Shares of One97 Communications Ltd. were locked in a lower circuit for the third day after the RBI put restrictions on the Paytm Payments Bank.

The National Stock Exchange and Bombay Stock Exchange notified on Feb. 2 that the daily limit on the shares has been revised to 10% from the earlier 20%.

Paytm also had 19.4 lakh shares change hands in a pre-market large trade, according to Bloomberg data. However, the buyers and sellers were not known.

The Reserve Bank of India found major supervisory concerns and persistent non-compliance from the company's payment banks and, on Jan. 31, restricted Paytm Payments Bank from undertaking any fresh deposit or credit transactions from Feb. 29. After this, One97 Communications said it would be working only with other banks and not its own payment banks.

Adding to the troubles in the company, there were media reports claiming that the enforcement directorate was investigating the company for money laundering activities.

However, the company clarified in an exchange filing on Sunday that the ED is not holding any such investigations on the company, its founders or the CEO.

"We would like to set the record straight and deny any involvement in anti-money laundering activities. We have and will continue to abide by Indian laws and take regulatory orders with the utmost seriousness," the company said.

Looking at the decision by the RBI, the Confederation of All India Traders' National President BC Bhartia and Secretary General Praveen Khandelwal said in a statement on Sunday that the restrictions by the RBI have raised concerns about the security and continuity of financial services that are provided by Paytm. He also advised traders to switch from Paytm to other platforms.

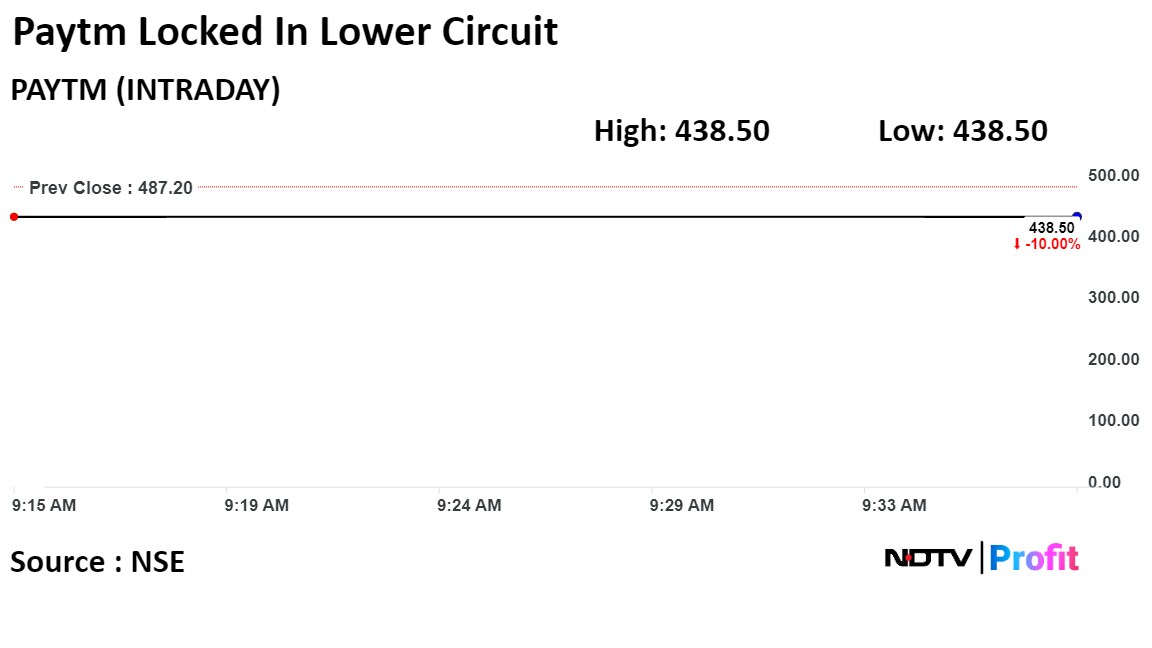

Shares of the company fell as much as 10% to Rs 438.50 apiece, to be locked in the lower circuit. This compares to a 0.13% advance in the NSE Nifty 50 Index as of 9:31 a.m.

It has fallen 21.46% in the last 12 months. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 19 indicating it was underbought.

Out of 15 analysts tracking the company, six maintain a 'buy' rating, four recommend a 'hold,' and five suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 16.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.