One97 Communication Ltd.'s shares gained on Wednesday after analysts said that the Paytm payments platform operator would become profitable soon through cost optimisation efforts amid a gradual recovery in business. They views followed the Vijay Shekhar Sharma-led company reporting marginal improvement in most of the business metrics in July–September, compared to the first quarter.

In other news, One97 Communication also finally received approval from the National Payments Corporation of India for adding new UPI users. This will help Paytm in adding new users to improve business quality, Emkay Global Research said in a note on Wednesday.

The brokerage retained its 'add' rating on the stock with a target price of Rs 750 apiece, implying an upside of 10% to the previous close.

NPCI's approval will allow Paytm to arrest the decline in its user base and subsequently boost investors' expectations of favourable outcomes based on other regulatory stances, Bernstein said in a note on Wednesday. It maintained an 'outperform' on Paytm shares with a target price of Rs 600, implying a 12% downside from Tuesday's closing price.

Overall business recovery remained slow in all segments, Emkay Global Research said. Its payment gross merchandise value rose 5% on the quarter and declined 1% on the year, it said.

Motilal Oswal Financial Services estimated One 97 Communications to turn Ebitda positive by financial year 2027. The brokerage expects the recovery will continue with revenue growth at 24% CAGR for the financial year 2025–2027. The brokerage kept the rating on Paytm unchanged at 'neutral', with a targert price of Rs 700 apiece, as it awaits more clarity on business growth recovery.

Paytm Q2 Results: Key Highlights (Consolidated, QoQ)

Revenue rose 10.5% to Rs 1,660 crore.

Net profit of Rs 930 crore versus net loss of Rs 840 crore

Ebitda loss of Rs 403 crore versus Ebitda loss of Rs 792 crore

Exceptional item of Rs 2,048 crore for sale of its events business

Note: The profit number is not comparable to previous quarter due to a one-time gain

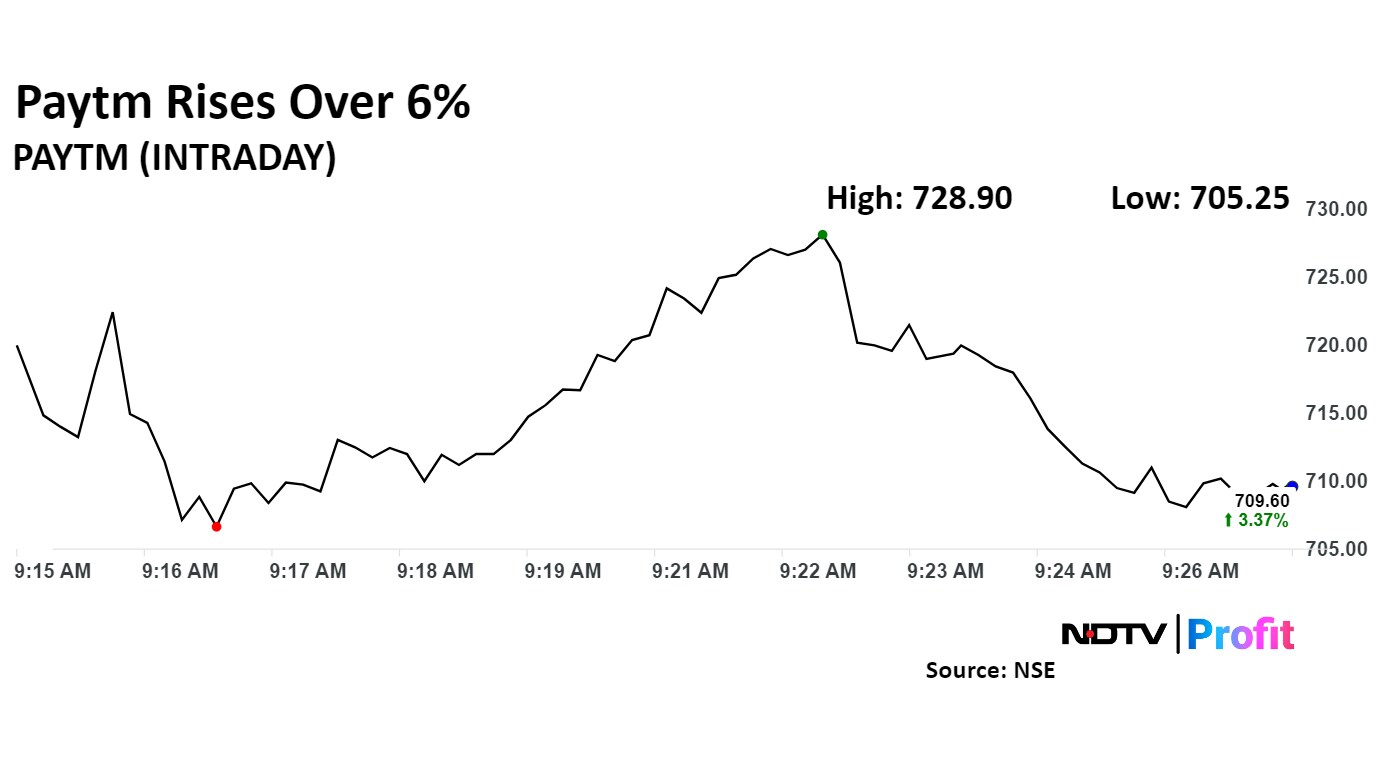

One 97 Communication's share price rose 6.18% to Rs 728.90 apiece. It was trading 3.30% higher at Rs 710 apiece, compared to a 0.13% gain in the benchmark BSE Sensex.

The stock declined 22% in the last 12 months and 13.31% so far this calendar year. Total traded volume so far in the day on NSE stood at 0.36 times its 30-day average. The relative strength index was at 54.01.

Out of 18 analysts tracking the company, six maintain a 'buy' rating, six recommend a 'hold,' and six suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 10.7%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.