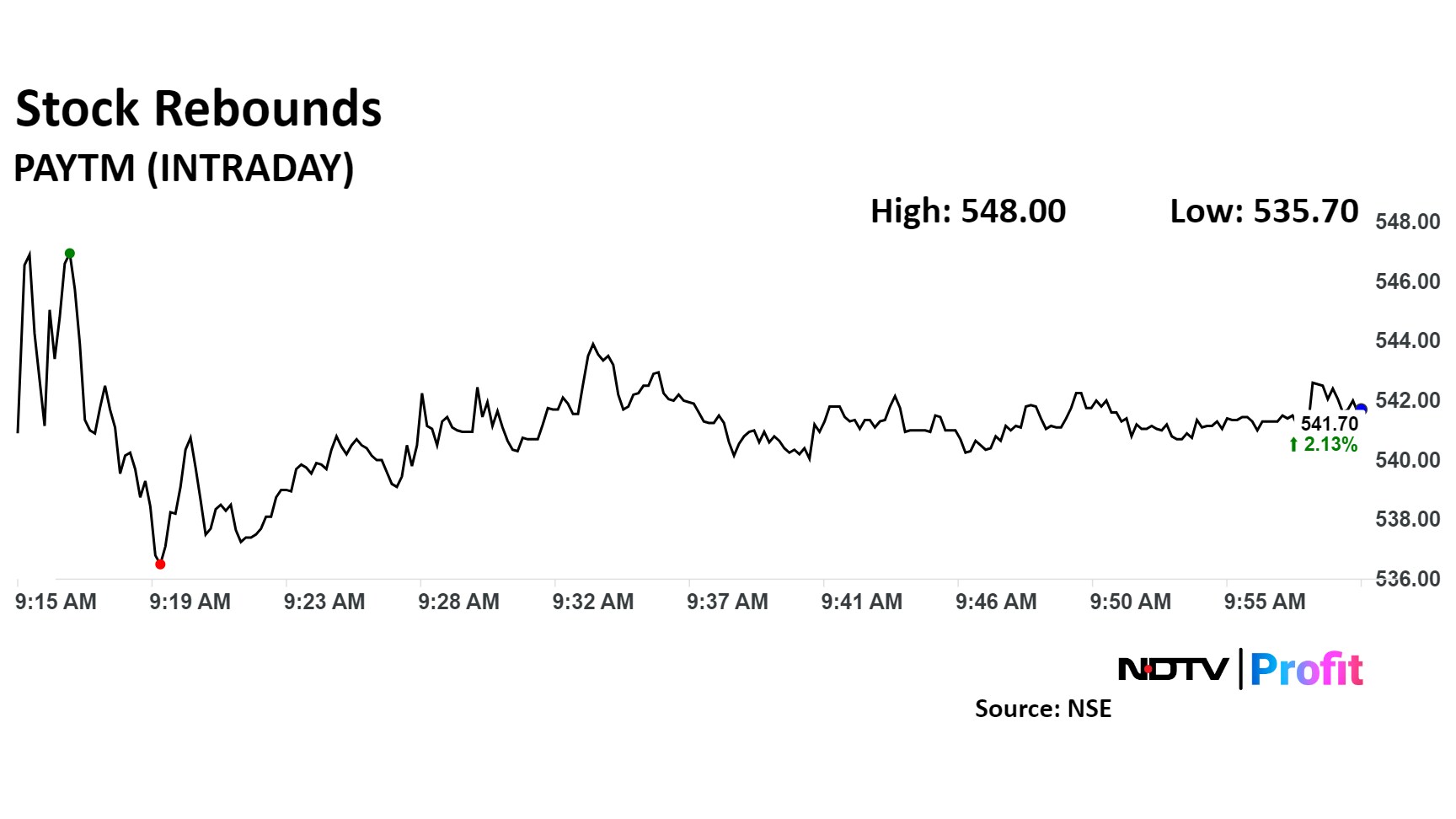

Shares of One97 Communications Ltd., the parent company of Paytm, rose over 3% on Tuesday after the company issued a clarification regarding a notice reportedly issued by the Securities and Exchange Board of India.

The uptick follows a nearly 9% decline on Monday, after reports that the markets regulator had issued a notice to founder Vijay Shekhar Sharma and former board directors from 2021 over alleged non-compliance with promoter classification norms during the IPO of One97 Communications Ltd.

In response to these reports, Paytm released a press statement addressing the concerns raised. The company emphasised that the matter was not new and had been previously disclosed in its financial results for the quarter and year ended March 31, 2024, as well as for the quarter ended June 30, 2024.

Paytm assured stakeholders that it was maintaining communication with SEBI and was actively making necessary representations regarding the notice. The company affirmed that the situation does not affect the financial results of the past quarters.

If the ESOPs issued are found to be non-compliant with regulatory guidelines, it is indeed the regulator's responsibility to conduct a thorough investigation, according to Sanjay Asher, senior partner at Crawford Bayley & Co. This stance reflects a commitment to ensure that all stock options adhere to the prescribed rules and regulations, he said.

Vijay Shekhar Sharma directly owns 9.1% of One97 Communications and holds an additional 4.8% through a trust structure. He also has indirect voting rights through another entity that controls nearly 10% of the company.

Such a structure must align with regulatory requirements, according Asher. Both direct and indirect shareholdings should be considered when calculating the total stake of a promoter. All forms of shareholding, whether direct or indirect, need to be accounted for in the overall assessment of Sharma's stake in the company, he said.

Shares of the company rose as much as 3.32% before paring gains to trade 1.89% higher at Rs 540.40 apiece, as of 09:55 a.m. This compares to a 0.11% advance in the NSE Nifty 50.

The stock has fallen 38.79% in the last 12 months. Total traded volume so far in the day stood at 1.9 times its 30-day average. The relative strength index was at 58.

Out of 17 analysts tracking the company, four maintain a 'buy' rating, six recommend a 'hold', and seven suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 17.5%.

Impact Of SEBI Notice To Paytm Founder | Watch

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.