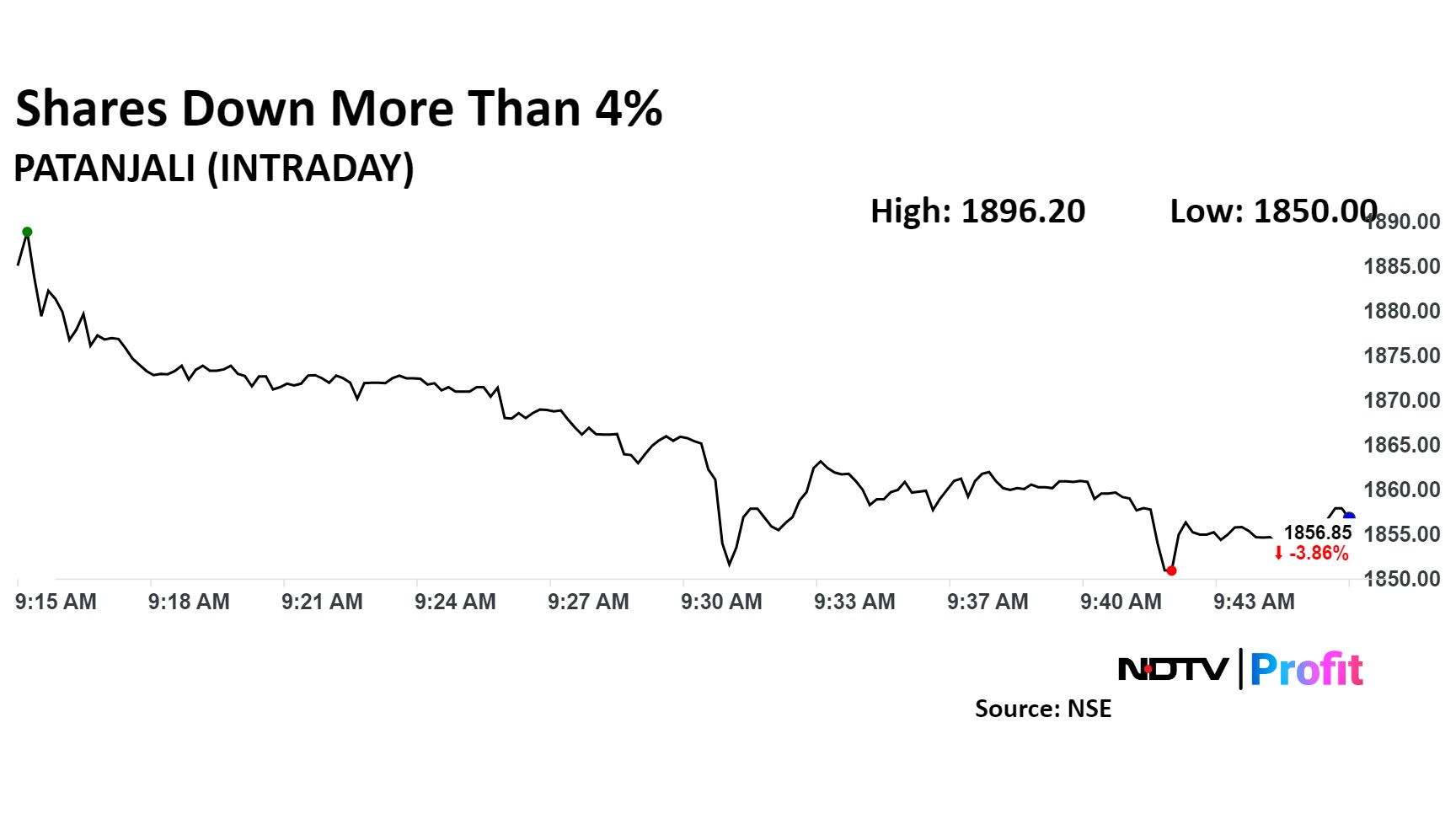

Shares of Patanjali Foods Ltd. fell by more than 4% on Friday following a large trade. At least 1.1 crore shares, or 3% of the company's equity, changed hand, according to Bloomberg.

The buyers and sellers were not know immediately.

Earlier in July, the company announced the acquisition of Patanjali Ayurved's non-food business for Rs 1,100 crore. This deal includes the home and personal care segments, such as dental care, skin care, hair care, and home care products.

Patanjali Foods reported a 199% year-on-year increase in net profit for the first quarter of the fiscal year. The fast-moving consumer goods company posted a net profit of Rs 263 crore for the quarter ending June, up from Rs 88 crore in the same quarter of the previous year. However, revenue declined by 7.7% year-on-year, totaling Rs 7,173 crore for the three months ended June, compared to Rs 7,767 crore in the corresponding period of the previous fiscal year.

Shares of the company fell as much as 4.16% to Rs 1,851 apiece. It pared losses to trade 3.86% lower at Rs 1,856.80 apiece as of 09:48 a.m. This compares to a 0.16% advance in the NSE Nifty 50 Index.

It has risen 43% in the last 12 months. Total traded volume so far in the day stood at 18.72 times its 30-day average. The relative strength index was at 48.

All the three analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 18.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.