One 97 Communications Ltd. has built a formidable payment business with large customer and merchant bases and market-leading infrastructure, according to UBS Research.

The research firm has initiated a 'buy' rating on the Paytm parent's stock with a target price of Rs 900, implying a potential upside of 24.48%.

UBS forecasted that the fintech company would break even on Ebitda in the next financial year and reach a 20% Ebitda margin by fiscal 2027–28, according to a note on Monday. "We view this as a key re-rating trigger, as seen at other new-age companies, such as Zomato, where investors value profitable growth more than pure growth."

It expects a moderating topline of a 21% compound annual growth rate in fiscal 2024–28, while operating leverage plays out as marketing-expense requirements ease and the costs of employee stock ownership plans moderate.

Strength Across Merchants, Customers

Paytm's omnichannel payment business has earned it a 25% industry gross-merchandise-value share. Its large top-of-the-funnel payment business has accelerated monetisation across merchant devices and loans, according to UBS. "We think regulatory issues have passed for payments and expect Paytm to benefit from a 24% CAGR in the payment-player fee pool in FY23–28."

Paytm's loan origination is expected to grow seven times during fiscal 2022–24, with lending partners rising to nine in the current fiscal from four in 2021–22.

UBS likes Paytm's merchant loan business as the firm's proprietary merchant data and daily settlement provide early delinquency indications. "We forecast an overall revenue CAGR of 21% in FY24-28."

Ebitda Margin To Gradually Reach 20%

Paytm's profitability has progressed, with the contribution margin improving to 55% of revenue in the current fiscal FY24 and Ebitda, excluding ESOP costs, turning positive. "We forecast the company to break even in Ebitda in FY25, aided by operating leverage and declining ESOP costs."

UBS said the market was overestimating the marketing-cost requirements of the business since most of Paytm's customer acquisitions had been done. "Our FY26–28 Ebitda estimates are 8–14% above consensus."

What's Priced In?

Paytm's share price is down nearly 25% from its peak in 2023, primarily because regulatory tightening for unsecured loans hurt its loan origination business, UBS said.

This has led to multiple de-ratings, with the stock trading at discounts to its global payment and Indian internet peers. The market perceives this as a roadblock for Paytm's broad monetisation strategy.

"We view it as only a cyclical downturn with a limited impact, as it affects only a portion (post-paid loans) of one business vertical. We believe in the company's overall monetisation strategy and forecast Ebitda breakeven in FY25," it said. "We view that as its key re-rating trigger, similar to those at leading Indian internet names."

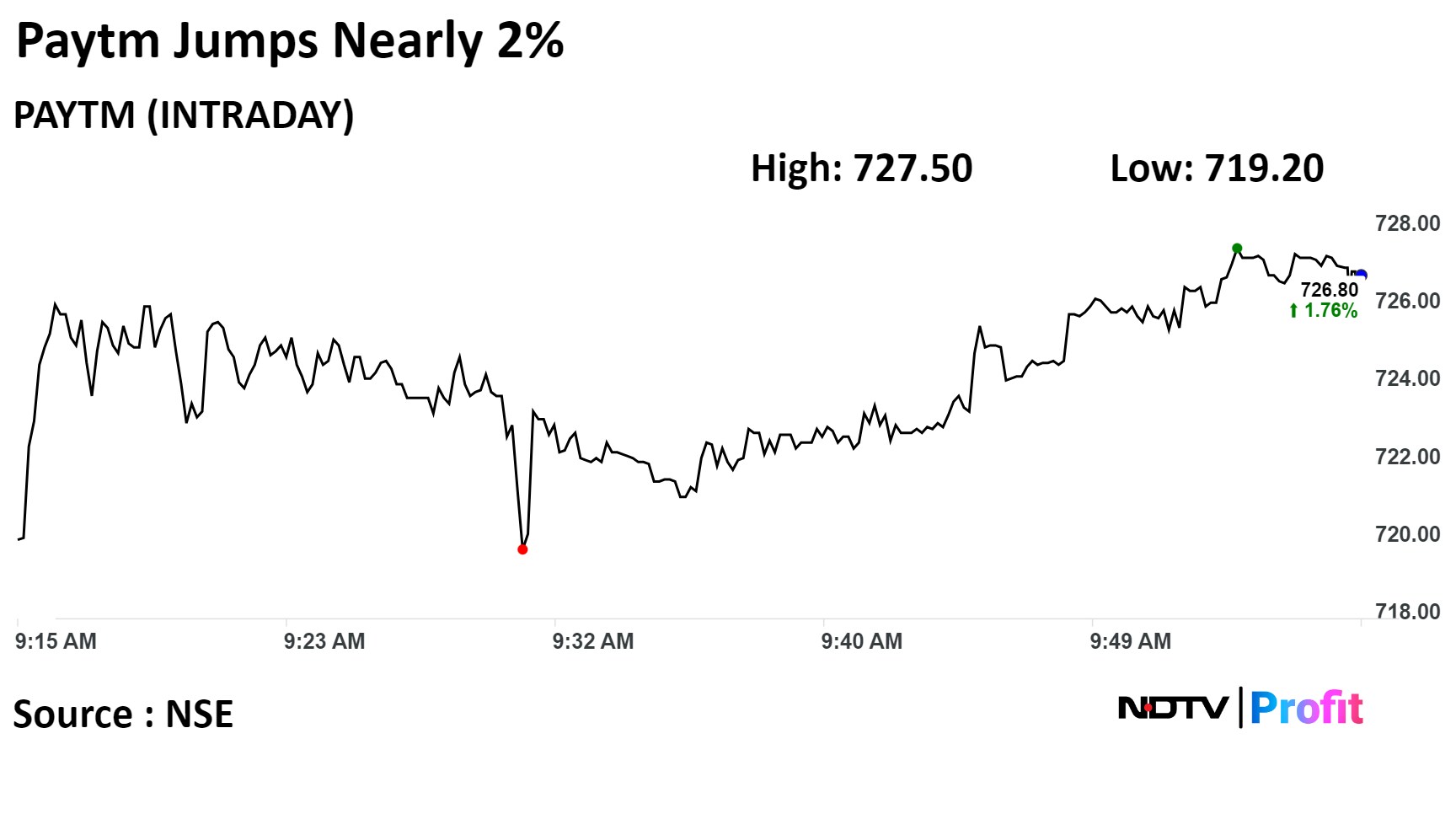

Paytm's stock rose as much as 1.86% intraday to Rs 727.50 apiece on the NSE. It was trading 1.82% higher at Rs 727.20 apiece compared to a 0.06% decline in the benchmark Nifty 50 at 9:58 a.m.

Eleven out of the 16 analysts tracking the company have a 'buy' rating on the stock and five suggest a 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 30.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.