad loans rise in the housing finance space.

Morgan Stanley also noted that there is significant room for re-rating after taking peer group valuation into account. "PNB Housing Finance is cyclically well placed, with limited downside risks from asset quality worsening relative to lenders in other asset classes. Recoveries from past written off loans also provide downside protection."

Key Risks

Supply in stock from private equity investors is not absorbed well

Mid-cap sell-off in India

Much weaker-than-expected earnings

PNB Housing Finance shares rose 38% since July 30, according to Morgan Stanley.

In past couple of years, PNB Housing Finance has seen a change in management, focused on building new segments, and added to distribution and raised capital.

Adding to this, at least 15.3 lakh shares of PNB Finance changed hands at Rs 1,097 apiece on NSE in pre-market hours.

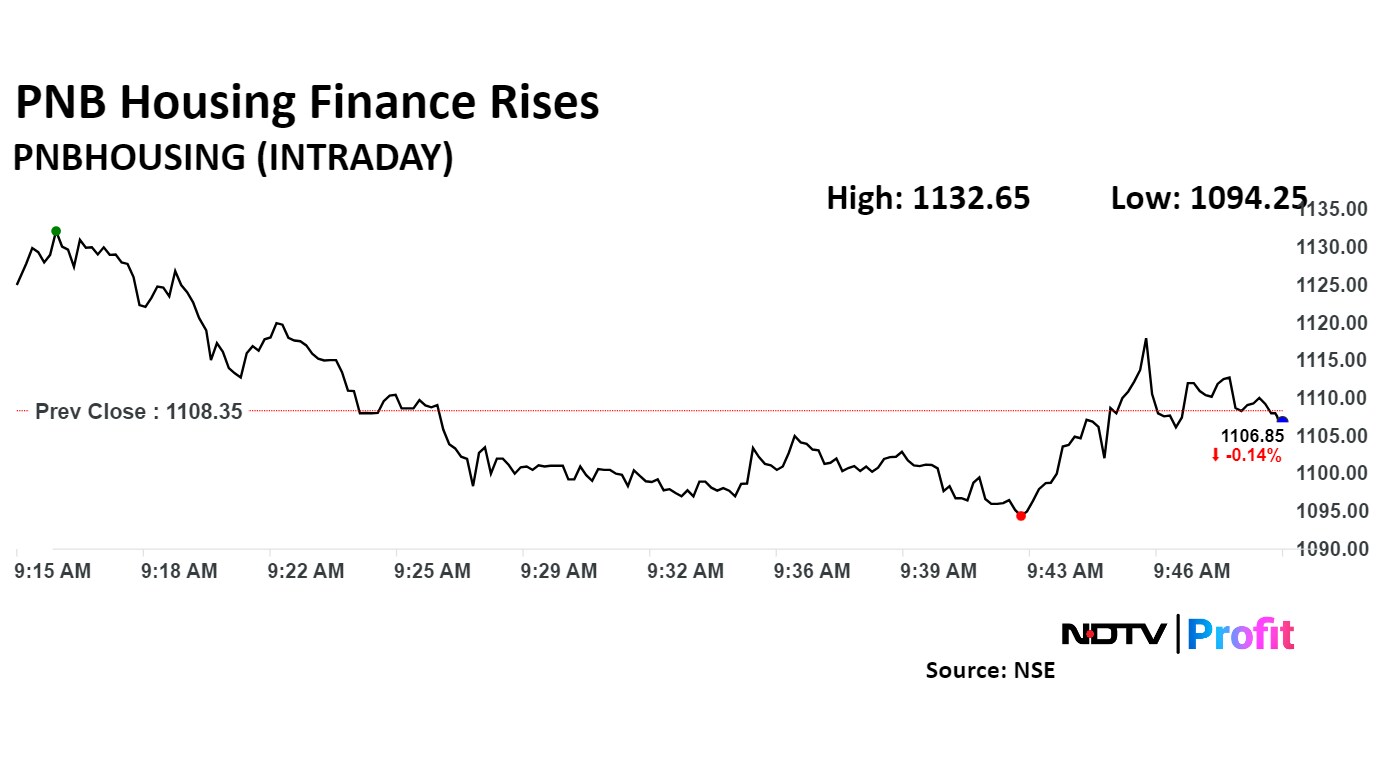

Shares of PNB Housing Finance rose as much as 2.19% to Rs 1,132.65 apiece. It was trading 0.33% higher at Rs 1,112.00 as of 9:47 a.m., compared to 0.46% advance in the NSE Nifty 50 index.

The stock gained 66.32% in the last 12 months and 42.2% year-to-date. The relative strength index was at 75.61, which implied the stock is overbought.

Out of 12 analysts tracking the company, 10 maintain a 'buy' rating, one recommends a 'hold,' and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 4.7%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.