Shares of PB Fintech Ltd. rose over 4% on Monday, ending a five-day decline, as the company announced plans to foray into healthcare sector. Yashish Dahiya, chairman and group chief executive officer of the parent company of Policybazaar and Paisabazaar, told NDTV Profit that the company plans to invest in an independent Health Maintenance Organisation.

Dahiya emphasised that the investment aims to address key challenges in the healthcare sector, including reducing costs for insurers and mitigating conflicts of interest between customers and hospitals. PB Fintech plans to acquire a 20-35% stake in the HMO with an investment of up to Rs 800 crore (approximately $100 million) over the coming quarters.

A Health Maintenance Organisation is an either public or private entity, that offers comprehensive medical care to a group of voluntary members through a prepaid contract. Members typically pay a fixed fee to access a range of healthcare services, emphasising preventive care and coordinated treatment.

At a recent event, Alok Bansal, co-founder and executive vice chairman of PB Fintech, reaffirmed the company's commitment to entering the healthcare space, labeling it a necessity for the middle class.

Dahiya expressed hopes that this initiative would lead to lower claims and an enhanced customer experience. Customers often worry about whether their claims will be approved and they will receive the amount, he noted. The goal is to better align the interests of customers and hospitals, fostering a more transparent and efficient healthcare ecosystem.

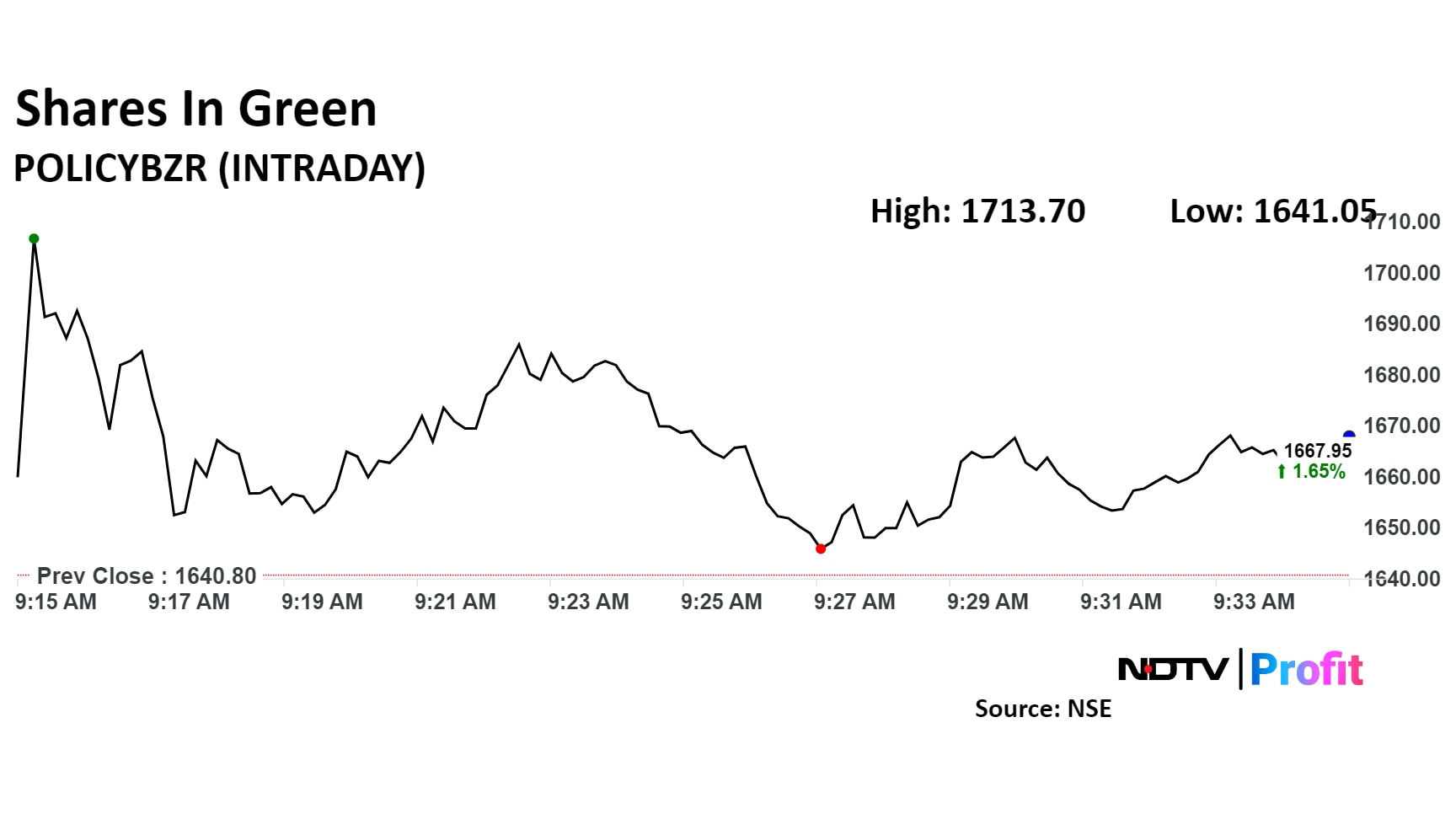

The company's shares had corrected around 15% over the last five trading sessions before turning green on Monday.

Dahiya mentioned that the company's investment would primarily focus on securing land, thus protecting against downside risks.

PB Fintech Share Price

Shares of PB Fintech rose as much as 4.44%, before paring gains to trade 1.79% higher at Rs 1,670.25 apiece, as of 09:37 a.m. This compares to a 0.58% decline in the NSE Nifty 50.

The stock has risen 119.65% in the last 12 months. Total traded volume so far in the day stood at 1.1 times its 30-day average. The relative strength index was at 43.

Out of 19 analysts tracking the company, eight maintain a 'buy' rating, seven recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 10.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.