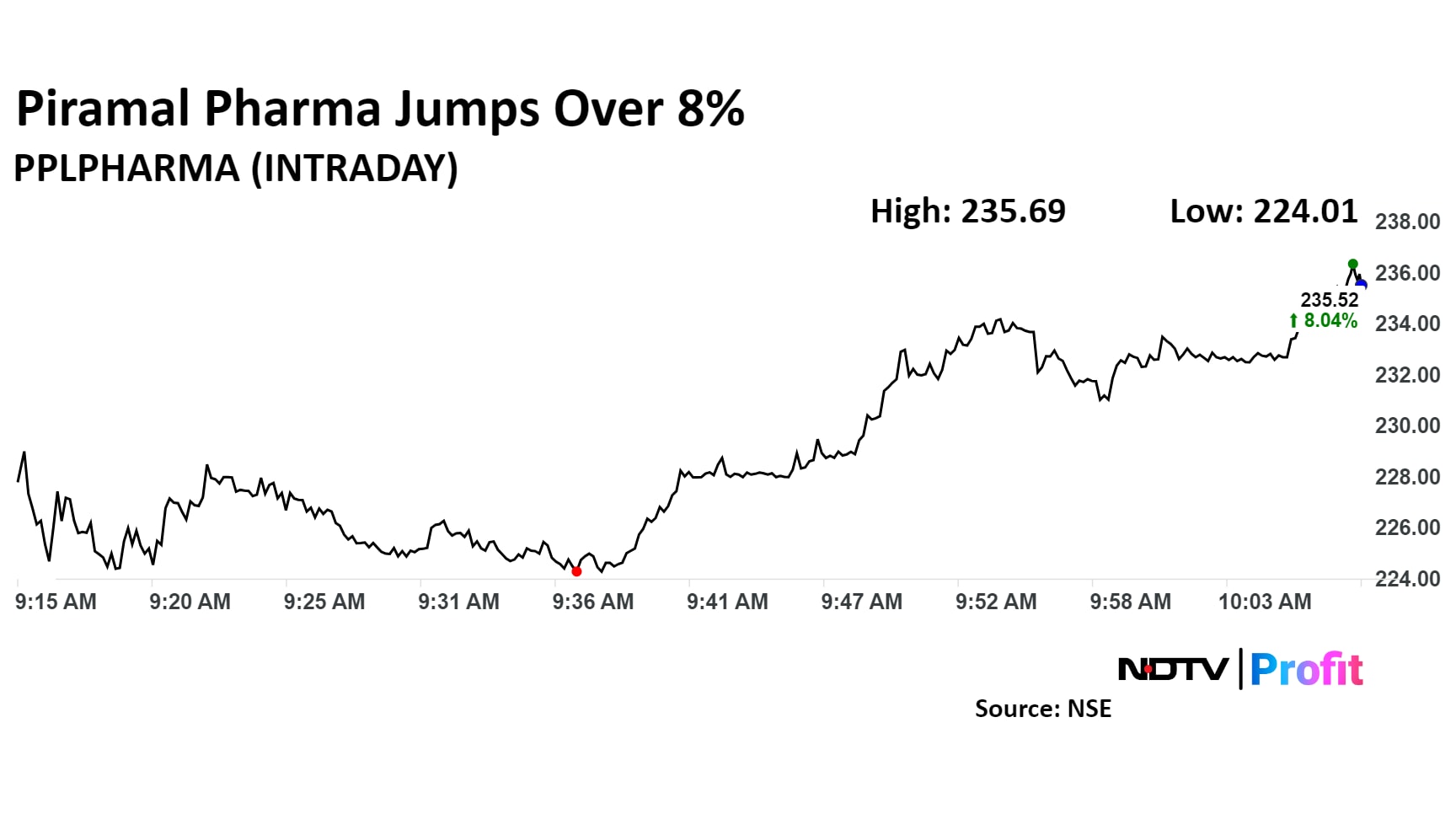

Piramal Pharma's share price surged over 8% on Thursday after the company reported the September quarter net profit at 4.6 times the number a year ago quarter.

The pharmaceutical company posted a profit of Rs 23 crore in the September quarter as against Rs 5 crore in the year-ago period, according to an exchange filing on Wednesday. Analysts tracked by Bloomberg had estimated a profit of Rs 31 crore.

"We continue our momentum of delivering healthy revenue growth. accompanied by YoY Ebitda margin expansion," Chairperson Nandini Piramal said. "This has been primarily driven by consistent growth in our CDMO business which has witnessed a good pick-up in innovation related work and on-patent commercial revenues."

To sustain this growth momentum and to capitalise on rising demand for sterile fill-finish capabilities, the company has announced a $80-million expansion plan at its Lexington facility, which is expected to get completed by the end of fiscal 2027, the chairperson said.

For the financial year 2030, the company targets over 3 times growth in Ebitda margin to 25%, more than double the revenues of over $2 billion, and reduce leverage on the balance sheet of 1 time net debt to Ebitda, according to the investor presentation. The company also targets PAT margin in early teens and high teens return on capital employed.

The scrip rose as much as 8.45% to Rs 236.40 apiece, the highest level since Sept 10. It pared gains to trade 7.8% higher at Rs 235 apiece, as of 10:12 a.m. This compares to a flat NSE Nifty 50 index.

It has risen 69.8% on a year-to-date basis and 125.65% in the last 12 months. Total traded volume so far in the day stood at 2.25 times its 30-day average. The relative strength index was at 59.2.

All nine analysts tracking the stock have a 'buy' rating for the stock, according to Bloomberg data. The average 12-month consensus price target implies an upside of 3.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.