Paytm founder Vijay Shekhar Sharma and former board directors from 2021 have received a show-cause notice from the Securities and Exchange Board of India for non-compliance with promoter classification norms during the IPO of One97 Communications Ltd. in November 2021, according to people familiar with the matter, though the company has clarified that the matter is old and has been disclosed in its financial results for March and June 2024.

The latest SEBI show-cause notice might make it difficult for Paytm to get its payment aggregator licence reinstated. Paytm recently got a government nod to apply for the licence after it assured authorities that the funds in Paytm Payments Services accounts are not from foreign sources. However, the latest notice might make that path difficult.

In 2023, Institutional Investor Advisory Services Ltd., a prominent proxy advisory firm, had also raised questions on Sharma's stake in the parent firm, as well as the employee stock options granted to him by the company ahead of the initial public offering.

Sharma is the founder and chief executive officer of One97 Communications Ltd., but is not classified as promoter, according to stock exchange disclosures. As a non-retiring director, Sharma chairs the company's board and has the right to a board seat if he holds at least 2.5% stake. Sharma would've also not been granted the ESOPs had he been classified as a promoter.

Effectively, he enjoys the rights of a promoter without the responsibilities and restrictions, Institutional Investor Advisory Services Ltd. said in a blog in January last year.

The latest regulatory shock to Paytm comes months after its arm, Paytm Payments Bank, was pulled up by the Reserve Bank of India on Jan. 31, which impacted its wallet and banking services.

Paytm, however, said that the exchanges that the matter is old, and has been in touch with SEBI over relevant disclosures that have been filed with the financial results for the quarter and year ended March 31, as well as the quarter ended June.

"The company is in regular communication with the Securities Exchange Board of India and making necessary representations regarding this matter. Accordingly, there is no impact on the financial results for previous quarters ended June 30, 2024, and March 31, 2024, respectively," the company said in a clarification statement to the exchanges.

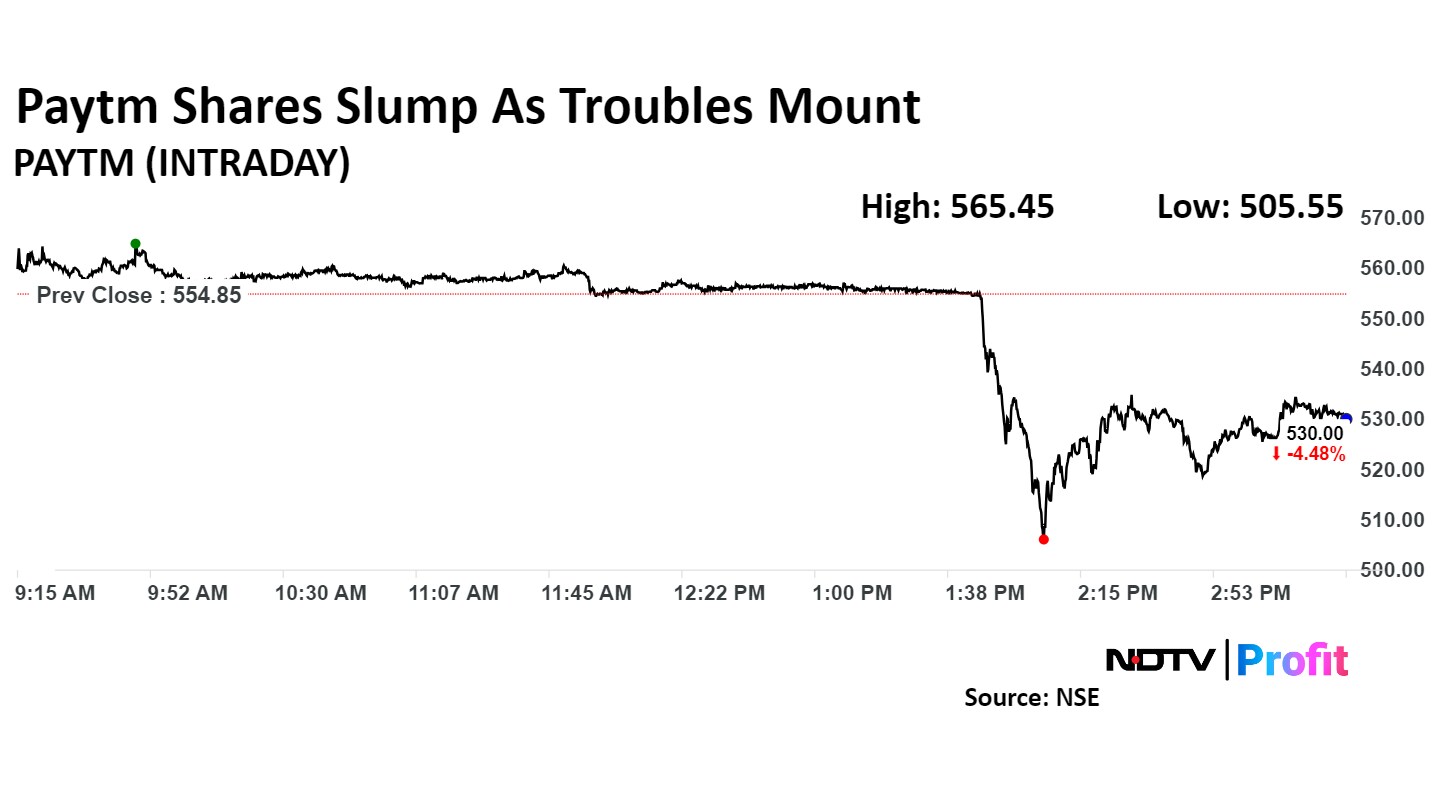

Shares declined as much as 9% intraday to Rs 505.5 apiece, after the news, before paring some losses to close at 4.48% at Rs 530 apiece. The NSE Nifty 50 closed 0.76% higher on Tuesday.

The stock has dropped 39.9% over the past 12 months and 16.5% year-to-date. The counter saw heavy selling in the latter half of the day as the total volume stood at 2.62 times. RSI stood at 36.08.

Seven out of the 17 analysts tracking Paytm have a 'sell' rating on the stock, six recommend a 'hold' and four suggest a 'buy', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 16%.

How Will SEBI Notice Impact Paytm's Business| Watch

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.